Since its start, blockchain technology has garnered significant attention in the information technology world. However, it also has the potential to change the real estate industry

Blockchain “allows for the creation of immutable records of transactions accessible by all participants in a network” (Lewis, McPartland, and Ranjan, 2017, p.1). While there is still much to learn about the technology, blockchain provides an ability to create a more secure and efficient transaction process. The emerging technology may open the door for a new way of completing transactions while reducing costs and increasing transparency.

What is Blockchain?

Blockchain “allows a network of economic agents (e.g., individuals, firms, devices) to reach consensus, at regular intervals, about the true state of some jointly maintained and shared data” (Catalini, 2018, p. 36). Simply put, blockchain is a completely transparent and unvarying digital ledger used to record transactions in cyberspace.

Another term for blockchain technology is distributed ledger technology. It draws from both well established technology and newer technology to operate a set of synchronized ledgers managed by one or more entities. This new technology can reduce the traditional dependence on a central ledger managed by a trusted entity for holding and transferring funds and other financial assets.

More than Bitcoin

Blockchain technology was first introduced to the world in January 2009 through Bitcoin, an innovative crypto-currency founded by an anonymous computer scientist under the pseudonym Satoshi Nakamoto. The purpose of the Bitcoin blockchain was to produce a public ledger that would record transactions in a decentralized way (Todorov, 2017). However, Bitcoin is not the only crypto-currency on the market today. Since its emergence, over 1,000 other crypto-currencies have gone online, such as Ethereum, Litecoin, and Dogecoin, each running on its own blockchain operating system.

Describing the difference between blockchain and Bitcoin, Manav Gupta of IBM said, “Think of blockchain as an operating system, such as Microsoft Windows or MacOS, and Bitcoin as only one of the many applications that can be run on that operating system” (Gupta, 2018, p. 6).

Just like how an iPhone has tons of different applications that perform different tasks through the MacOS, blockchain is more than just Bitcoin and crypto-currencies. Crypto-assets such as Bitcoin use blockchain technology to record the movement of any asset. This electronic ledger allows transactions that would normally take days or weeks to process to be cut down to just minutes. Ultimately, blockchain creates credibility across a network of users by providing them with “cryptographic proof over a set of transactions; because transactions can’t be tampered with and are signed by the relevant counterparties, any corruption is readily apparent” (Gupta, 2018, p. 10). As Gupta states, “It’s not that you can’t trust who you do business with; it’s that you don’t need to when operating on a blockchain network” (Gupta, 2018, p. 10). This ensurance of credibility is a vital piece of the blockchain puzzle.

Bitcoin represents the largest implementation of blockchain technology, heightening interest to unleash potential for other uses that could lead to financial and real estate market innovations. Blockchain is viewed as having the force to disrupt payment, clearing, and settlement systems.

How Does a Blockchain Work?

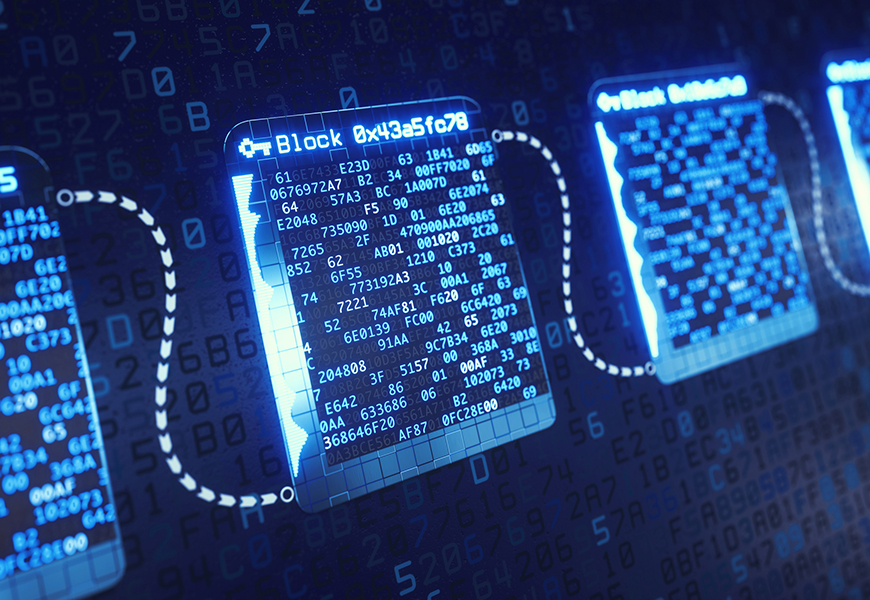

Transaction information and data are stored in “blocks” that become linked together as they are created to build a “chain,” hence the name blockchain.

