Texas manufactured housing industry looks forward to a solid 2025

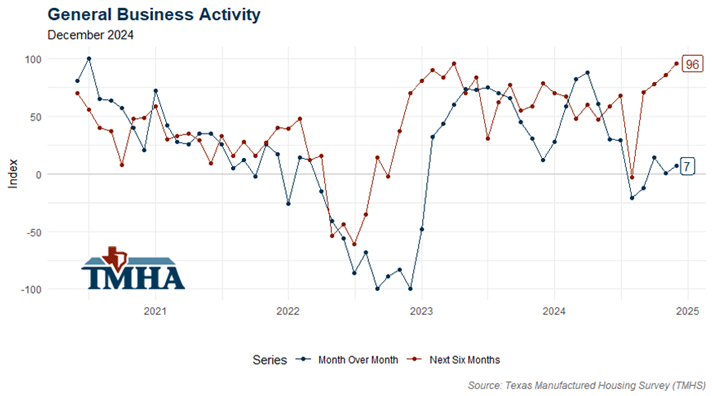

COLLEGE STATION – The December Texas Manufactured Housing Survey (TMHS) suggests the industry has started off 2025 on a positive note, with high expectations for better general business activity and an improved company outlook over the next six months.

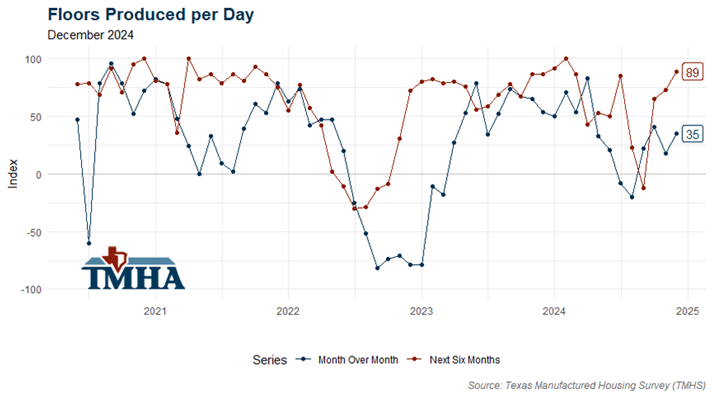

“Manufacturers have increased their production rate every month since August, and the December survey results have that streak continuing to close out the year,” said Rob Ripperda, vice president of operations for the Texas Manufactured Housing Association (TMHA). “We should get the shipment data for December in a few weeks, but another increase would put manufacturers output back up to volumes not seen since September of 2022.”

In December, expectations for the number of floors (sections) to be produced grew to their widest mark since February 2024.

Capital expenditure projections are still strong but down a bit from November, possibly reflecting some seasonality in the results.

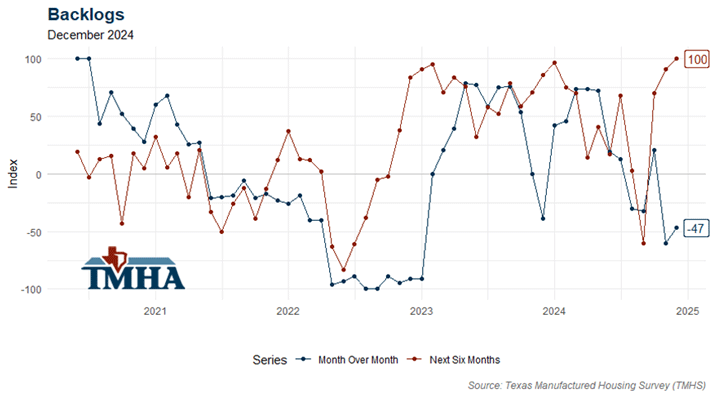

Backlogs are also showing seasonal variation, with December levels declining from the previous month but future expectations at a record high. The same seasonal pattern is evident in the number of floors sold per day, with lower numbers reflected at year-end but high expectations for strong sales over the next six months.

Supply chain disruptions were subdued and are expected to remain that way, a bit of a surprise considering the intense discussion about tariffs.

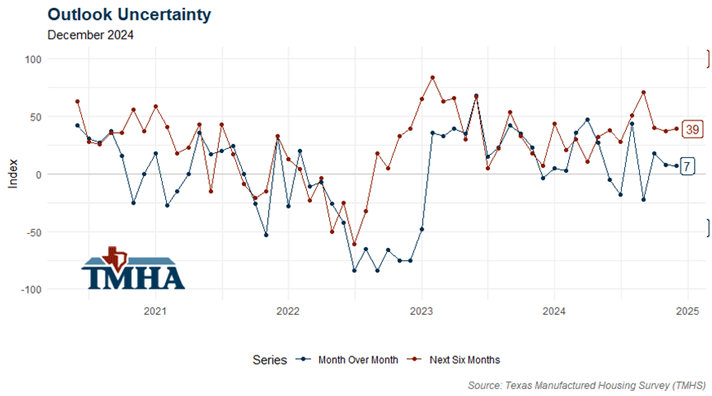

Current outlook uncertainty exhibited low numbers again in December, while expectations continue to show a post-election reduction.

Current and expected sentiment regarding regulatory burden remains tepid as well.

“The concern about across-the-board tariffs leveled against every country by President Trump seems to be subsiding,” said Harold Hunt, PhD., research economist at the Texas Real Estate Research Center at Texas A&M University (TRERC). “Many companies are taking a wait-and-see attitude, with some convinced that the threat of widespread tariffs could just be a bargaining chip. If true, the impact of tariffs could be less than has been expected.”

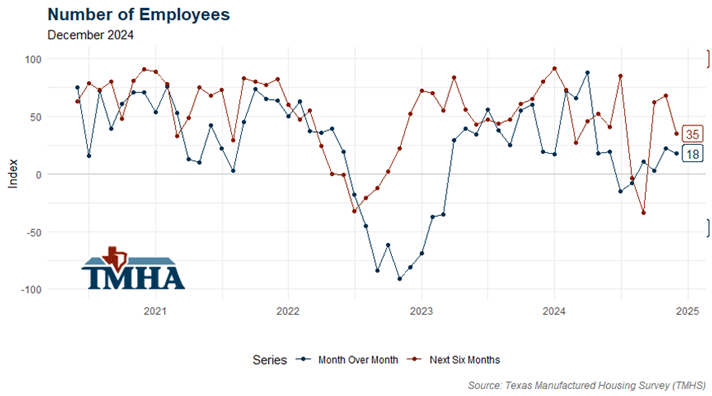

The survey continues to indicate little change in the expectations for average employee workweek while labor supply is expected to increase six months out. Expectations for labor costs and number of employees are both quite positive although highly volatile based on their historical trends.

The TMHS monthly sentiment survey gauges current conditions and expectations surrounding Texas’ manufactured housing industry. All TMHA members with manufacturing facilities in the state are invited to participate, and the survey panel represents 89 percent of HUD-code homes produced in Texas. The survey was created by TRERC, who administers it and calculates the responses.

In This Article

You might also like

Publications

Receive our economic and housing reports and newsletters for free.