Living It Up Downtown

Downtown housing is making a comeback in both large and small cities across Texas. This article reviews what is happening and where.

Helping Texans make the best real estate decisions since 1971.

In the early part of the 20th Century, downtowns were the bustling hubs of city life and centers of retail and office activity. Merchants often lived in apartments above their shops, and other residential buildings were an integral part of the downtown landscape. Over time, businesses moved away from city centers, and downtowns declined as retail and housing centers shifted to the suburbs.

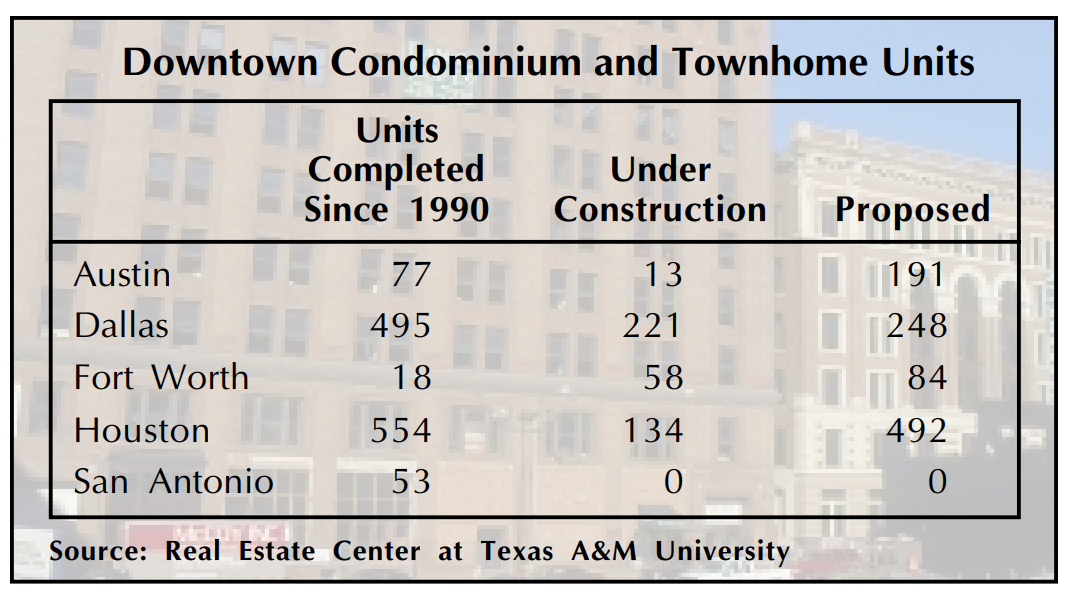

But downtown housing is making a comeback. More than 13,000 housing units were completed in downtown areas of the state’s largest cities during the 1990s. The majority of current developments are rental units, but roughly 10 percent of projects in major cities are for sale.

According to market surveys by Central Dallas Association and Downtown Houston Management District, the primary market for downtown housing is college-educated people age 35 and younger who earn more than $35,000 per year. Surveys show that the median income of downtown residents is more than $88,000 in Dallas and $68,750 in Houston. Thirty-nine percent of downtown Dallas residents make more than $100,000 per year, while 27.6 percent of downtown Houston residents fall into that income range. This degree of affluence has led to a demand for high-quality residential products with easily accessible entertainment, restaurants and offices.

Major developers and home builders are involved in developing new townhouse projects downtown. Perry Homes has completed a large townhouse project in midtown Houston with more construction planned. The firm also developed the Remington Place townhomes at Belknap and Lexington in downtown Fort Worth. These 2,100- to 2,900-square-foot townhomes sell for roughly $250,000 to $290,000 and provide gated security.