The development and creation of new blocks is referred to as mining. As more blocks are mined as part of a single chain, the entire structure’s verification becomes stronger. Miners, or nodes, construct the blocks by selecting a transaction from “a pool of unconfirmed transactions” (Jimi S., 2018).

Once a transaction is selected, the miners create the block by giving it a unique identifier known as a hash. To create this identifier, the miner must solve a complex math equation unique to each individual block. The new block consists of time-stamped information about recent transactions that have been previously validated by a network of miners and is added to the blockchain. The hash transparently links the existing block and the newly created one, preventing deceitful behavior by corrupt individuals looking to alter an existing chain. Fundamentally, the mission of mining is to create a “secure, counterfeit-resistant agreement” (Todorov, 2017, p. 164).

The integrity, confidentiality, and reliability of blockchain technology provides buyers and sellers with an unchanging record of their transaction. In decentralizing the data, everyone overseeing the transaction has a copy of the contract. As a result, if someone tries to cheat the agreement, the other copies on file “won’t match up and everybody will be aware immediately” (Bolgar, 2017). In this way, attempts at fraud are invalidated by the blockchain network. This kind of security gives everyone involved a reliable chain of verified and accurate information.

In their article, “The Coming Blockchain Disruption: Trust Without the Middle-man,” authors Mark D. Hansen and Michael T. Kokal reiterate that once blocks have been validated, cryptographically sealed, and distributed through the chain, any attempt at “falsifying them, destroying them, altering them or concealing them is practically impossible” (Hansen & Kokal, 2017, p. 3).

For a visual representation of how blockchain works, see figure.

Blockchain and Real Estate

Blockchain technology might be used to improve real estate transactions through tools such as smart contracts, which “automatically authenticate buyer and seller identities using unique blockchain passcodes. The verified identity is then used throughout the process, eliminating the need for further authentication at each step in the process. Third-party providers that authenticate and process transactions will be either eliminated or significantly reduced, resulting in faster closings” (Cushman & Wakefield, 2018, p. 5).

By cutting out the middlemen (e.g., title offices, lawyers), transactions can occur faster, resulting in lower litigation fees. Smart contracts are also extremely versatile as they can be used in any form of real estate transaction, “from buying/selling properties to leasing agreements, property management, and vendor agreements” (Cushman & Wakefield, 2018, p. 5). By using a smart contract as a method of authentication, “the potential for fraud is practically eliminated” (Stewart, 2018).

Moreover, smart contracts can be applied in more than one way for a real estate deal. In a commercial real estate transaction, smart contracts can aid in acquiring developments that are under construction. A buyer of a property under construction can put money into an escrow account within the blockchain that cannot be touched by the developer until the buyer has obtained the property rights. Once construction has been finished and verified, the blockchain will unlock the developer’s earnings, and the sale will be complete (Kalyuzhnova, 2018, p. 6).

Rather than the closing process being done through the traditional method, which takes at least 30 days, the blockchain’s transaction becomes verified through mathematical equations and a general consensus in just a matter of hours. To summarize, a smart contract holds each party responsible for holding up their end of an agreement. If one party strays from the outlined specifics of the deal, the contract becomes invalid, and any money that was previously exchanged gets returned to the rightful owner.

The transfer of title and land registries can also be revolutionized through blockchain technology. By modernizing the recordkeeping process, property title management can become increasingly more transparent and cost-effective. Take title defects, for example. According to the American Land Title Association, “In nearly all real estate transactions there is at least one title defect that must be corrected before transferring the title” (Kejriwal & Mahajan, 2018, p. 17). As a result, about a quarter of real estate transactions require legal action to fix defective titles (Kejriwal & Mahajan, 2018, p. 17). Problems such as these force buyers to protect themselves with title insurance, which only adds to the purchasing costs. However, the protective services provided by blockchain technology have the potential to simplify the title-check process. Buyers can trust that this digital identifier’s existing data could be modified only through a general consensus established by the network of blockchain nodes.

