Outlook for the Texas Economy | July 2021

Prospects for the Texas economy continued to improve even as new COVID-19 cases accelerated in July. Payrolls expanded robustly, led by hiring in the leisure and hospitality industry, while retail employment flattened.

Outlook for the Texas Economy summarizes significant state economic activity and trends. All measurements are calculated using seasonally adjusted data, and percentage changes are calculated month over month, unless stated otherwise. Click here to receive email notifications each time this report is published.

Prospects for the Texas economy continued to improve even as new COVID-19 cases accelerated in July. Payrolls expanded robustly, led by hiring in the leisure and hospitality industry, while retail employment flattened. Staffing shortages exacerbated ongoing wage pressures, but real earnings declined due to supply bottlenecks driving up inflation. Joblessness dropped despite hiring challenges; however, unemployment claims rose for the second straight month. Oil prices dipped for the second consecutive month but remained relatively elevated as the recent uptick in the oil industry sparked recovery throughout the state. Containment of the pandemic is vital as additional waves of infection, mainly from the Delta variant, can weigh on consumer behavior and slow the return to pre-pandemic conditions.

Texas’ economy continued its recovery in July according to the Dallas Fed’s Texas Business-Cycle Index, which accelerated 9 percent on a seasonally adjusted annualized rate (SAAR) amid steady payroll expansions. Rising faster than the statewide trend, Austin and Dallas’ metric increased 13.6 and 14.2 percent, respectively, due to labor-market improvements. Economic activity maintained moderate growth in the Fort Worth and Houston indexes, rising 4.7 percent in the former and 8 percent in the latter. San Antonio’s local index decelerated due to monthly payroll contractions but still increased 6.9 percent SAAR.