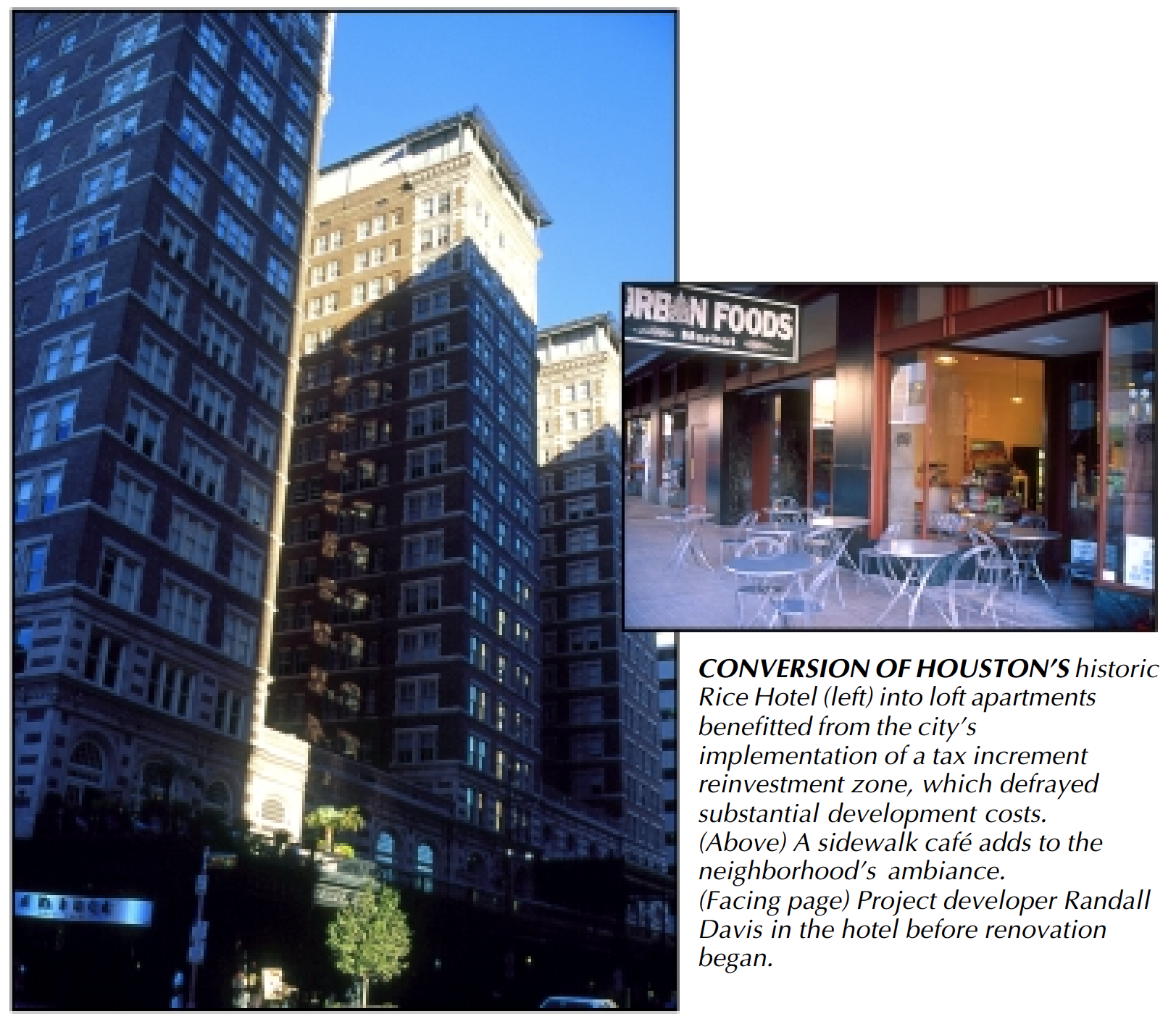

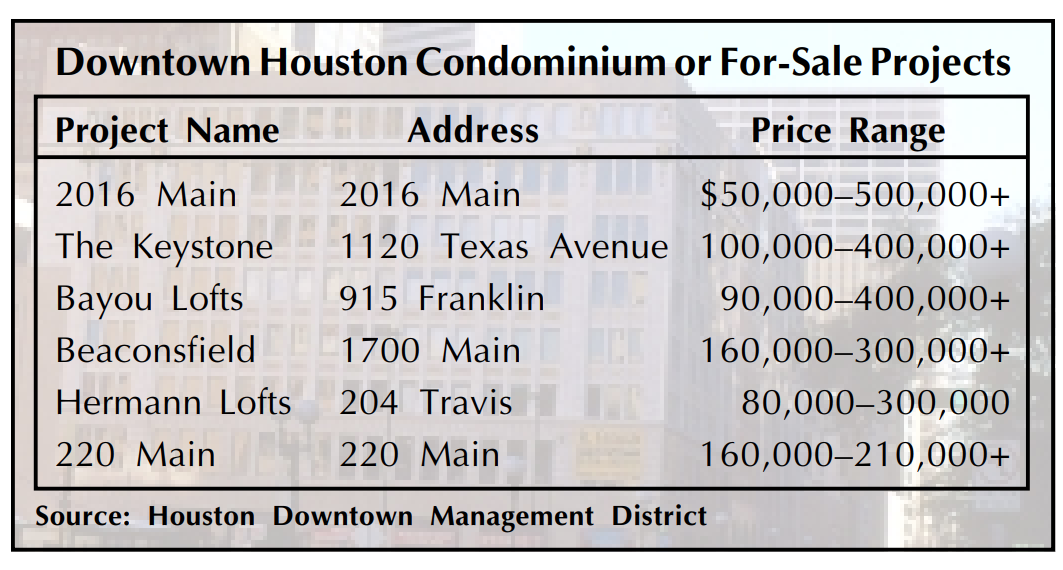

In addition to new townhouse construction, some historic downtown buildings are being used as condominiums. Beaconsfield in downtown Houston is a prime example of such a project. This luxury residential complex originally opened in 1911.

