Texas Border Economy | Second Quarter 2023

Economic indicators along the border were mostly positive in the second quarter.

Helping Texans make the best real estate decisions since 1971.

Texas Border Economy is a summary of important economic indicators that help discern trends in the housing markets along the Texas-Mexico border.

Economic indicators along the border were mostly positive in the second quarter. Employment numbers increased in the two largest Metropolitan Statistical Areas (MSAs), which contributed to the border’s total employment gains. The border unemployment rate, however, increased 10 basis points to 5.3 percent by quarter-end.

Housing sales are still down compared with last year, but home prices remain elevated. Inflation also continued to cool as the Federal Reserve’s interest rate increases showed more impact. Data showed that while inflation is still well above the Fed’s inflation target, it is at least showing continuing signs of decelerating.

According to the Dallas Fed’s Business-Cycle Indexes, a measure of general economic output, the second quarter revealed mixed progress for growth. El Paso had the strongest year-over-year (YOY) growth at 2.6 percent, followed by McAllen at 2 percent. Brownsville had a positive YOY growth rate at the quarter end but has been in gradual month-over-month (MOM) decline since September of last year. Finally, Laredo posted both negative growth YOY and MOM. Monthly growth in Laredo reached its post-COVID peak in September and has been in gradual decline ever since.

Pedestrian and personal vehicle passenger crossings at the border increased by 6.6 and 7.1 percent YOY, respectively. At the current rate, both metrics are likely to fall short of last year’s combined level of 74 million individuals, well below 2019’s combined level of 83 million.

Overall, border MSA nonfarm employment added 5,400 positions due to hiring expansion in McAllen-Edinburg-Mission (Table 1). The first quarter had robust employment growth, particularly in the McAllen-Edinburg-Mission region, where the professional and business services and trade and transportation industries have emerged as the most significant contributors to job creation.

The border-wide unemployment rate averaged 5.3 percent in the second quarter. Joblessness in both Brownsville and El Paso increased by 20 basis points. McAllen-Edinburg-Mission’s unemployment rate remained unchanged at 6.3, while in Laredo it bumped up 10 basis points to 4.1 percent.

Growth in average hourly earnings has been mixed along the border this year. Both El Paso and Laredo have grown almost every month since 2021. Between May 2021 and June 2023, the average hourly earnings in El Paso grew from $19.33 to $22.93, while from December 2021 to June 2023 the average earnings in Laredo grew from $17.73 to $21.52. Meanwhile, over the same period, earnings in both Brownsville and McAllen have remained mostly unchanged.