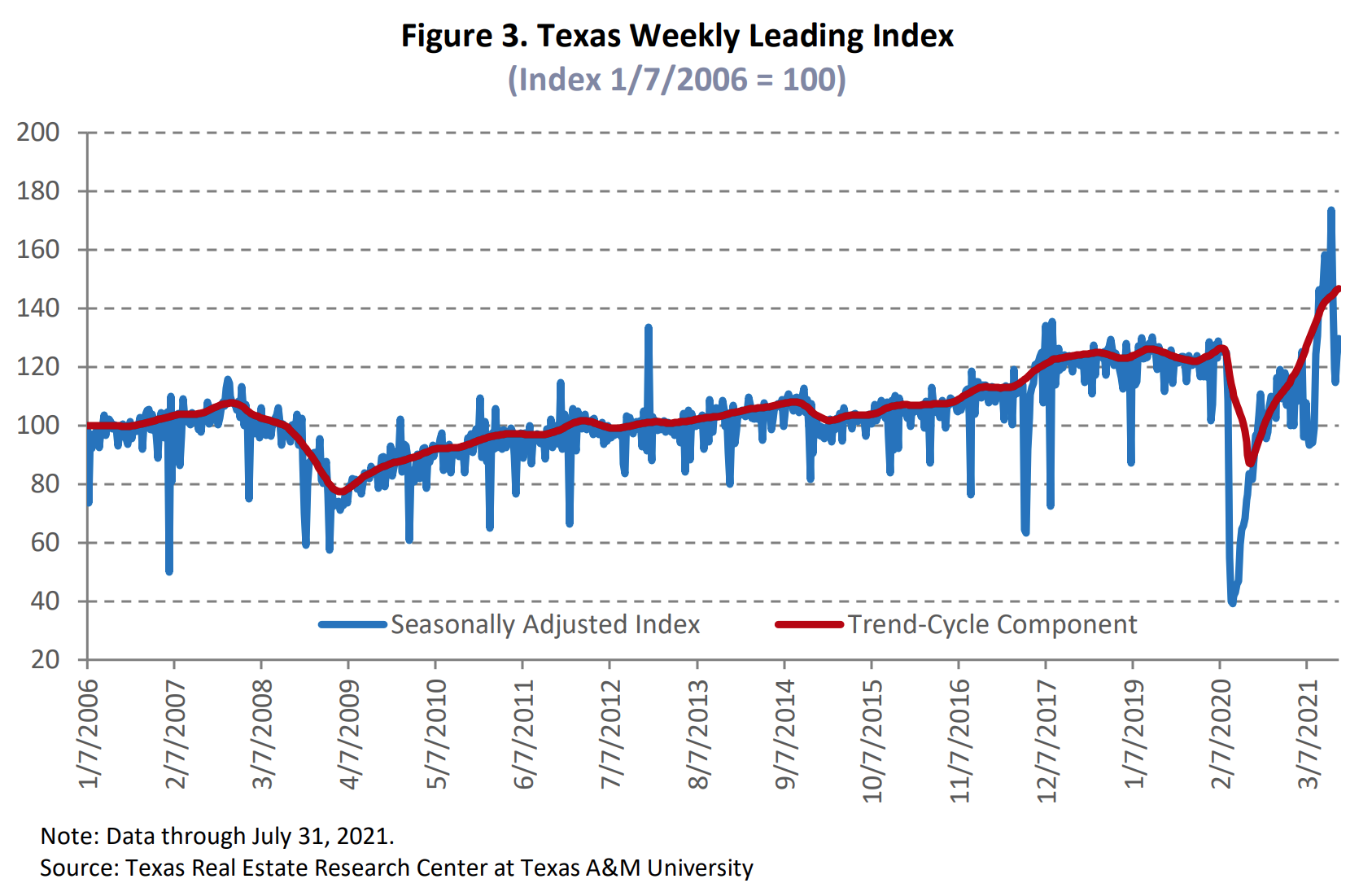

A three-month improvement in the Texas Leading Economic Index (a measure of future directional changes in the business cycle) halted due to a rise in initial unemployment claims and depreciation of the Texas value of the dollar. The leading index, however, maintained a positive trend, suggesting growth in the coming months. The Texas Consumer Confidence Index posted its highest reading since February 2020 as overall business activity ramped up.

Amid low expectations of additional fiscal and monetary stimulus, economic growth forecasts for the rest of the year cooled as the initial and strongest stage of recovery likely reached its peak, and inflation pressures are believed to be temporary. The ten-year U.S. Treasury bond yield fell to 1.3 percent, and the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate decreased to 2.9 percent. Despite lower rates for borrowers, mortgage applications for home purchases continue to fall, declining 22.1 percent YTD. Mortgage rates remained low for the typical Texas homebuyer in June, sinking to 3.03 percent for non-GSE loans, while the median interest rate for GSE loans was 3.11 percent. Texas home-purchase applications, however, declined for the fourth consecutive month in July, falling 22.1 percent YTD. Refinance applications improved on a monthly basis yet were still down 18.5 percent over the same period. (For more information, see Finding a Representative Interest Rate for the Typical Texas Mortgagee.)

Total Texas housing sales extended its negative trend, ticking down 0.3 percent amid reduced activity for homes priced less than $300,000. The sales composition continued to shift toward homes above that price point, accounting for 51 percent of transactions in July and signaling supply constraints at the lower price cohorts. Sales for homes priced less than $200,000 reached an all-time low as homes appreciated across the state. The Texas Residential Construction Cycle (Coincident) Index, which measures current construction activity, inched up amid increased construction values and wages while employment flattened in the industry. The Residential Construction Leading Index (RCLI) normalized as residential starts flattened and weighted building permits decreased; the ten-year real Treasury bill also decreased. Weighted building permits and residential starts increased in Houston and San Antonio. However, the leading index ticked down in the former due to an overall downward trend while the metric increased in the latter. Meanwhile Dallas-Fort Worth (DFW) and Austin indexes flattened as housing starts and building permits decreased in both metros. (For additional housing commentary and statistics, see Texas Housing Insight.)

The West Texas Intermediate (WTI) crude oil spot price fell from its highest level since November 2014 as the global economy gained momentum, averaging $69.30 per barrel. On July 18, members of OPEC+ agreed to increase monthly production by 400,000 barrels per day beginning in August 2021, and the price of crude oil fell 7 percent the day after the decision was made public. Texas’ active rig count increased to 238 while crude oil production flattened to 4.91 million barrels per day in June. Natural gas prices trended upward with the Henry Hub spot price reaching $4.02 per million British thermal unit (BTU). In the Permian Basin, recent pipeline expansions allowed for additional takeaway capacity. However, a pipeline failure temporarily restricted production levels and narrowed the discount between the Waha Hub and Henry Hub prices.

