Outlook for the Texas Economy summarizes significant state economic activity and trends. All measurements are calculated using seasonally adjusted data, and percentage changes are calculated month over month, unless stated otherwise. Click here to receive email notifications each time this report is published.

Texas’ economic activity slowed in February when Winter Storm Uri caused power and water outages across the state. Payrolls contracted by 19,000 workers in Dallas-Fort Worth and 500 positions in Houston. Central Texas, however, continued to hire, and state unemployment claims declined on a monthly basis despite some businesses pausing operations due to the freeze. The manufacturing, construction, professional/business services, leisure/hospitality, and government sectors all posted job losses, but retail and energy-related employment increased. On the bright side, survey data revealed overall optimistic outlooks for future business activity. Energy prices surged during the weather-related demand shock but should stabilize as demand expectations remain positive in 2021 with the economy reopening and travel picking up. Total housing sales and export values decreased, but activity should rebound in the coming months. The passing of the third fiscal stimulus package, ongoing vaccine distribution, and the rollback of business restrictions in Texas contributed to a positive outlook for the state’s economy for the rest of 2021. Still, containment of the pandemic is vital as additional waves of infection can weigh on consumer confidence and spending and slow the return to pre-pandemic conditions.

Recently released 2020 data revealed Texas’ real gross domestic product (GDP) declined 3.5 percent annually during the pandemic. On the bright side, the Lone Star State ranked second in the nation in fourth quarter recovery behind South Dakota, although inflation-adjusted growth slowed from 29.7 to 7.5 percent on a seasonally adjusted annualized rate (SAAR). Finance/insurance, professional/scientific/technical services, and administrative/support/waste management/remediation services were the largest contributors to quarterly improvement, offsetting a contraction in the utilities sector.

After a strong economic recovery during the second half of 2020, momentum decelerated within Texas in February during severe power and water outages. The Dallas Fed’s Texas Business-Cycle Index flattened on a monthly basis but rose 6.9 percent SAAR. Austin’s index exceeded the statewide growth rate as employment remained in positive growth territory, climbing 7.9 percent. Similarly, San Antonio’s index accelerated 4.6 percent amid increased hiring. The Dallas metric elevated 5.8 percent, but economic activity slowed to a halt in Fort Worth and Houston with the metric ticking up just 1.1 and 1.6 percent, respectively.

The Texas Leading Economic Index (a measure of future directional changes in the business cycle) flattened for the second straight month as unfavorable currency fluctuations and reduced help-wanted advertising offset other positive indicators, including decreased initial unemployment claims, increased oil prices, and more hours worked in manufacturing. Even though some aspects of the state’s economy improved, the Texas Consumer Confidence Index plummeted 14 points to its lowest level since 2012 during the winter storm. Sentiment, however, is expected to rebound as the weather returns to average temperatures and business activity recovers.

Progress on the vaccine front and an approved third fiscal stimulus package resulted in higher growth and inflation expectations for 2021. The ten-year U.S. Treasury bond yield rose to an annual high of 1.3 percent2 in February. The Federal Home Loan Mortgage Corporation’s 30-year fixed-rate ticked up for the second straight month to 2.8 percent, although the metric still hovered around historically low rates (series starting in 1971). Further increases in mortgage rates this year may soften housing demand and slow home-price appreciation. Mortgage rates remained low within Texas during January3, sinking to 2.66 percent for non-GSE loans, while the median interest rate for GSE loans was 2.80 percent. February home purchase applications were affected by the winter storm, falling 14.8 percent year to date (YTD) but remaining positive relative to year-ago levels. Similar fluctuations were observed in refinance activity as lenders added more requisites and the pool of households able to refinance shrank. (For more information, see Finding a Representative Interest Rate for the Typical Texas Mortgagee.)

____________________

2Bond and mortgage interest rates are nonseasonally adjusted.

3The release of Texas mortgage rate data typically lags the Outlook for the Texas Economy by one month.

After a solid start to the year, total Texas housing sales decreased 16.1 percent in February during severe disruptions to the state’s power grid due to the winter storm. The Texas Residential Construction Cycle (Coincident) Index, which measures current construction levels, ticked up as industry employment and wages improved. The Residential Construction Leading Index continued its upward trajectory due to overall elevated building permits and housing starts despite monthly contractions, pointing toward increased construction in the coming months. Similarly, the metropolitan leading indexes suggested future activity to be favorable. Only in Houston, where permits and starts fell significantly, did the metric indicate an impending slowdown in building. (For additional housing commentary and statistics, see Texas Housing Insight.)