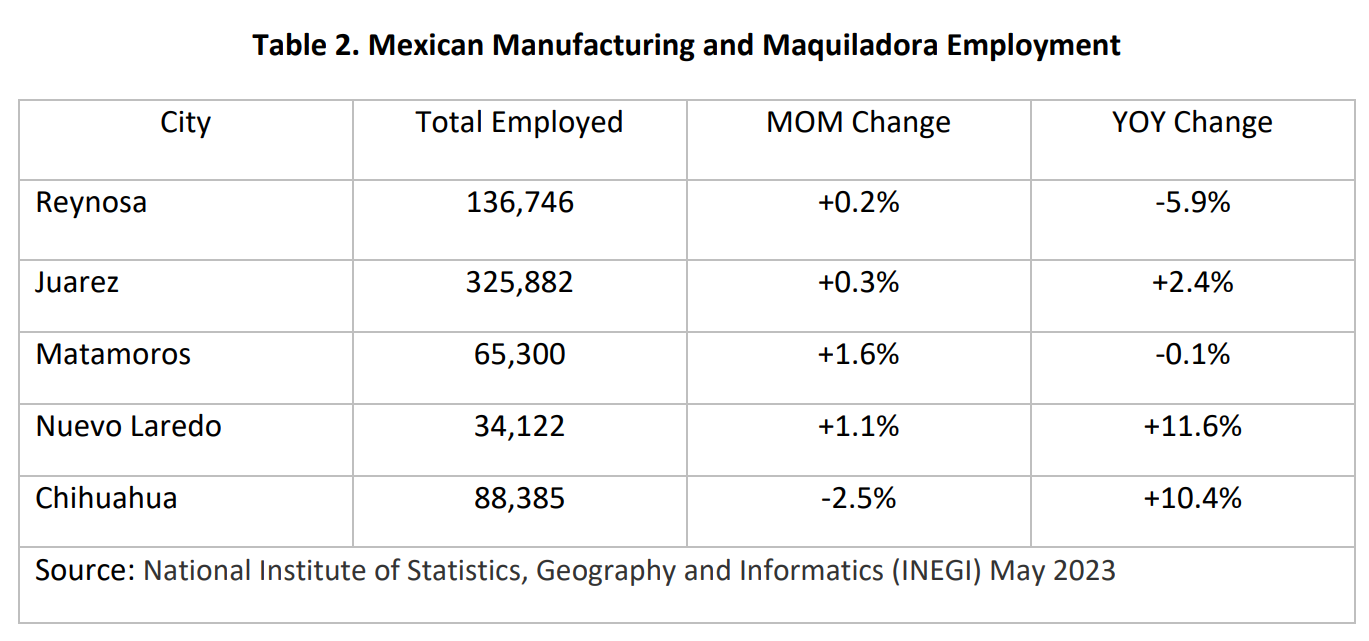

On the southern side of the border, Mexican manufacturing and maquiladora employment1 in both Nuevo Laredo and Chihuahua recorded double-digit YOY growth (Table 2). The burst in growth has helped manufacturing in both of these cities to finally recover from COVID job losses. In Juarez, the largest manufacturing city along the border, job growth has sustained a consistent positive pace.

1Mexican manufacturing and maquiladora employment is generated by the Nacional de Estadística y Geografía.

In the currency market, the peso per dollar exchange rate continued its downward trend, reaching $17.74. Compared with a year ago, when the exchange rate was above $20, the peso has continued to strengthen against the dollar.

At the end of 2Q2023, both YTD imports and exports along the border have exceeded levels reached in the last three years, signifying a recovery from the COVID disruption. Growth was propelled by major increases in export activity coming out of Laredo, reaching almost $62 billion versus $56 billion the year before. Import activity also increased in Laredo, but at nowhere near the same rate.