Furthermore, the blockchain would eventually develop a more organized, complete, and up-to-date record than any national registry possibly could. Typically, buyers take the physical copy of the title to a recording office where it gets uploaded within the county’s database (Proskauer, 2018). However, it is only a matter of time before recordkeeping becomes fully automated. Once blockchain technology becomes implemented, it could “greatly reduce, if not eliminate, the constant need for scanning documents, printing labels, and organizing physical files in local recording offices” (Proskauer, 2018). Automating such tasks will help avoid human error and allocate resources to create a more productive operating system.

Real-World Applications

The application of blockchain holds more than just a transitionary function to the real estate industry. A blockchain system would eliminate the need for paper records that are vulnerable to natural disasters or simple misplacement.

Real-world issues that arose after the Haiti earthquake in 2010 could have been avoided had this technology been at the Haitians’ disposal. The uncertainty of ownership for thousands of land parcels contributed to lengthy legal disputes and diverted resources away from issues such as the redevelopment of major infrastructure and entire communities. In the nearly nine years since the earthquake, Haiti has still yet to see much improvement. According to Alexandru Oprunenco of the United Nations Development Programme, “Businesses and homes that are desperately needed to help citizens of Haiti get back on their feet are not being built” (Oprunenco & Akmeemana, 2018). When used together, smart contracts and transfer of property records via blockchain technology could help property owners avoid problems like those experienced in Haiti.

A buyer and seller need to register the property deed with the local governing body after they close on the sale of the property. Once the government begins the authentication process and the transaction is verified, ownership is transferred instantly, and the system records it. Blockchain technology will give countries like Haiti a significant increase in transparency and efficiency, as well as provide administrators with “instant access to a complete and permanent transactional history for each property and sale deed” (Oprunenco & Akmeemana, 2018).

This technological revolution is already underway in areas such as India, Dubai, and Brazil, where historical corruption and fraud forced governing entities to start developing blockchain networks for land title recording (Soliman, 2018). In fact, Sweden’s land registry, Lantmateriet, has been experimenting with and implementing blockchain as a way of recording property transactions since June 2016. According to Quartz, Sweden’s potential switch from a traditional land and property registry to an automated blockchain system is expected to save the taxpayers $106 million a year by “eliminating paperwork, reducing fraud, and speeding up transactions” (Wong, 2017). Blockchain’s benefits, such as cost savings and noncorruptive features, are only just beginning to come into fruition. As blockchain continues to grow beyond infancy, it will create radical change, just as the Internet created the digital age.

Other Residential and Commercial Applications

Buying and selling homes on a blockchain network would have a significant impact on the time it takes to close a deal and the closing costs. In a traditional real estate transaction, the paper copy of the deed has to be transferred from the seller to the buyer, who then is required to take it to the town clerk where the title is processed and stored in a ledger. However, the entire transaction could be done electronically through blockchain technology. According to Michael Pieciak, commissioner of the Vermont Department of Financial Regulation, blockchain would be able to “authenticate who owns a property and the history of that deed” (Wallace, 2018). As a result, the future of blockchain essentially has the potential to cut out middlemen such as lawyers and title insurance companies.

Blockchain would provide real-time updates on everything occurring on a property, such as “liens, encumbrances, building permits, and property improvements” (Wallace, 2018). When a transaction occurs, it would become available for everyone on the blockchain to access. Once added to the chain, the information could not be changed or tampered with as easily as it could be if it was stored on, say, a Google Doc.

From a commercial investment perspective, the technology also has potential to innovate the way deals are conducted and processed by storing data on a decentralized ledger that would give investors access to all of the information regarding an asset. By adopting a “tokenized system” (Lerman, 2018), blockchain would create a lower barrier of entry to foreign investors as well as divide a property into shares that would be represented by tokens, similar to shares of a stock (La Rosa & Pimentel, 2018). The sale and trading of the shares could happen instantly, which is a key component of what differentiates this blockchain-based model of real estate investing from the traditional way of crowdfunding. Similar to the residential applications, blockchain would enable fund managers and investors to work efficiently together without the outside assistance of a middleman.

