Almost all small towns in Texas would love to revitalize their downtowns. Lofts can play an important role in reviving neglected old buildings that have historical interest and character.

An old way of life is becoming cool again. Across the country, the popularity of compact cityscapes where people actually walk, interact, and enjoy a more intimate “vibe” is returning. A 2015 survey by the National Association of Realtors and Portland State University found that when deciding where to live, 79 percent of Americans in the 50 largest metropolitan areas wanted to be within an easy walk of places and things to do in their community.

Pockets of redevelopment within the state’s five major metros have been implementing this “New Urbanism” theme for quite some time. However, smaller Texas cities have not seen the same level of revitalization occurring in their downtowns.

With help from technology, a growing number of empty nesters, and millennials, a small-town revival is gathering steam. More Texas cities are discovering they can offer something unique and appealing to folks wanting to live in their downtowns. More entrepreneurial millennials are discovering they can live and work in any town that has fast internet connections and Amazon delivery.

One distinctive type of real estate many smaller cities offer is older buildings with genuine architectural character. Although they have their challenges, some of these buildings are being converted into one-of-a-kind residential lofts. This article focuses on a few Texas cities that have successfully drawn residents back to their downtowns to experience loft living.

Whittling Down the List

Since not every small town in Texas could be contacted, the starting point for discovering successful downtown revivals was the presence of postsecondary educational facilities. Technical schools, junior colleges, colleges, or universities are located in about 100 Texas cities. The assumption was made that even a small number of college-age students should improve the odds of locating cities with vibrant downtowns.

Austin, Dallas, Fort Worth, Houston, and San Antonio, as well as any cities directly connected to them, were removed from consideration. Of the more than 50 cities that remained, all were contacted about their level of downtown residential activity. They were also asked whether any of their old downtown buildings had been converted into loft apartments.

The majority of these cities had not yet experienced sufficient revitalization to bring any meaningful residential activity back downtown. Based on in-depth phone conversations with city officials, chambers of commerce, and local real estate professionals, seven cities were chosen to visit.

The cities were Commerce, Denison, Denton, Paris, San Marcos, Tyler, and Waco. Sulphur Springs was later added based on an extensive New Urbanist-style makeover of its downtown, even though it has no postsecondary educational facilities.

Who Chooses Loft Living?

The conversations revealed students were not the primary demographic for renovated downtown lofts. Dylan Simon, an urbanist and investment sales advisor at Colliers International in Seattle, confirms the logic behind this. Simon sees a distinction between “first-move” and “second-move” locations for renters.

First-move locations are where new residential renters tend to land initially. This group generally clusters around housing that is well advertised and can be found with a web browser or smartphone. Easy commutes are desirable, which correlate with the increased popularity of new high-amenity campus housing targeting today’s more particular students.

Postsecondary facilities in most cities under discussion were not within walking distance to downtown, ruling out easy commutes to campuses. San Marcos and Denton were exceptions, leading to much higher student populations frequenting those downtowns.

Second-move locations are primarily driven by a deeper understanding of the city and its neighborhoods. When these older, more informed residents relocate, they tend to gravitate toward places where the activities, character, lifestyle, and scale match their individual needs and wants at that point in their life. They are also looking for authenticity.

“I’ve found that folks don’t like what I call Disney downtowns,” says Beverly Abell, City of Tyler Main Street Department leader. “Cities develop over decades, and buildings with different architectural styles are acceptable to residents downtown as long as their makeovers are well done and in context with the other buildings.”

Abell admits that some of the nicest downtowns in Texas were “preserved by mid-century poverty” because less-prosperous cities didn’t destroy the early 1900s features of their older buildings with 1950s and ’60s renovations.

Within the eight cities visited for this study, landlords reported that young professionals were the primary tenants occupying downtown loft conversions. Empty-nesters came in a distant second.

Although some downtown residents owned their own space, or even the whole building, the vast majority of loft-dwellers were renters. The exception was Waco, which has three downtown loft condo buildings. Local real estate professionals stated many of these are second homes, with some having sold for more than $200 per square foot.

Building Characteristics

Loft conversions were found in residential-only and mixed-use buildings. In the case of mixed-use properties, residential units upstairs, in combination with a retail or commercial use on the ground floor, were most common. However, loft tenants seemed to prefer that the retail and commercial businesses they frequent be near, as opposed to actually in, their buildings.

Total downtown residents living in renovated loft conversions charging market rents numbered less than 100 in each of the cities visited. This count excludes any new downtown residential construction or government-subsidized housing. Denton and Waco were the only cities with significant new downtown apartment construction.

Loft rental rates generally ranged from $0.75 to $1.25 per square foot per month, with the average being about $1. However, some rents exceeded this range on the high end in Waco and the low end in Denison. Tenants generally paid for their own electricity.

The typical loft was much larger than the typical new apartment in these cities. Loft size averaged 900 to 1,000 square feet, although some were much larger.

The demand for loft residential space far exceeded the demand for commercial space in almost all cities visited. Few landlords reported loft vacancies, and some had waiting lists for lofts.

