Outlook for the Texas Economy | March 2022

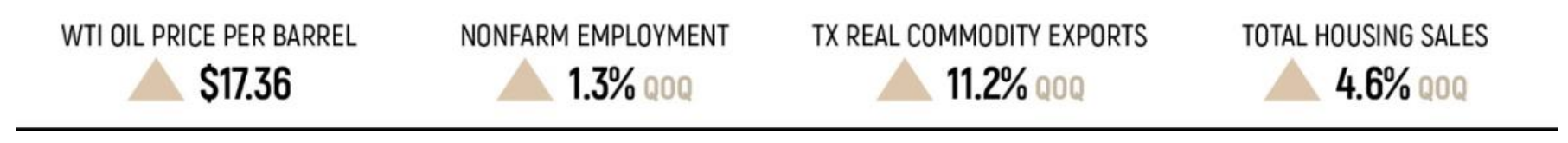

The Texas economy grew during first quarter 2022. Seasonally adjusted employment expanded 1.3 percent over the quarter, resulting in more than 166,000 new jobs. Consequently, the unemployment rate trickled down to 4.4 percent by the end of the quarter.

Outlook for the Texas Economy summarizes significant state economic activity and trends. All measurements are calculated using seasonally adjusted data, and percentage changes are calculated month over month, unless stated otherwise. Click here to receive email notifications each time this report is published.

The Texas economy grew during first quarter 2022. Seasonally adjusted employment expanded 1.3 percent over the quarter, resulting in more than 166,000 new jobs. Consequently, the unemployment rate trickled down to 4.4 percent by the end of the quarter. Some of the biggest employment sector winners were professional and business services and retail employment. However, there are some major headwinds facing the latter sector. For the time being, retail spending is still high relative to pre pandemic trends, but rising inflation may eat away those gains if not managed soon. Headline inflation reported by the Bureau of Labor Statistics rose 8.5 percent in March, a level not seen since the late ‘70s/early ‘80s. In coming months, the Texas economy will face either prolonged high inflation, the pain that tends to follow from fighting inflation, or possibly both.

Economic Activity

Cyclical movements supported optimism in the broad economy as the Dallas Fed’ Texas Business Cycle Index rose 10.1 percent on a seasonally adjusted annualized rate (SAAR). While the major economies all had bullish expansion, Austin outperformed the rest with the highest index value. Operating as the two largest concentrated economies in the state, Dallas followed Austin closely with steady double-digit growth. Houston, with a relatively rigid advancement, needed to renovate business policies for faster growth.

In Q1, the Texas Leading Economic Index was up 17.4 percent year over year (YOY), signaling a continuous upward trend for the future business cycle. However, the Texas Consumer Confidence Index decreased as a result of high prices and high interests, cooling customer purchase intentions.

The pandemic prompted people to reevaluate their locations, and many chose to move into tax-light states with affordable housing. In 2021, Texas was the second most-popular state. Recently released Census data revealed 56 percent of the 170,000 net domestic migrants to Texas chose Austin and Dallas.= Notably, domestic migrants preferred San Antonio (26k) to Houston (19k). Meanwhile, Texas gained 27,000 net international migrants, fewer than the annual levels gained during the first half of the 2010 decade.

____________________

1 All measurements are calculated using seasonally adjusted data, and percentage changes are calculated

month-over-month, unless stated otherwise.

Financial Activity

The Federal Reserve is expected to reduce its balance sheet assets and increase the Federal Funds rate several more times in 2022. The ten-year U.S. Treasury bond yield2 rose from 1.5 percent in December to 2.1 percent in March, a major change for such a short period. Furthermore, the Federal Home Loan Mortgage Corporation’s 30-year fixed-rate rose to 4.2 percent in March 2022 from a record low of 2.7 percent in January 2021. Responding to these increased property interests, Texas home-refinance applications declined over 10 percent in the past month, and the metric shrunk more than 50 percent from a year ago. Home-purchase applications, on the other hand, had strong growth in 2022, albeit diminishing 8 percent from a year ago.

Housing

Total housing sales grew 4.6 percent QOQ in the Texas urban triangle. In 1Q2022, over one-third of home sales were concentrated in the $300,000- $399,000 price cohort, while sales had double-digit growth for more expensive homes ($400,000-$1 million-plus). Sales grew most significantly for higher priced homes (more than $750,000), elevating 70.5 percent QOQ. At the metropolitan level, increased housing sales were pronounced in every major metro. Houston led with a notable sales growth of 8.6 percent, while Dallas kept expanding as the metro with most total sales.