The West Texas Intermediate (WTI) crude oil spot price rose to its highest level in more than a year, averaging $58 per barrel as extremely frigid temperatures shocked demand. Weather-related disruptions to production and refinery activity, additional fiscal stimulus, and tensions in the Middle East also contributed upward pricing pressure. A bullish economic and energy outlook for 2021 pulled Texas’ active rig count to 179 after crude oil production increased for the first time in six months to 4.6 million barrels per day in January4. Crude oil output is predicted to rebound in March and remain elevated through 2022. The winter storm also affected natural gas prices with the Henry Hub spot price doubling to a seven-year high of $5.54 per million British Thermal Units. Prices should normalize in March, however, as supply and demand imbalances ease.

____________________

4 The release of crude oil production typically lags the Outlook for the Texas Economy by one month.

Texas nonfarm employment snapped a nine-month hiring streak in February as most of the state suffered power and water outages during the winter storm, resulting in 27,500 layoffs. Nearly 600,000 jobs need to be regained to return to year-ago levels. Nevertheless, the Dallas Fed still believes a full recovery to be possible in 2021, with their annual employment forecast estimating a 6.0 percent payroll increase to 13.1 million workers. Texas’ unemployment rate rose to 6.9 percent compared with the national average of 6.2 percent, while the state’s labor force participation rate decreased to 62.2 percent. Texans exiting the labor force were mostly located outside of the major Metropolitan Statistical Areas (MSAs), as the size of the major metropolitan labor forces were largely unchanged. Joblessness fell to 5.6 percent in Austin and 6.8 and 6.9 percent in Dallas and San Antonio, respectively. Houston’s metric ticked down to 8.3 percent, and Fort Worth unemployment flattened at 7.1 percent.