Demographic Data Insights

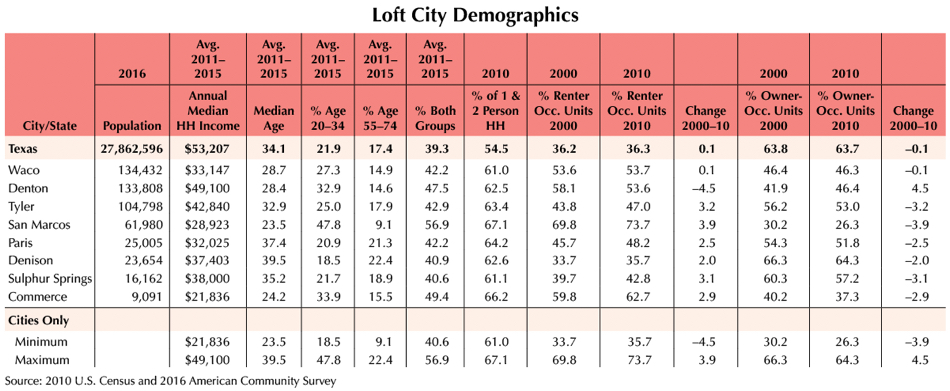

Census data illustrate selected demographics of the eight cities and the State of Texas (see table). The 20- to 34-year-old age bracket was chosen to represent young professionals. The 55- to 74-year-old bracket includes empty-nesters.

Young professionals are included in the millennial generation. The age of millennials is not as well defined as are baby boomers. However, estimates most often place millennials between the ages of 18 and 37.

A case could be made for empty-nesters being younger than age 55. An assumption was made that the wave of adult children moving back in with parents during the Great Recession has forced a delay in older households attaining empty-nester status.

Census data reveal cities with successful loft conversions can be quite small, with Commerce being the smallest at 9,091 residents. Annual median household incomes vary widely. The highest income of $49,100, found in Denton, was still below the state median of $53,207.

Denison reported the highest median age (39.5) and the lowest percentage of people aged 20 to 34 (18.5 percent). Alternatively, San Marcos reported the lowest median age (23.5) and the highest percentage of people aged 20 to 34 (47.8 percent).

This finding is not surprising. Texas State University’s enrollment exceeds 38,000. College students as a percentage of city size is about three times larger in San Marcos than in Denison.

All eight cities have a higher percentage of one- or two-person households than the state average, ranging tightly between 61 and 67 percent. However, more variation shows up in the percentage of renter-occupied units in both 2000 and 2010. Only Denison comes in under the state average in both decades, while San Marcos records the highest percentages of renters.

Finally, seven cities reported an increase in the percentage of renter-occupied housing units between 2000 and 2010, with the exception of Denton. Denton’s reduction could be due to a significant increase in new on-campus housing constructed during that time. This would have had the effect of pulling students out of privately owned off-campus housing and into “group quarters,” a classification excluded from a city’s census count.

Constraints to Downtown Vitality

Downtown redevelopments always have their challenges. Parking is an important issue in virtually all of the cities visited. In a tradeoff, Sulphur Springs actually removed parking spaces in their courthouse square to create an interactive water feature and greenspace. Tyler built a 384-space parking garage downtown; several other cities are considering them.

“A parking garage just outside the perimeter of downtown would be a real benefit for us in several ways,” says Donna Dow, main street director for the City of Denison. “It would lower vehicle traffic downtown and get patrons to walk past our shops and businesses instead of just driving by them.”

The speed and flow of traffic downtown is another challenge. Several cities replaced stoplights with stop signs, slowing vehicle traffic and giving pedestrians more time to make a leisurely street crossing. Because of this, vehicles in a hurry to get through downtown tend to avoid it.

Tired building facades and streetscapes were a concern to most cities.

“Tyler has used public art extensively along our streetscapes,” says Abell. “But you have to be careful with trees that block views. You want to be able to see what’s coming up farther down the street.”

Most of the cities offered some type of support or grants for street and façade improvements. Several cities had implemented a Tax Increment Reinvestment Zone (TIRZ) to help raise funds. The Houston-Galveston Area Council has published a guide titled Bringing Back Main Street with an extensive list of funding tools and government programs at the website:

http://www.h-gac.com/bringing-back-main-street/documents/Bringing-Back-Main-Street-May-2015.pdf.

One of the most difficult challenges to downtown revitalization is the number of vacant old buildings held by investors or long-time owners who have no desire to renovate them. Many are waiting for others to improve downtowns so they can reap the value increases at minimal cost.

Several city officials noted that absentee owners were often the most difficult to motivate because the property may have come to them through an estate. They pay low taxes to hold it, and they bear “no visual shame” by not living in the city where the building is located.

Finally, financing the renovation of an old building in poor condition is extremely difficult. Traditional mortgage loans are not available. Loans that are offered usually have short terms and cover only a small part of the total cost to rehab a building.

Those who would speak said the original purchase price of old downtown buildings ranged from $1 to $50 per square foot. Condition and timing in the life cycle of a city’s downtown revitalization were the two most important factors in price paid.

After the initial purchase, additional tens of thousands of dollars were needed to bring the buildings’ electrical, plumbing, and structural problems up to code. Loft owners agreed that many more renovations would occur if adequate financing with longer terms were available.

Changing Mindsets

In the end, much of downtown revival hinges on awareness.

“You would be surprised at the number of people who live in Tyler who haven’t been downtown in years,” says Abell. “There is no silver bullet that’s going to magically transform a downtown. It’s pretty much one storefront, five jobs, and a $50,000 investment at a time.”

____________________

Dr. Hunt ([email protected]) is a research economist with the Real Estate Center at Texas A&M University.

Takeaway

You might also like

Infrastructure & Transportation

7 minute read

Feb 26 2024

Thinking Outside the Grid

How Innovative Communities Can Address Growing Pains

For years, communities in states like Florida and Arizona have been experimenting with new ways to address problems such as traffic congestion and overworked power grids. Is Texas learning from them?

Development

6 minute read

Feb 20 2023

A Towering Task

Logistical Challenges of Office-to-Residential Conversions

Reduce, reuse, and recycle are the “three Rs” of protecting the environment. Nowadays, some commercial property owners are finding new uses for old office buildings, adding a fourth R: residential.

SUBSCRIBE TO OUR

Publications

Receive our economic and housing reports and newsletters for free.