Texas nonfarm employment added 93,600 jobs in July, accelerating 5.2 percent SAAR. Payrolls, however, were still down by more than 249,000 positions from pre-pandemic levels. The Dallas Fed’s annual employment forecast was lowered to 4.3 percent, down 1.3 percentage points from last month’s estimates amid an increase in COVID-19 hospitalizations, dampening job-growth forecasts. Texas’ unemployment rate declined for the fourth straight month to 6.2 percent but was still greater than the national rate of 5.4 percent. The state’s labor force participation rate ticked up to 62.3 percent while the labor force grew by 36,800 workers. Joblessness in the major metros declined at a steeper rate than the state average and was lowest in Austin at 4.2 percent. San Antonio’s metric was 5.3 percent, while North Texas’ unemployment rate decreased to 5.2 and 5.5 percent in Dallas and Fort Worth, respectively. Houston’s metric fell to 6.5 percent but remained above the Texas average.

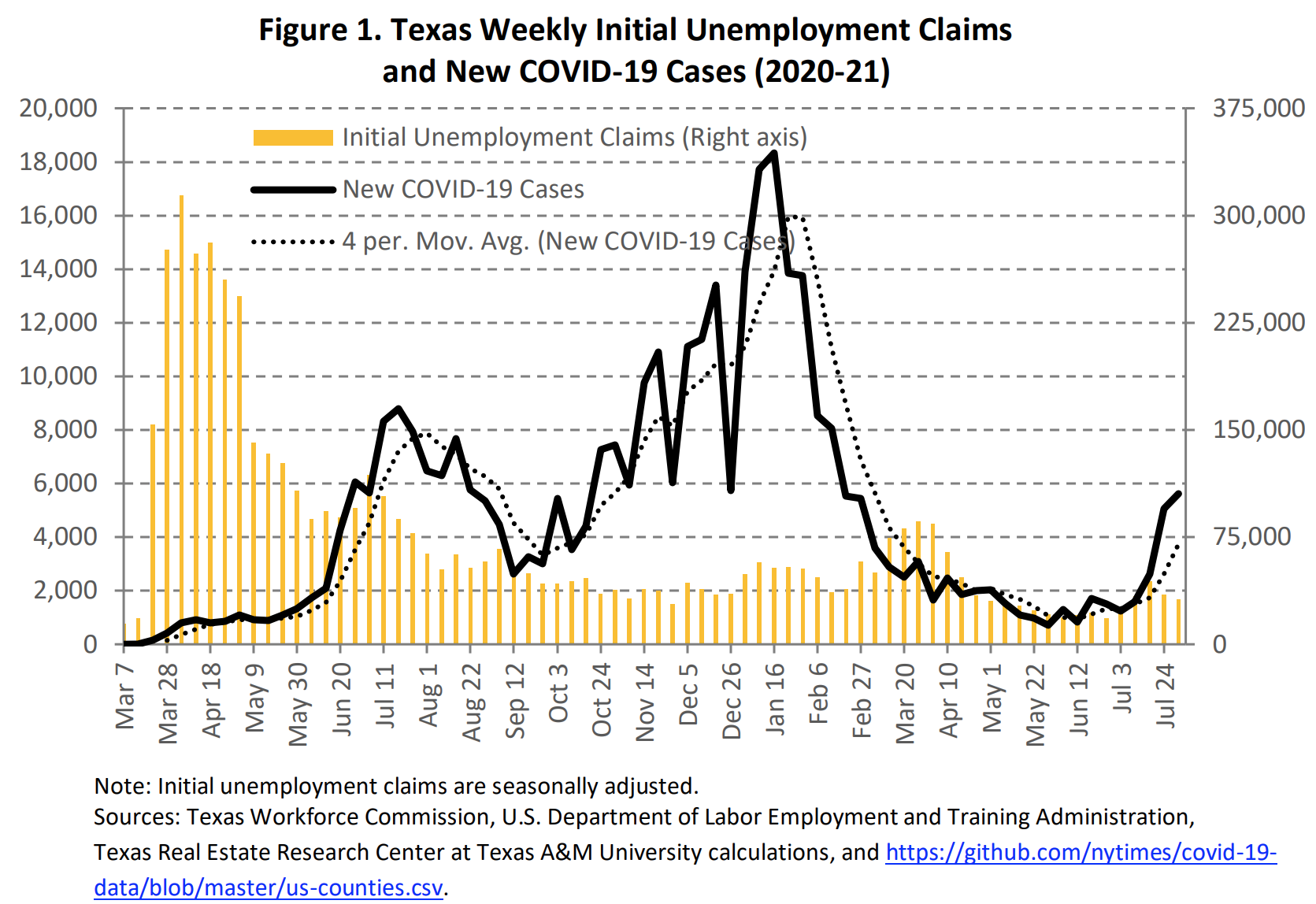

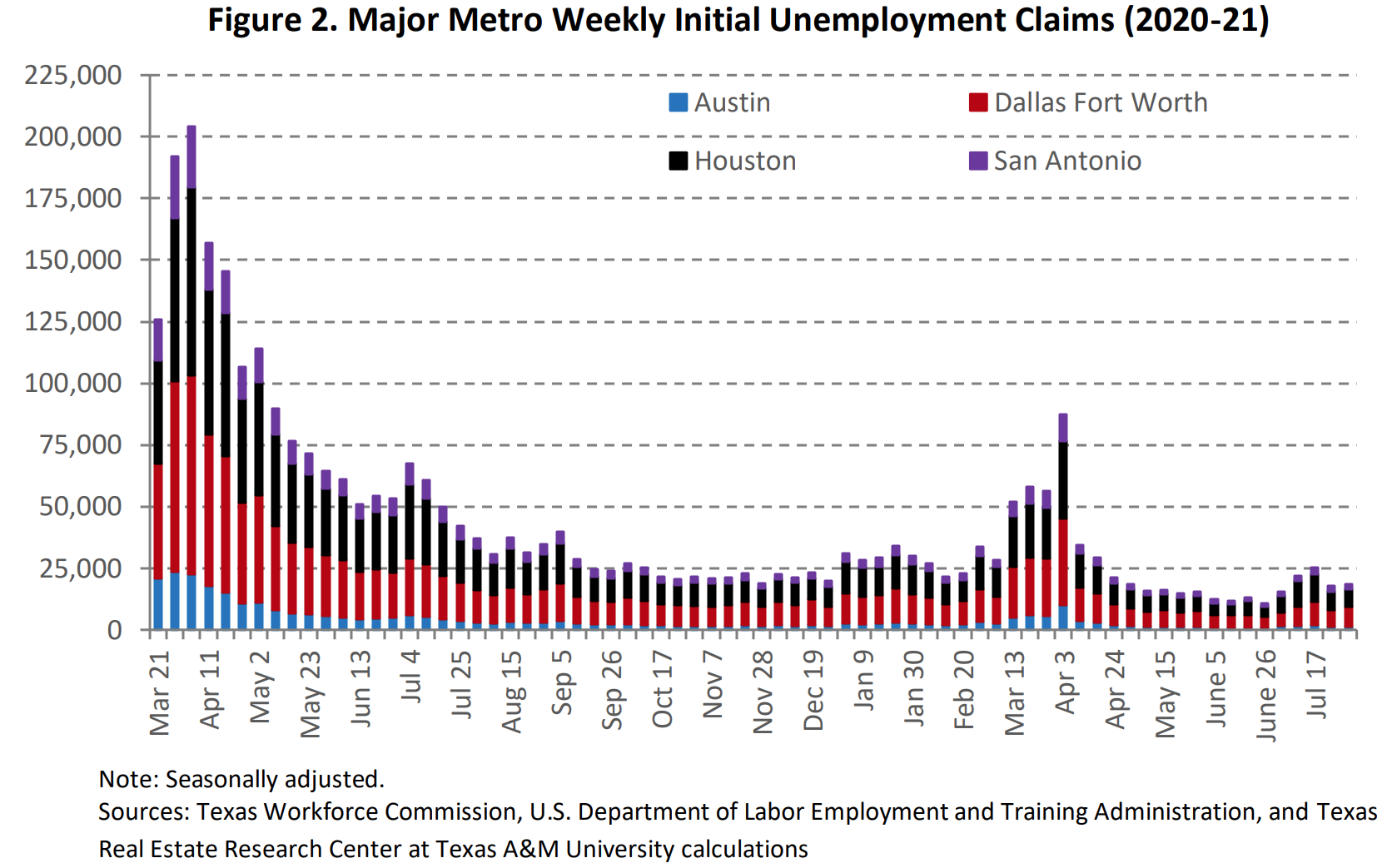

The number of Texans filing initial unemployment insurance claims increased for a second consecutive month to 150,000 in July. Initial claims trended upward within the major metros except Austin (Figures 1 and 2). Moreover, Texas’ average weekly continued unemployment insurance claims climbed consistently throughout the month, suggesting worsened conditions for laid-off workers seeking new job opportunities. Businesses attributed the tight labor market to the surge in COVID-19 cases, particularly in high contact-intensive industries and ongoing child-care issues. Total claims were nearly 50 percent higher than pre-pandemic levels although drastically lower than its May 2020 peak.

