Can Opendoor cash in on Texas?

A blank-check company led by billionaire Chamath Palihapitiya has inked a deal to merge with Opendoor, one of the largest iBuyer players in the market. The deal issued a huge vote of confidence—as well as much-needed cash—in the company despite the current economic turmoil. Palihapitiya already has high hopes for Opendoor in the near future. “Before the end of 2021, they’ll be back in a really solid place to where they were and growing again," he told the Financial Times last week.

Before the COVID-19 crisis, Texas was in the crosshairs for major growth among iBuyers, with many increasing their statewide portfolios in 2019. Now with cash in hand, Opendoor seems almost ready to repeat last year’s activity. But what homes will the company buy?

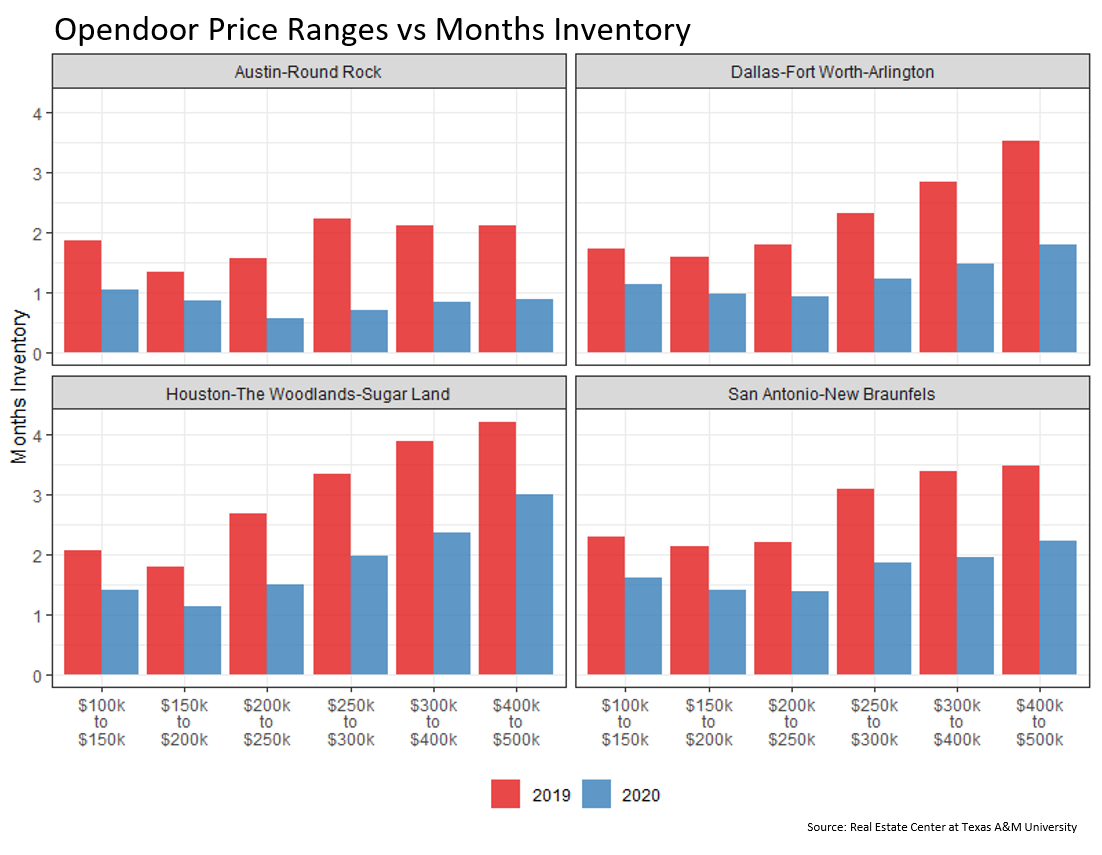

According to their website, Opendoor typically invests in residential homes valued between $100,000 and $500,000, depending on the market. There’s a scarcity of homes in those price cohorts within the four big Texas metros. In Dallas-Fort Worth-Arlington, where Opendoor has its largest Texas presence, there’s currently a one-month inventory of homes in the upper $100,000s and lower $200,000s. Most other price cohorts have less than two months of inventory.

At this point, it’s uncertain how long inventories will remain. Homeowners are simply not putting their homes on the market at the rate they did in prior years. The obvious reason is the pandemic, which influenced sellers to pull their homes off the market in the first place largely for health and safety concerns.

After the initial COVID-19 shock, mortgage rates bottomed out, making staying put and refinancing a more attractive option than moving. Since refinancing isn’t free, it often takes several years to recoup closing costs from the monthly savings gained.

Refinancing increases the time homeowners commit to their homes, a trend that has already been on the rise over the past decade and is not expected to change anytime soon. This phenomenon can reduce housing turnover.

Texas isn’t the only market in Opendoor’s sights, and iBuyer concerns about inventory haven’t been ignored. At the same time, these threats aren’t unique to Texas. Assuming that Opendoor can acquire homes in the current environment, the increased competition for homes in their price range will likely continue to push prices up. Higher buy-in prices come at the expense of future profits, something iBuyers have already been struggling with. Given the current state of Texas housing, it’s hard to envision an optimistic outlook for iBuyers anytime soon.

For more on this, read my latest article, “You Sell, iBuy: Are Instant-Purchase Services Making a Comeback?" This topic was also featured on a recent Real Estate Red Zone podcast.

In This Post

You might also like

Publications

Receive our economic and housing reports and newsletters for free.