The Residential Construction Cycle (Coincident) Indexes, which measure current construction activity, increased both nationally and within Texas as construction employment and wages grew because of growing construction activity. The Texas Residential Construction Leading Index (RCLI) is on the rise, signaling an increase in future activity. While the construction industry faces many roadblocks, Texas’ new-home market has been propelled by a wave of migrants, housing shortages, and the desire to expand and upgrade.

Energy

With the elevated disruption of global petroleum supplies, the West Texas Intermediate (WTI) crude oil spot price surged in March, averaging $107.34 per barrel and increasing $17.36 in one month. In March, Texas’ active rig count maintained the February level at 302. Crude oil production still contributed 43 percent of the national field production, despite decreasing to 4.83 million barrels per day in February3 . Given the volatile nature of the current energy climate, the Henry Hub spot price rose to $4.79 per million British thermal units (BTU), up $0.13 over the previous month. Energy prices are expected to continuously increase because of the evolving oil sanctions imposed on Russia.

Mounting oil prices have driven retail gasoline prices to historic highs. The U.S. price per gallon averaged $4.19 (seasonally adjusted), the highest ever, while Texas remained below the national average at $3.75. This constituted a 57.1 and 59.5 percent increase YOY, respectively, at the national and the state levels. Core U.S. inflation for March increased 6.5 percent YOY, the highest since the early 1980s.

Natural resource executives reported a faster oil production than gas on Dallas Fed’s Energy Survey. Production costs increased for the fifth consecutive quarter, and the 1Q2022 average price was approximately $34 per barrel. Once the price hit $56, firms would become profitable drilling a new well. The six-month outlooks improved as uncertainty became more pronounced by the end of the first quarter, and respondents expected to see both oil and gas prices decrease at year-end.

____________________

2 Bond and mortgage interest rates are nonseasonally adjusted. Loan-to-value ratios, debt-to-income ratios, and the credit score component are also nonseasonally adjusted.

3 The release of crude oil production typically lags the Outlook for the Texas Economy by one month.

Employment

Texas had stable employment growth, with state nonfarm employment adding over 166,900 jobs in the first quarter. Meanwhile, March employment was the smallest monthly gain in the past six months as acceleration in goods-producing sectors were offset by flattened out service sectors. Accordingly, the slowed gain pushed the Dallas Fed’s annual employment forecast down to 3.3 percent. While the labor force participation rate balanced at 63.4 percent, Texas’ unemployment rate decreased to 4.4 percent, still higher than the 3.6 percent national rate. Joblessness remained highest in Houston and lowest in Austin at 5 and 3.1 percent, respectively.

The number of Texans filing initial unemployment insurance claims peaked in January with 60,555, as people came out of the holiday season and started looking for work. Claims declined as the Texas economy continued to strengthen. By the same token, Texas’ average weekly continued unemployment insurance claims fell 8.5 percent in March to 118,000. The continued monthly decreases indicated strong labor demand as the economy expanded into record territory.

Texas’ average nominal private hourly earnings climbed 7.1 percent YOY to $29.67. In March 2021, Dallas was the only Texas metro recording nominal earnings higher than the national average. In March 2022, Dallas ($33.29), Fort Worth ($32.37), and Austin ($32.60) significantly exceeded the national average, signaling Texas employers’ urgent need to recruit qualified employees. On the other hand, after adjusting for inflation, these notable nominal growths pushed Texas’ average real private hourly earnings down, as the state’s annual growth could not match the speed of the skyrocketing inflation.

Among the major Texas metros, Dallas led with 64,900 new jobs over the quarter. Growth in Dallas was propelled by sustained growth in the services sector, particularly in professional and business services jobs. Trailing far behind was Houston, which added 32,400 new jobs over the quarter led by strong growth in retail employment and robust healthcare employment.

Manufacturing

Texas’ goods-producing sector created 37,100 jobs during the first quarter after adding 38,900 positions in the previous quarter. Amid increasing oil prices, energy-related employment rose by 13,700 jobs but remained around 13.3 percent below pre-pandemic levels. Recovering global economic conditions supported the state’s manufacturing industry, which gained 13,000 employees, with durable and nondurable-goods payrolls equally expanding. With Texas’ manufactured-housing market, March presented a myriad of concerns that weighed on industry optimism. According to the Center’s Texas Manufactured Housing Survey, in addition to labor shortage and supply constraints, the upcoming rules from the U.S. Department of Energy (DOE) generated skepticism on the feasibility of compliance costs, as these new regulations will elevate housing prices by at least 1.2 percent.