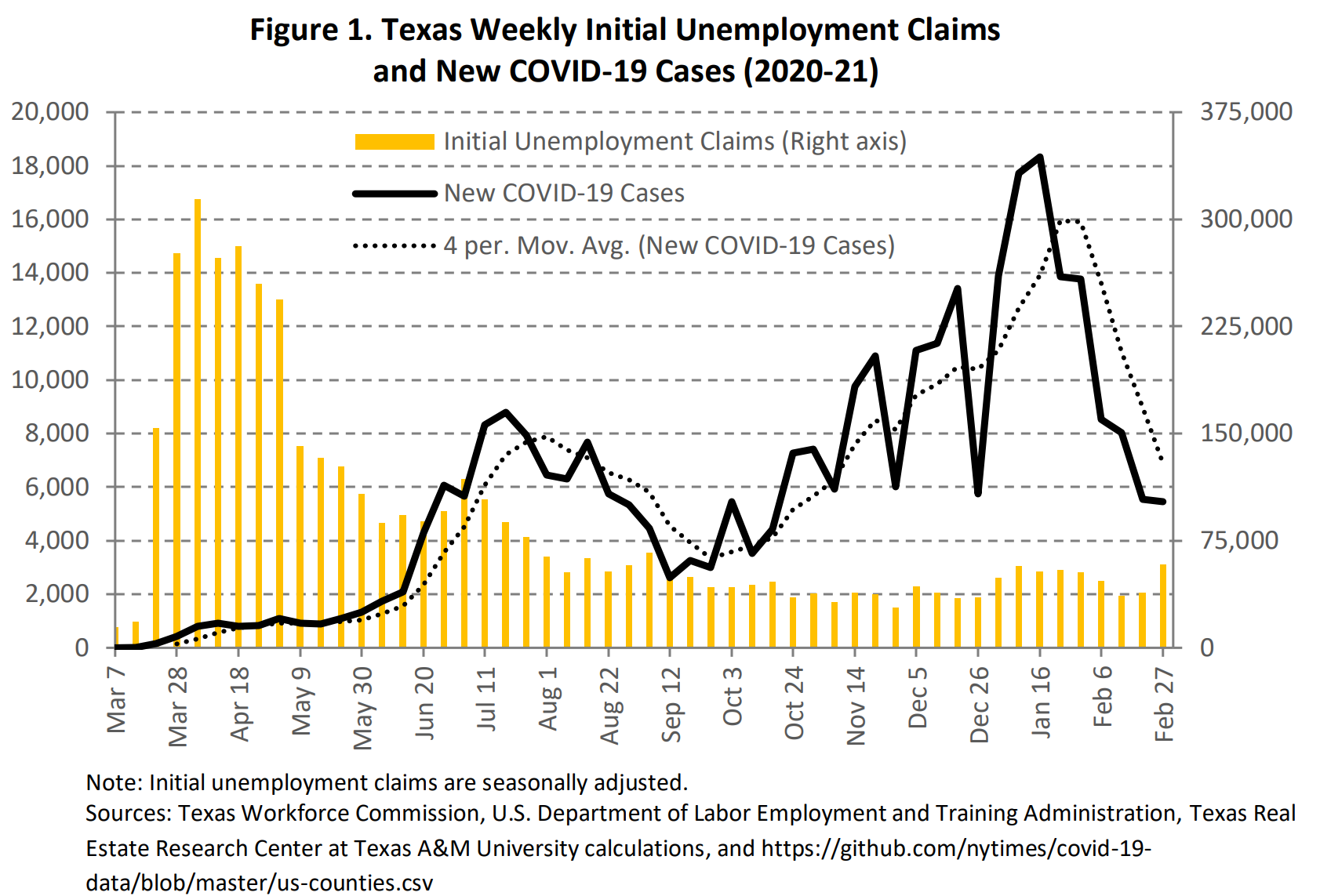

The number of Texans filing initial unemployment insurance claims declined to 195,300 despite increasing in the latter half of the month after the winter storm on a statewide and metro level (Figures 1 and 2). Texas’ average weekly continued unemployment insurance claims trended down during the month, suggesting improved conditions for laid-off workers seeking new job opportunities. Nevertheless, the labor market still has a long road to recovery with total claims remaining three-and-a-half times greater than pre-pandemic levels a year ago.

Texas’ real income per capita ticked up just 0.8 percent year over year (YOY) in 4Q2020, significantly less than the 2.4 percent national improvement. On a quarterly basis, however, the metric fell around 2 percent in the state and U.S. due to reduced government transfer payments after the bulk of the first round stimulus checks were sent out during the second quarter. Net earnings posted positive quarterly growth, albeit at a slower rate than during 3Q2020, with the professional/business/technical services, administrative/support/waste management/remediation services, and finance/insurance sectors leading the state.

After unimpressive improvement to end 2020, wage growth picked up at the start of the year with Texas’ average real private hourly earnings accelerating 2 percent YOY in February. Dallas continued to lead the state in nominal wages, paying an average of $32.17 per hour. North Texas also posted the greatest inflation-adjusted increase with real hourly earnings climbing 5.7 and 7.7 percent in Dallas and Fort Worth ($29.87), respectively. Houston wages ($29.06) rose 3.1 percent after accounting for inflation, but Central Texas real earnings posted upticks of just 0.9 percent in San Antonio ($25.59) and 0.5 percent in Austin ($30.54). The latter, however, did break a two-month decline.

Payroll contractions were largely concentrated in North Texas with 11,000 and 8,000 layoffs in Fort Worth and Dallas, respectively. Professional/business services led the decline in the MSA, followed by goods producing sectors. The same industries posted losses in Houston, offsetting trade/transportation/utilities gains for an overall 500-job decrease. On the positive side, Austin’s trade/transportation/utilities and education/health services contributed to total employment increasing by 700 positions in the metro despite professional/business services dismissals. San Antonio was the only major MSA to accelerate hiring, adding 2,200 employees, more than half of whom began work in education/health services or retail trade. Government employment decreased across the board.

Texas’ goods-producing sector shed 3,100 jobs despite regaining 1,800 energy-related positions. Manufacturing employment declined by 2,600 durable-goods workers and flattened in the nondurable goods sector. Respondents of the Texas Manufactured Housing Survey noted a weeklong freeze in production during the winter storm, but the weather shock subsided by month-end. Despite prolonged supply-chain disruptions, Texas’ manufactured housing industry remained optimistic heading into the spring selling season. Average hourly manufacturing earnings rose 6.6 percent after accounting for inflation. Improvement in Fort Worth was strongest, but Dallas, San Antonio, and Houston eked out modest gains. The Dallas Fed’s Manufacturing Outlook Survey corroborated earnings data while the employment index weakened, although more business executives reported positive net hiring than net layoffs. Despite the survey collection period including the week of the winter storm, production and general business activity accelerated, and the outlook uncertainty index was below the series average. Comments revealed business sentiments were largely positive due to an improved outlook regarding the pandemic and vaccine distribution; some respondents, however, expressed reservations about future activity during ongoing supply-chain disruptions and a still-weak oil and gas industry.

