Purchase Affordability

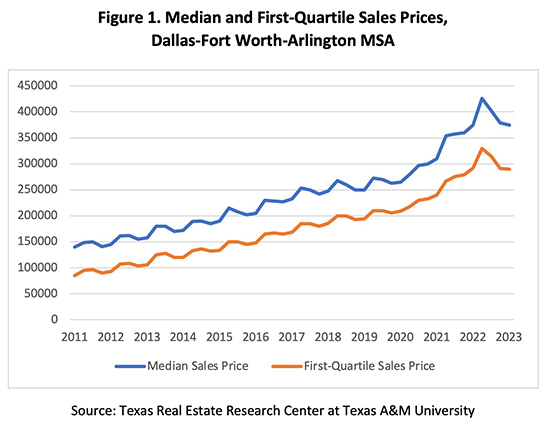

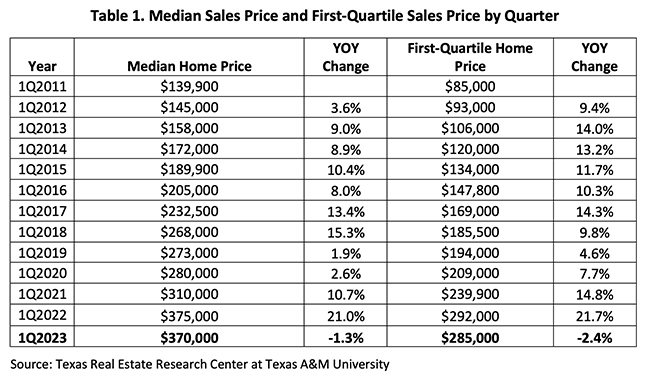

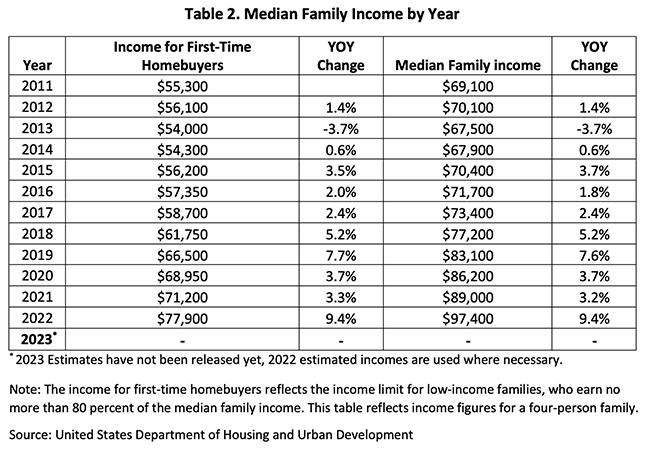

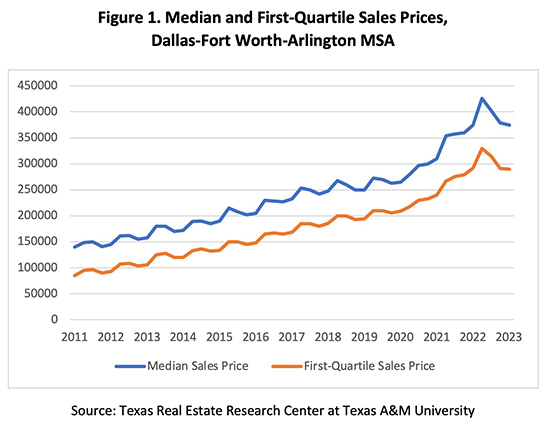

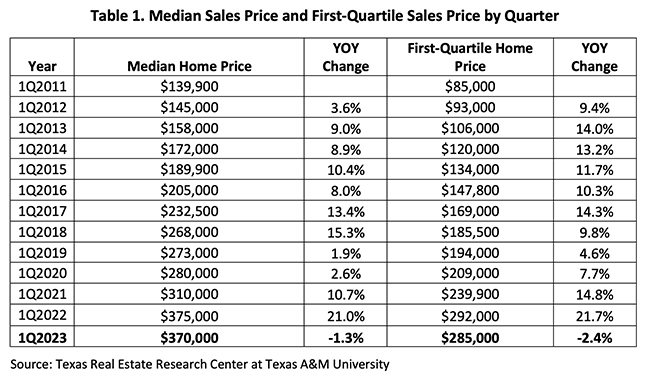

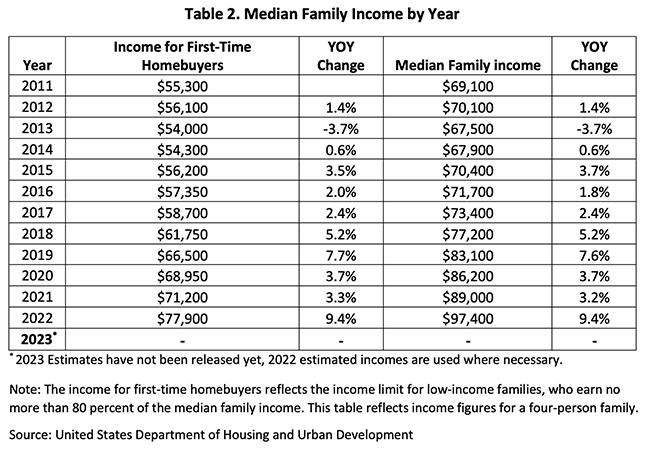

Affordability remained low in 4Q2022 amid higher mortgage interest rates and still-elevated home prices. Year-over-year (YOY) growth in both the median and first-quartile sales price continued, at 5.6 percent and 4.7 percent, respectively (Figure 1 and Table 1).1 The significant YOY increase in family income followed years of modest rises (Table 2). This was outpaced by the rise in family income at 9.4 percent.

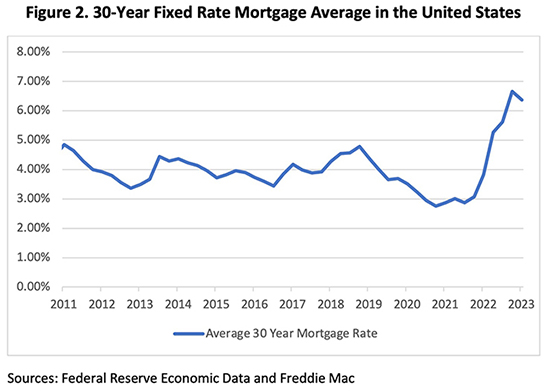

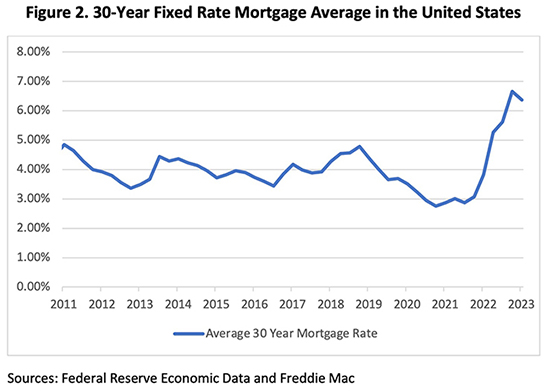

The rapid rise in mortgage interest rates continued to diminish home-purchasing potential. Rates averaged 6.66 percent in 4Q2022, up considerably from 2Q2022 and 3Q2022, which averaged 5.27 and 5.62 percent, respectively (Figure 2). All other things being equal, lower (higher) mortgage interest rates translate into lower (higher) monthly mortgage payments and ease (diminish) purchase affordability. The Federal Reserve is widely anticipated to raise the federal funds rate an additional 75 basis points in 2023 to reduce inflationary pressures. Expectations dictate that mortgage rates will continue to decrease slightly before settling in the 5 percent range. For more information on the effect of mortgage interest rates on purchase affordability, see “How Higher Interest Rates Affect Homebuying.”

____________________

1 The first quartile reflects the lowest-priced 25 percent of homes sold in a particular geography. The first-quartile sales price represents the highest home price among those lowest-priced 25 percent of homes sold. If the price of the lowest 25 percent of homes sold ranges from $100,000 to $150,000, the first-quartile sales price would be $150,000.

To read this report in its entirety, download the pdf.

Previous reports online:

2022: 1Q2022, 2Q2022, 3Q2022

2021: 4Q2021