Land Insights | Winter 2025

The last three years have been a wild ride for rural land market participants, but that cycle may be over. The Texas rural land market appears to be in flux and in search of a new direction.

Helping Texans make the best real estate decisions since 1971.

Editor’s note: The data in this article were current at the time of author’s submission on November 11, 2024.

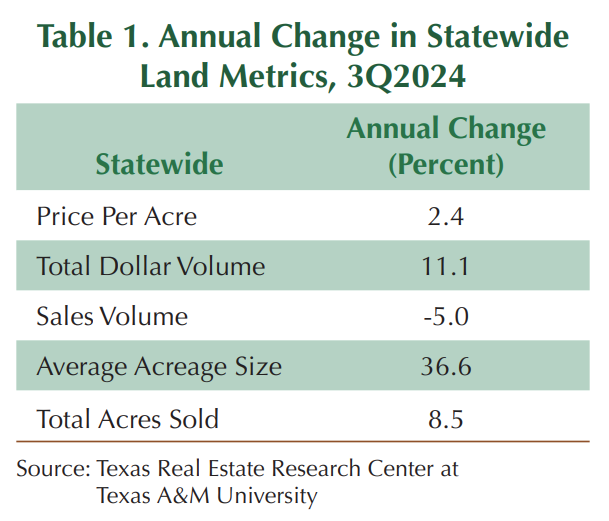

The last three years have been a wild ride for rural land market participants, but that cycle may be over. The Texas rural land market appears to be in flux and in search of a new direction. Annualized statewide price change continued to moderate, up 2.4 percent year-over-year through third quarter 2024 (Table 1).

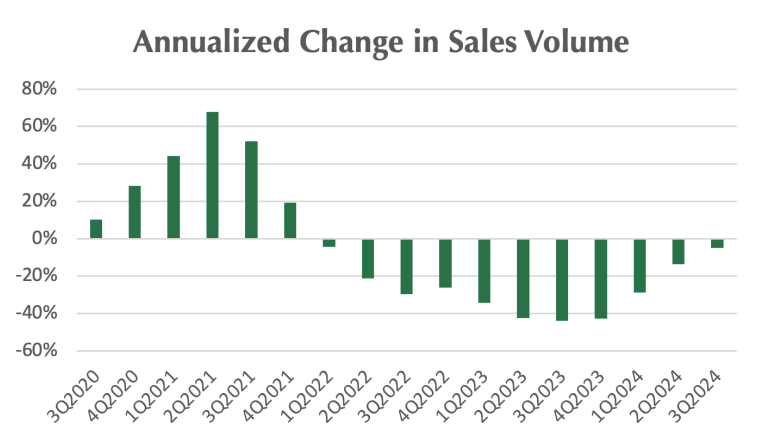

While this rate of change may appear to indicate stabilization, some issues are worthy of discussion. First, market activity is still depressed (well below 2019 levels), and annualized total sales continued to decline, down 5 percent YOY.