Challenges

Blockchain’s potential is remarkable, however; the technology still holds many challenges before it can be successful implementated. One area where blockchain will need improvement is standardization. For blockchain to reach its full potential, there must be “generally accepted technical standards” that can be implemented by businesses and organizations around the world (Lewis et al., 2017, p 11).

Additionally, the need for increased scalability poses a challenge for adoption of the technology. What causes the scalability issue is the amount of computing power required to confirm a transaction. The power required to complete the transaction limits the speed at which new blocks can be added to the chain.

Security also needs to be addressed when dealing with a blockchain system. While the cryptographic tools available today are effective, future technology has the potential to make current tools ineffective and less secure (BIS, 2017, p. 14). Reduction of a central authority eliminates the single point of failure; however, in return, the system becomes more vulnerable to cybercriminals. If cybercriminals were to hack important information, “They could create fraudulent, immutable, transactions” (Lewis et al., 2017, p. 12).

Conclusion

Blockchain technology has the potential to transform financial and real estate services and markets by:

- simplifying transactions,

- decreasing processing times while increasing accessibility of assets and funds,

- decreasing the need for balancing across multiple recordkeeping databases,

- increasing transparency and immutability of transaction records,

- improving network resilience through distributed information management, and

- reducing operating and financial risks.

Blockchain technology comes with risks. Those risks include potential uncertainty about its operation and security; inability to exchange and use information with current technologies; uncertainty regarding the final settlement; legal questions regarding the soundness and implementation; absence of an ample governance framework; and issues related to data integrity, privacy, and invariability.

Market players, regulators, and policymakers that include the Committee on Payments and Market Infrastructures are currently looking into benefits and risks. Like any new technology, for blockchain to become a general-purpose technology (GPT) it must be pervasive, able to improve over time, and able to spawn complementary innovations. It’s too soon to tell whether blockchain is a GPT disrupter that increases efficiency, lowers costs, and allows for better practices in the financial and real estate industries.

References

“Blockchain: What Does the Future Hold for Blockchain in Australia?” Spark: Predicting Bushfire Spread – Data61, May 2017, www.data61.csiro.au/en/our-work/safety-and-security/secure-systems-and-platforms/blockchain.

Bolger, Catherine. “Paid Program: Blockchain for Business.” The Wall Street Journal, Dow Jones & Company, 3 Apr. 2017, partners.wsj.com/luxoft/the-new-perspective/blockchains-promise/.

Catalini, Christian. “Blockchain Technology and Cryptocurrencies: Implications for the Digital Economy, Cybersecurity, and Government.” Georgetown Journal of International Affairs, vol.19, 1 pp. 36-47, 1 September 2018, http://web.b.ebscohost.com.ezproxy.library.tamu.edu/ehost/pdfviewer/pdfviewer?vid=13&sid=78588d7b-b59c-494d-b672-0d8ae73de535%40pdc-v-sessmgr05.

Committee on Payments and Market Infrastructures. “Distributed ledger technology in payment and clearing and settlement: An analytical framework,” Bank for International Settlements (BIS), February 2017.

Cushman & Wakefield. “Blockchain, Bitcoin, and Real Estate,” Cushmanwakefieled.com, November 2018, pp. 1-12, http://www.cushmanwakefield.com/en/research-and-insight/2018/blockchain-bitcoin-realestate, 1 December 2018.

De La Rosa, Shawna, and Joseph Pimentel. “No Longer A Test: More Companies Are Now Using Blockchain For CRE Investment.” Bisnow.com, 11 Nov. 2018, www.bisnow.com/national/news/technology/no-longer-a-test-more-cre-companies-are-now-using-blockchain-94710.

Gupta, Manav. Blockchain For Dummies. John Wiley & Sons, Inc., 2018, EBSCOhost, http://web.b.ebscohost.com.ezproxy.library.tamu.edu/ehost/pdfviewer/pdfviewer?vid=1&sid=79b5ba43-7509-4cad-ac83-69441a1714ca%40sessionmgr102. 13 November 2018.