Texas’ average real private hourly earnings flattened relative to year-ago levels as inflation chipped away at purchasing power. Some sluggishness in the metric may be attributed to the recent hiring in leisure and hospitality, which typically pay lower than the average, pushing the sector’s share of the employment distribution upward relative to July 2020. San Antonio’s hourly earnings declined 4.3 percent year over year (YOY) in real terms with an average nominal wage of $25.51. The Dallas ($32.02) and Fort Worth ($30.31) metric posted real annual growth of 2.3 and 3.6 percent, respectively, while Houston ($29.53) real wages equalized for the fourth month. In Austin ($30.41), hourly wages fell for the fifth straight month YOY, decreasing 5.1 percent after adjusting for inflation.

Hiring in Houston decelerated to 4.3 percent on a SAAR, recovering just 16,900 jobs. Houston payrolls remained 4.7 percent below pre-pandemic levels, a larger gap than the other major metros. Dallas also added 16,900 employees in July, accelerating 6.3 percent SAAR and exceeding the statewide metric. Fort Worth and Austin registered increases of 1,400 and 13,100 workers, respectively. Payroll expansions across the major metros were largely concentrated in the leisure/hospitality, professional/business services, government, and education/health services industries. Employment declined only in San Antonio, which shed 1,200 positions as extensive layoffs in professional/business services and education/health services industries negatively affected the local service-providing industry. Goods-producing employment remained flat due to falling construction jobs.

Texas’ goods-producing sector recovered 8,100 positions after laying off 19,300 workers in April. Energy related payrolls added 2,000 jobs but remained 18.6 percent below pre-pandemic levels. The nondurable goods manufacturing sector gained 7,800 workers, while durable-goods manufacturing registered a more modest payroll expansion of 600 employees. The Real Estate Research Center’s Texas Manufactured Housing Survey revealed an uptick in industry optimism regarding the second half of 2021. Manufacturers increased capital expenditures and expanded payrolls in hopes of boosting production, but supply-chain disruptions remained a hindrance. Average hourly earnings decelerated 5.5 percent YOY across the manufacturing sector after adjusting for inflation. Respondents to the Dallas Fed’s Manufacturing Outlook Survey reported increased wages in an attempt to attract job applicants as the employment index rose slightly from historically-elevated levels from the previous month despite reported labor shortages. Other business indicators suggested overall positive conditions. However, perceptions of future activity declined. Unfulfilled demand for labor, rising input prices, and ongoing supply-chain disruptions were top concerns.

Construction payrolls fell by 2,300 jobs, marking four months of contraction and tempering goods-producing employment growth. Average hourly construction earnings ticked up to a nominal wage rate of $28.25 per hour; however, the average declined 4.6 percent YOY after adjusting for inflation and seasonality. Total construction values declined for the fourth consecutive month, largely due to a decrease in residential investment. Single-family construction values contracted on a monthly basis in all four major metros, falling from a peak in residential values in either April and May. Apartment construction continued a three-month decline as significant investment reductions occurred in Houston and San Antonio and erased growth in Austin and North Texas’ multifamily sector. Statewide nonresidential activity increased for the second consecutive month due to largescale expansions of hospitals and other health treatment facilities; office/bank buildings and school construction, however, decreased.

Texas’ service-providing sector added 85,500 employees, regaining 670,400 jobs over the last year. Payrolls were down only 1 percent relative to the February 2020 peak, and the difference is less than the 1.9 percent decline in total nonfarm employment. Accommodation/food services employment led the monthly recovery, hiring 18,400 workers, followed by professional/scientific/technical services (9,000). A vast majority of respondents to the Dallas Fed’s Service Sector Outlook Survey communicated strong business activity as revenue and employment indexes rose, while the hours worked index dipped despite maintaining above-average levels. Concurrently, capital expenditures accelerated to its highest levels since 2018 to meet growing demand. Anecdotal evidence from industry executives highlighted back-log and delays due to difficulty in recruiting workers along with ongoing supply-chain challenges. However, these issues were less prevalent than in prior months. Growing concerns regarding inflation and rising COVID-19 cases weighed on expectations of future activity. Although the outlook remained optimistic, uncertainty mounted over the last two months.