Average hourly manufacturing earnings declined 0.4 percent YOY after adjusting for inflation. This decline marked the first drop since January 2020. The Dallas Fed’s Manufacturing Outlook Survey corroborated mixed perceptions. The production index held steady at 13.2, despite the persisting supply chain issues hindering manufacturing conditions. Outlook uncertainty rose from 17 to 20.5 amid surging inflation, oil prices, supply shortages, and the evolving Russia situation with Ukraine, all of which were driving up prices and impacted business operations.

Construction

After the abrupt gain of 9,100 construction workers in December, Texas construction payrolls expanded with another 9,500 jobs in the last three months. The growth of higher-paying nonresidential jobs led to an uptick in nominal average hourly construction earnings ($28.57) but fell 5.1 percent YOY in real terms as inflationary pressures weighed on wages. Total construction values increased 0.5 percent QOQ as the nonresidential construction sector rose by 2.6 percent. On the residential side, the single-family construction value hike was highest in the last six quarters. In March, Houston’s single-family construction projects were worth twice as much as Austin’s as weather warmed and the construction season started. Meanwhile, in the multifamily market, decreased construction values in Houston, Austin, and San Antonio outweighed the gain in Dallas.

Services

Texas’ service-providing payroll surpassed the pre-pandemic level by 2.7 percent after creating 119,200 jobs during the first quarter. The hospitality industry alone contributed 26 percent of the payroll gains with 31,500 workers in the accommodation/food services sector, and the retail trade followed with 25,200 positions. Compared with 2021’s quarterly growths, the real estate/rental leasing employment expanded exponentially, accelerating at 61.6 percent. While the overall job market outlook was optimistic, transportation/warehousing/utilities lost 1,700 workers. The Dallas Fed’s Service Sector Outlook Survey reported the highest revenue index in the recent four months. The war between Russia and Ukraine increased uncertainty drastically among service providers, reflected by the falling future general business activity index. Other future service sector activity indexes, on the other hand, remained elevated.

Texas retailers added 28,800 workers in the quarter, with expansion in every sector. Clothing/clothing accessories and general merchandise stores grew most significantly, each with over 10,000 new jobs. Food/beverage stores recruited new workers consistently, while service stations rebounded moderately in March after the February layoff. Inflation-adjusted retail sales ticked down in March, extending declines to the third quarter. The Dallas Fed’s Retail Outlook Survey corroborated weakened retail activity as the sales index and retailers’ perception of broader business conditions fell into negative territory. Retailers were having a hard time covering the skyrocketing input prices with selling prices.

Trade

The U.S. Consumer Price Index (CPI) accelerated 8.5 percent annually and 2.2 percent quarterly. Inflation affected Dallas (9 percent) more than Houston (8.1 percent). Dallas’ March rate was the highest YOY increase since December of 1981. While sanctions on Russian oil lifted transportation costs 23 percent YOY for both metros, prices for food/beverages, housing, and medical in Dallas rose significantly faster than Houston. Core inflation, which excludes food and energy, was less aggressive at 6.5 percent.

The Texas trade-weighted value of the dollar4 depreciated for all three months during the first quarter, making Texas goods less expensive to foreign buyers. Under the benign currency exchange, countries responded with more international trades. Compared with the upbeat 6.3 percent QOQ increase in the national exports, Texas’ real commodity exports skyrocketed 11.2 percent QOQ to a record high, doubling May’s 2020 export value. The considerable amount of gas and oil exports rose for world trade. Texas crude oil exports hit the highest level since January 2002, serving 94 percent of the national crude oil exports from petroleum and bituminous minerals. Quarterly inflation-adjusted manufacturing exports grew modestly at 3.9 percent, as exports for aerospace products, engines/turbines/power transmission equipment, and industrial machinery shrunk.

____________________

4 The release of the Texas trade-weighted value of the dollar typically lags the Outlook for the Texas Economy by one month.

In This Article

Related Data & Reports

You might also like

2025 Texas Real Estate Forecast

Texas real estate decisions impact everyone, from those buying or renting homes in the state’s smallest communities to global firms looking to relocate. Informed insights from our economic research team appear in this special forecast report.

Texas Border Economy | Third Quarter 2024

Like last quarter, border employment grew in 3Q2024but not enough to prevent an increase in the unemployment rate. Housing sales had a worse second quarter this year than last year, and home prices increased in two of the four border metros.

Texas Housing Insight | October 2024

Home sales typically cool off by October, but this year is a little different with sales in both September and October higher than they were during the summer. The rate of new listings is still on the rise resulting in rising inventory levels.

Publications

Receive our economic and housing reports and newsletters for free.