Construction jobs decreased by 2,300 as outdoor activity was curtailed by the extreme weather, pulling industry employment 7.2 percent below year-ago levels. Average real hourly construction earnings fell 3.7 percent YOY and extended a seven-month downward trend. On top of a slow start to the year, inflation adjusted total construction values sank 6.9 percent on a monthly basis and flattened YTD compared with activity during the first two months of 2020. Both nonresidential and residential values contracted, with the latter normalizing from record activity in October 2020 to its year-long average. Single-family building declined across the board, offsetting increased apartment values in Central and North Texas. School construction also picked up in the two regions but was overshadowed by a steep drop in San Antonio warehouse values, which accounted for the majority of the overall reduction.

Service-providing payrolls contracted by 24,400 workers in February, widening the gap between current and year-ago employment to 427,300 jobs. After strong growth to start the year, administrative/waste management/remediation services shed 23,100 positions. Accommodation/food services employment decreased by 6,900 jobs. These industries were among the hardest hit by the pandemic last year, and the winter storm setback, although temporary, is disheartening. On the bright side, the trade/transportation/utilities sector added 14,800 employees to exceed year-ago employment, and three fourths of the Dallas Fed’s Service Sector Outlook Survey respondents indicated unchanged headcounts and workweeks. The revenue and capital expenditures indexes increased but remained below their long term averages. More than one-third of business executives reported improved expectations of future conditions despite comments revealing concerns regarding the pandemic, difficulty hiring high-skilled labor, and impacts of the new presidential administration.

The number of Texas retail jobs rose for the third consecutive month, recovering 7,900 positions. Only the building material/garden equipment/supplies dealers sector registered a decrease in payrolls, although YOY growth remained in double-digit territory. Inflation-adjusted retail sales ticked down on a monthly basis as business activity fell during the winter storm; the metric, however, accelerated 3.1 percent annually. The Dallas Fed’s Retail Outlook Survey corroborated sales data, but both the full-time and part time employment indexes and hours worked metrics declined. Outlook uncertainty increased, yet perceptions of future activity were still positive.

Although the U.S. Consumer Price Index (CPI) rose at its fastest pace in a year, the 1.7 percent YOY increase continued to hover below the Federal Reserve’s 2 percent target. In contrast, core inflation decelerated for the third straight month to 1.3 percent growth as food/beverage price appreciation softened. There have been worries that inflation may run rampant in 2021 as the economy recovers, but Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen maintain that, while inflation will rise temporarily during the economic recovery, significant long-term risk is unlikely. In Houston, transportation costs still weighed on the local CPI, which elevated just 1 percent, as opposed to national transportation costs, which have tipped into positive growth territory for the first time in a year.

The Texas trade-weighted value of the dollar5fell for the sixth straight month in January to year-ago levels, making domestic goods less expensive to the foreign buyer. Texas’ real commodity exports, however, declined 2 percent in February amid a weather-related pause in activity. Manufacturing exports plummeted 13.8 percent in real terms with reduced chemical, machinery, and computer/electric products shipments accounting for the majority of the contraction. Inflation-adjusted crude oil exports dropped 6.2 percent as purchases from Asia, the United Kingdom, and Canada decreased. Correspondingly, the share of total Texas exports to China, Canada, South Korea, and Taiwan sank in February. On the other hand, oil/gas shipments to Mexico rose to a record-high in February, pushing the country’s share of Texas exports to 41 percent, its highest reading in nearly five years.

____________________

5 The release of the Texas trade-weighted value of the dollar typically lags the Outlook for the Texas Economy by one month.