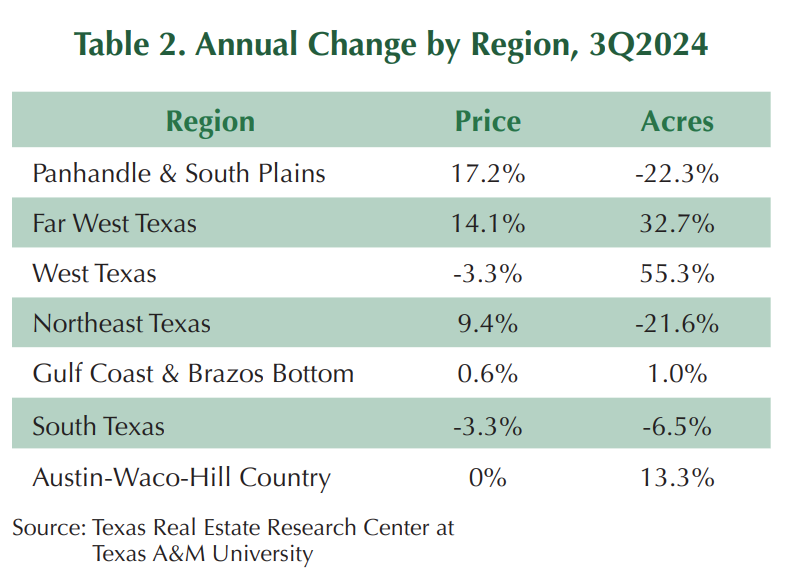

Secondly, YOY price growth varied widely by region and was heavily influenced by recent sales price strength in Regions 1, 2, and 4, but it is worth noting that Regions 1 and 4 had substantial drops in total acres sold (Table 2). This is indicative of a market in which quality tracts are selling at higher prices while less attractive tracts are sitting on the market longer.

Though the number of sales was down in the third quarter, total acres sold was up 8.5 percent as the typical tract size jumped 36.6 percent. The typical size was pushed up by large tracts in Regions 1, 2 and 4. Statewide total dollar volume rose 11.1 percent over the prior annualized total.

Statewide median price rose to $4,737, which, as previously noted, was up 2.4 percent YOY. The real (deflated) price increased only 0.15 percent. The five-year compound annual growth rate (CAGR) is still strong at 9.92 percent, down from a peak of 10.85 percent at the end of 2023.

Prices declined 3.3 percent YOY in Regions 3 and 6. These were the only two regions with a YOY price decline. However, Region 7 was flat and Region 5 was up less than 1 percent.

While statewide annualized sales volume through Q3 was the lowest seen since 2Q2013, the rate of decline is the lowest since 1Q2022 when sales activity started to descend from the 2020-21 frenzy (see figure).

Regional price and volume dynamics indicate an unsettled market. Feedback from market participants consistently indicates many sellers are expecting prices that suggest a rate of appreciation that does not currently exist, at least not broadly. In other words, with the low volume of total sales, current market prices appear to be propped up by a relatively small number of well-off buyers securing premium properties.

TRERC’s forecast model predicts small declines in statewide price followed by slightly more total acres sold over the next year. For this to happen, the dynamic described in the previous paragraph will need to change. It is likely that sellers will moderate their asking prices, which will attract new buyers who will likely also be encouraged by lower interest rates. Additionally, many would-be buyers, fearful of the election and its potential aftermath, held off purchases. With the election over, those buyers may now be prepared to act.

____________________

Lynn D. Krebs, Ph.D. ([email protected]) is a research economist with the Texas Real Estate Research Center.

Check out the latest issue of our flagship publication.

Receive our economic and housing reports and newsletters for free.

Housing

As the state’s population grows, so does the need for more housing. Here are the data and tools you need to keep up with housing market trends in your area.

Commercial

Whether you’re talking about DFW’s financial services industry, Austin’s tech sector, Houston’s energy corridor, or the medical hub that is San Antonio, commercial real estate is big business in Texas.

Rural Land

Mineral rights. Water issues. Wildlife management and conservation. Eminent domain. The number of factors driving Texas land markets is as big as the state itself. Here’s information that can help.

Economy

Texas is a large, diversified state boasting one of the biggest economies in the world. Our reports and articles help you understand why.

Data & Reports

Center research is fueled by accurate, high-quality, up-to-date data acquired from such sources as Texas MLSs, the U.S. Bureau of Labor Statistics, and the U.S. Census Bureau. Data and reports included here are free.

News

Stay current on the latest happenings around the Center and the state with our news releases, NewsTalk Texas online searchable news database, and more.

Conferences

Our popular Outlook for Texas Land Markets conference provides a yearly, comprehensive look at the issues impacting the state’s rural land markets.

About Us

Established in 1971, the Texas Real Estate Research Center is the nation’s largest publicly funded organization devoted to real estate research. Learn more about our history here and meet our team.

Helping Texans make the best real estate decisions since 1971.

You are now being directed to an external page. Please note that we are not responsible for the content or security of the linked website.