Hansen, Mark D., Michael T. Kokal. “The Coming Blockchain Disruption: Trust Without The Middle-man,” IADC Committee Newsletter Business Litigation, pp. 1-3, 2017, http://web.b.ebscohost.com.ezproxy.library.tamu.edu/ehost/pdfviewer/pdfviewer?vid=9&sid=91cc3f25-a4bd-42a1-9a43-7e404c3ec019%40sessionmgr104.

Kalyuzhnova, Nadezhda. “Transformation of the Real Estate Market On The Basis Of Us Of The Blockchain Technologies: Opportunities and Problems,” MATEC Web of Conferences, 5 December 2018, pp. 1-11, https://doi.org/10.1051/matecconf/201821206004.

Kejriwal, Surabhi, and Saurabh Mahajan. “Blockchain in Commercial Real Estate (CRE) | Deloitte US.” Deloitte United States, Deloitte, 9 Aug. 2018, www2.deloitte.com/us/en/pages/financial-services/articles/blockchain-in-commercial-real-estate.html.

Lerman, Tara. “Commercial Real Estate Prepares For The Era Of Blockchain.” Bisnow.com, 22 Aug. 2018, www.bisnow.com/chicago/news/technology/commercial-real-estate-prepares-for-the-era-of-blockchain-91571.

Lewis, Rebecca, McPartland, John, and Ranjan, Rajeev. “Blockchain and financial market innovation,” Economic Perspectives, Federal Reserve Bank of Chicago, 7/2017.

Oprunenco, Alexandru, and Chami Akmeemana. “Using Blockchain to Make Land Registry More Reliable in India.” UNDP, United Nations Development Programme, 1 May 2018, www.undp.org/content/undp/en/home/blog/2018/Using-blockchain-to-make-land-registry-more-reliable-in-India.html.

Patterson, Sara S. “Get Smart. Commercial Investment Real Estate,” vol. 37, no. 4, July | August 2018, pp.30-32, EBSCOhost, https://cire.epubxp.com/i/1001816-jul-aug-2018, 13 November 2018.

Proskauer. “Modernizing Real Estate Record with Blockchain,” proskauer.com, 30 June 2018, https//www.proskauer.com/blog/modernizing-real-estate-records-with-blockchain, 5 December 2018.

S., Jimi. “Blockchain: How Mining Works and Transactions are Processed in Seven Steps.” Medium.com, Coinmonks, 2 May 2018, https://medium.com/coinmonks/how-a-miner-adds-transactions-to-the-blockchain-in-seven-steps-856053271476. 13 November 2018.

Soliman, Joseph M. “Blockchains and Land Title Records,” Mintz, https://www.mintz.com/insights-center/viewpoints/2176/2018-05-blockchains-and-land-title-records, 5 December 2018.

Stewart, Tyler. “Why Blockchain Will Revolutionize Commercial Real Estate,” Realcrowd.com, 5 December 2018, https://www.realcrowd.com/blog/2018/07/blockchain-will-revolutionize-commercial-real-estate-industry/.

Stinchcombe, Kai. “Blockchain Is Not Only Crappy Technology But A Bad Vision For The Future,” Medium.com, 5 April 2018, https://medium.com/@kaistinchcombe/decentralized-and-trustless-crypto-paradise-is-actually-a-medieval-hellhole-c1ca122efdec, 5 December 2018.

Todorov, T. “Bitcoin – An Innovative Payment Method with A New Type of Independent Currency.” Trakia Journal of Sciences, vol. 15, no. 1, 2017, pp. 163-166, doi:10.15547/tjs.2017.s.01.029.

Veuger, Jan. “Trust in a viable real estate economy with disruption and Blockchain,” Facilities, Vol. 36 Issue: 1/2, pp.103-120, https://doi.org/10.1108/F-11-2017-0106.

Wallace, Charles. “Want to Buy or Sell a Home for Less? Look to Blockchain Technology.” Find Real Estate, Homes for Sale, Apartments & Houses for Rent – Realtor.com®, Realtor.com, 21 May 2018, www.realtor.com/news/trends/blockchain-technology-disrupt-real-estate/.

Wong, Joon Ian. “Sweden’s Blockchain-Powered Land Registry Is Inching Reality,” Quartz, 3 April 2017, https://qz.com/947064/sweden-is-turning-a-blockchain-powered-land-registry-into-a-reality/, December 5 2018.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.