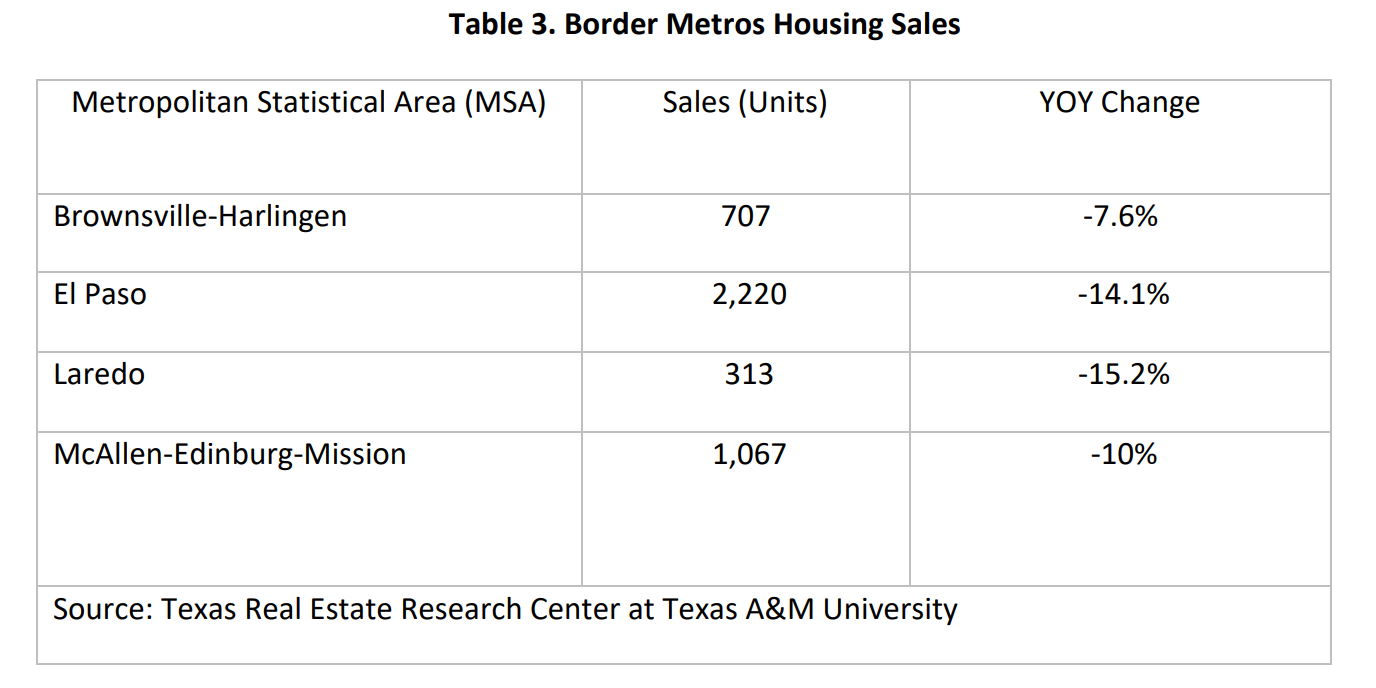

Housing sales have been down as a result of higher interest rates. The average 30-year mortgage rate in 2Q, according to Freddie Mac, was 6.5 percent, or over 100 basis points greater than this time last year. As a result, home sales across the border have been far below sales in recent years.

The largest drop in home sales has been Laredo (Table 3) with a 15.2 percent fall compared with 2Q2022. Both El Paso and McAllen followed with their own double-digit drops at 14.1 and 10 percent, respectively. Brownsville was the only border metro with a single-digit YOY loss at 7.6 percent.

Despite falling sales volume, home prices within the border metros continued to climb (Table 4). El Paso gained the most YOY at 7.8 percent in 2Q while Laredo gained the least at 3.5 percent. Limited supply has helped sustain elevated prices. While not as tight as a year ago when most border metros held supply levels at or below two months, this year’s levels are still below pre-pandemic levels.

The slowdown in home sales has impacted not only existing homes, but also new home activity. Both permits and starts for single-family homes reported lower YTD activity than this time last year. Like the existing home market, while units are down prices are up. Even with units below last year, construction output is still ahead of the long-term trend before COVID.

Check out the latest issue of our flagship publication.

Receive our economic and housing reports and newsletters for free.

Housing

As the state’s population grows, so does the need for more housing. Here are the data and tools you need to keep up with housing market trends in your area.

Commercial

Whether you’re talking about DFW’s financial services industry, Austin’s tech sector, Houston’s energy corridor, or the medical hub that is San Antonio, commercial real estate is big business in Texas.

Rural Land

Mineral rights. Water issues. Wildlife management and conservation. Eminent domain. The number of factors driving Texas land markets is as big as the state itself. Here’s information that can help.

Economy

Texas is a large, diversified state boasting one of the biggest economies in the world. Our reports and articles help you understand why.

Data & Reports

Center research is fueled by accurate, high-quality, up-to-date data acquired from such sources as Texas MLSs, the U.S. Bureau of Labor Statistics, and the U.S. Census Bureau. Data and reports included here are free.

News

Stay current on the latest happenings around the Center and the state with our news releases, NewsTalk Texas online searchable news database, and more.

Conferences

Our popular Outlook for Texas Land Markets conference provides a yearly, comprehensive look at the issues impacting the state’s rural land markets.

About Us

Established in 1971, the Texas Real Estate Research Center is the nation’s largest publicly funded organization devoted to real estate research. Learn more about our history here and meet our team.

Helping Texans make the best real estate decisions since 1971.

You are now being directed to an external page. Please note that we are not responsible for the content or security of the linked website.