Texas retail employment remained flat, adding 1,300 workers mainly due to hiring in food/beverage stores, which reached unprecedented employment numbers. Payrolls also expanded in both clothing/clothing accessories and non-store retailers, a record high for the latter. On the other hand, building material, garden equipment, and supplies dealers employment laid off 2,950 workers as do-it yourself activity normalized from rampant levels during the pandemic. Retail sales ticked up 0.5 percent from last month’s record levels after adjusting for inflation. The Dallas Fed’s Retail Outlook Survey, however, reported depressed retail sales activity as the sales index remained negative for the third consecutive month amid a five-month period of low inventories, but 50 percent of executives expected inventories to improve in the next half year. Retail price and wage indexes fell from record-high levels, softening the year-long upward pricing pressures in the industry. Retailers revealed lowered optimism regarding future sales and general business activity, but they retained positive expectations for future employment growth.

The U.S. Consumer Price Index (CPI) accelerated 5.4 percent annually with a 23.6 percent YOY increase in energy costs as oil prices surpassed pre-pandemic levels. Core inflation, which excludes energy and food, rose 4.3 percent relative to last July. Despite above-average inflation rates, the deceleration of core figures eased concerns about the economy overheating. The Federal Reserve chose not to make any policy changes regarding their dual mandate of full employment and stable prices as the Federal Open Market Committee (FOMC) continued to believe inflation levels were transitory. Supply shortages and low base effects in travel services drove substantial growth during July, but upward pricing pressures should ease over the next year. Similar fluctuations in the components of Dallas’ CPI resulted in annual growth of 5.6 percent overall and 4.6 percent less food and energy.

The Texas trade-weighted value of the dollar increased 1.3 percent in April compared with the previous month but fell 5 percent annually. Meanwhile, Texas’ real commodity exports decreased 1.2 percent in July from last month’s record high. Manufacturing exports also declined, slipping 1.2 percent after adjusting for inflation despite growing machinery and chemical shipments. Crude oil exports declined 19.5 percent from last month’s shipments in real terms but remained well above the YTD average. Crude oil contributed to a 3.3 and 2.4 percent decrease in Texas’ exports to Brazil and Taiwan, respectively. Lower exports to Mexico contributed nearly 90 percent of the monthly decline as large reductions in agricultural and petroleum shipments pushed its share of Texas total exports down to 32.1 percent.

The Center created a Texas weekly leading index to predict turning points in the Texas economy. (For more information, see Texas Weekly Leading Index.) The index decreased during the first half of July but rose in the final two weeks of the month, gathering impetus and pointing toward higher future economic activity as the reopening of the economy continues (Figure 3). The improvement in the last two weeks was mainly due to a decrease in the number of people filing for unemployment insurance and an increase in the number of new business applications. The elevated number of new business applications signals strong future business activity. In addition, an increase in the real price of WTI oil contributed to the increase in the weekly index. In contrast, an increase in the real rate for the ten-year Treasury bill (which continues to exhibit a negative return in real terms) countered the increase in the weekly index. The rebound in Texas’ economic activity could be hindered by possible upsurges in COVID-19 cases as economic and social activity increases. Further waves of infections can reverse increased mobility and spending, affecting the path to recovery.

Related Data & Reports

You might also like

2025 Texas Real Estate Forecast

Texas real estate decisions impact everyone, from those buying or renting homes in the state’s smallest communities to global firms looking to relocate. Informed insights from our economic research team appear in this special forecast report.

Texas Border Economy | Third Quarter 2024

Like last quarter, border employment grew in 3Q2024but not enough to prevent an increase in the unemployment rate. Housing sales had a worse second quarter this year than last year, and home prices increased in two of the four border metros.

Texas Housing Insight | October 2024

Home sales typically cool off by October, but this year is a little different with sales in both September and October higher than they were during the summer. The rate of new listings is still on the rise resulting in rising inventory levels.

Publications

Receive our economic and housing reports and newsletters for free.