Condominium units in the refurbished building range from 1,600 to 2,300 square feet and have amenities such as high ceilings, brass hardware, fireplaces and custom mantels. The complex provides a doorman, gated parking and 24-hour concierge service.

The Homes of Thomas Court project in the State Thomas Historic District in downtown Dallas consists of 25 two- and three-bedroom, modern row houses priced from $250,000 to $525,000. Units range in size from 1,800 to 3,500 square feet and feature 10- and 12-foot ceilings, hardwood floors, gas cooktops and attached two-car garages. All homes have been sold.

Summit Ruins at Seventh is a new seven-story luxury condominium building in Fort Worth with units priced from $525,000 to $1 million. The two- to four-bedroom, 3,700- to 4,200-square-foot condominiums feature two floors, underground parking and rooftop gardens with a view of downtown and the Trinity River.

Large cities are not the only ones experiencing a boom in downtown housing. In Denton and San Angelo, the second or upper floors of some small commercial buildings in the Main Street areas are being converted to residential lofts. According to Denton’s Main Street project, 27 such apartments exist downtown. Most buildings house one to four units, although a developer is working on a six-unit rehabilitation project and plans a 20-unit new construction project.

San Angelo, too, is seeing increased interest in down town residential development. The Cactus Hotel in downtown San Angelo includes several apartments, and investors have purchased an old rooming house on South Oakes Street to convert to residential units.

In Wichita Falls, a 29-unit condominium project called Richmond Condominiums is in the works. The condos are expected to sell for about $70 per square foot with floor plans ranging from 624-square-foot one-bedroom units to 1,800- square-foot two-bedroom units. One major selling point: the 59 covered parking spaces adjacent to the building. This $1.1 million project was self-financed by the developer.

Financing is proving to be a major stumbling block for downtown residential projects, primarily because these types of developments are viewed as experimental ventures with no guarantee of success in many cities. Consequently, many building conversions are self-financed, especially in smaller cities. A Texas A&M University professor who renovated a downtown Bryan building to include office and residential space agrees that lack of available financing is a major growth inhibitor in the downtown housing market.

Most cities advertise federal and local financial incentives to develop downtown housing, including loans, tax credits, tax abatement and infrastructure and parking development. In some cases, these incentives reduce the cost of the project, but in other cases, the red tape associated with the incentives, along with development restrictions, negates the benefits.

For developers and investors trying to select a suitable site for a downtown housing project, the “livability” of the downtown area poses the greatest challenge. Residents must feel that safety and cleanliness issues are adequately addressed. Areas dominated by low-income housing and social service agencies may have greater difficulty attracting market-rate development. Lack of conveniences such as grocery and discount stores may also be an issue. The best site is located in an area of downtown that has an active day and night life and is perceived as safe.

Construction of downtown housing is expected to remain strong across the state. The majority of for-sale projects are at the high end of the price scale, and prices are expected to remain high as the availability of easily converted buildings shrinks. Approximately 6,000 downtown housing units are currently proposed statewide, 17 percent of which are expected to be for sale.

For more information, order Center technical report 1351, Downtown Texas Housing. See the order form on page 28.

Evans is a research associate and Spillette is a graduate research assistant with the Real Estate Center at Texas A&M University.

Check out the latest issue of our flagship publication.

Receive our economic and housing reports and newsletters for free.

Housing

As the state’s population grows, so does the need for more housing. Here are the data and tools you need to keep up with housing market trends in your area.

Commercial

Whether you’re talking about DFW’s financial services industry, Austin’s tech sector, Houston’s energy corridor, or the medical hub that is San Antonio, commercial real estate is big business in Texas.

Rural Land

Mineral rights. Water issues. Wildlife management and conservation. Eminent domain. The number of factors driving Texas land markets is as big as the state itself. Here’s information that can help.

Economy

Texas is a large, diversified state boasting one of the biggest economies in the world. Our reports and articles help you understand why.

Data & Reports

Center research is fueled by accurate, high-quality, up-to-date data acquired from such sources as Texas MLSs, the U.S. Bureau of Labor Statistics, and the U.S. Census Bureau. Data and reports included here are free.

News

Stay current on the latest happenings around the Center and the state with our news releases, NewsTalk Texas online searchable news database, and more.

Conferences

Our popular Outlook for Texas Land Markets conference provides a yearly, comprehensive look at the issues impacting the state’s rural land markets.

About Us

Established in 1971, the Texas Real Estate Research Center is the nation’s largest publicly funded organization devoted to real estate research. Learn more about our history here and meet our team.

Helping Texans make the best real estate decisions since 1971.

You are now being directed to an external page. Please note that we are not responsible for the content or security of the linked website.