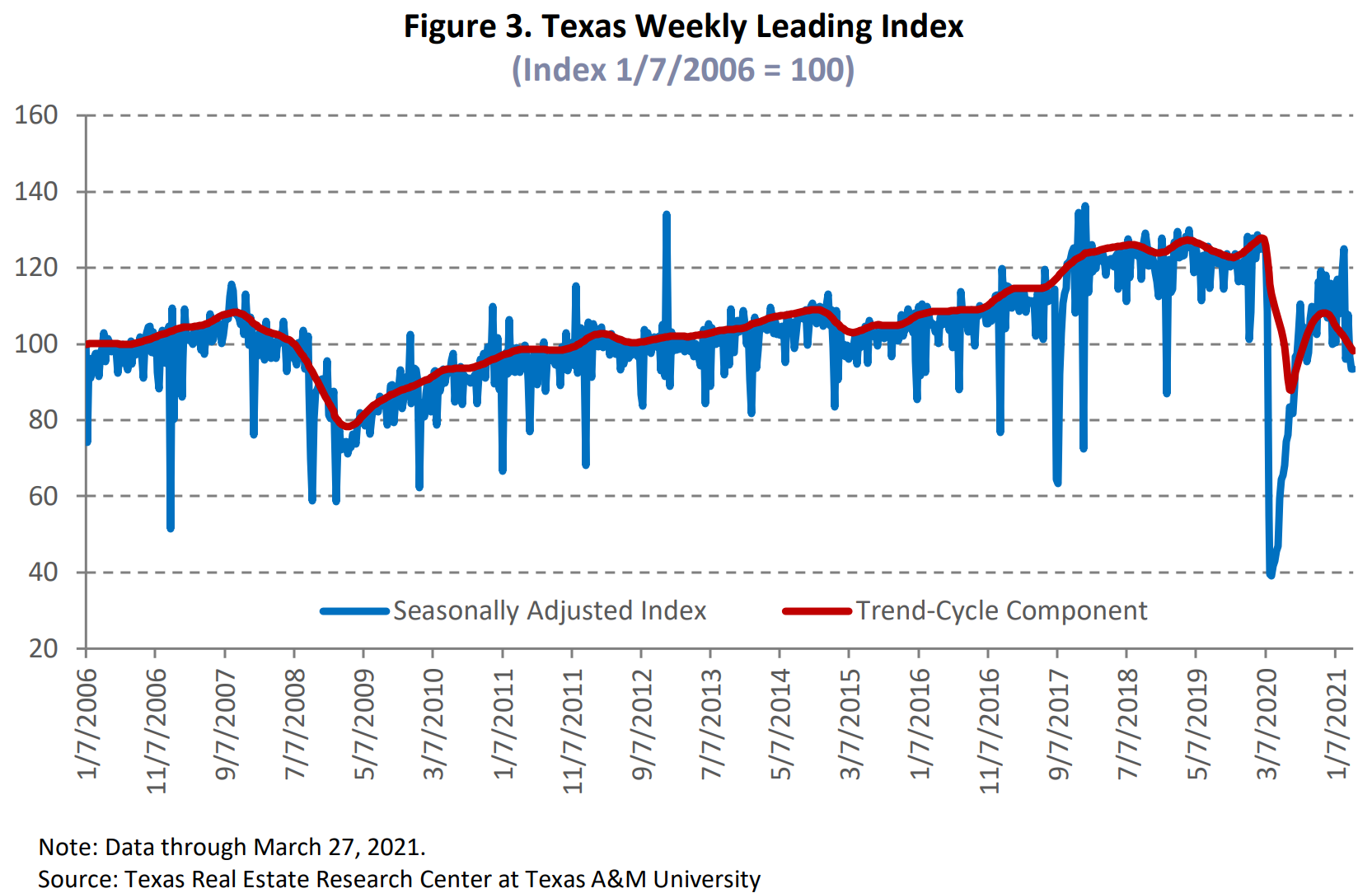

The Center created a Texas weekly leading index to predict turning points in the Texas economy. (For more information, see COVID-19 Impact Projections on Texas Economy.) Although the index increased the first week of March after the winter storm, the overall downward trend indicates the state’s recovery lost some momentum (Figure 3). The number of people filing for unemployment insurance surged unexpectedly for three straight weeks, offsetting the rise in new business applications. The real rate for the ten-year Treasury bill climbed through the month (but continued to exhibit a negative return in real terms), while the real price of WTI oil increased the first two weeks before decreasing. Gov. Greg Abbott lifted the mask mandate and removed capacity restrictions for all businesses and facilities in the state effective March 10, 2021. Combined with the decline of COVID-19 cases through March 27 and improving vaccination rates, prospects for the state’s economic recovery in 2Q2021 look optimistic.

Related Data & Reports

You might also like

2025 Texas Real Estate Forecast

Texas real estate decisions impact everyone, from those buying or renting homes in the state’s smallest communities to global firms looking to relocate. Informed insights from our economic research team appear in this special forecast report.

Texas Border Economy | Third Quarter 2024

Like last quarter, border employment grew in 3Q2024but not enough to prevent an increase in the unemployment rate. Housing sales had a worse second quarter this year than last year, and home prices increased in two of the four border metros.

Texas Housing Insight | October 2024

Home sales typically cool off by October, but this year is a little different with sales in both September and October higher than they were during the summer. The rate of new listings is still on the rise resulting in rising inventory levels.

Publications

Receive our economic and housing reports and newsletters for free.