Purchase Affordability

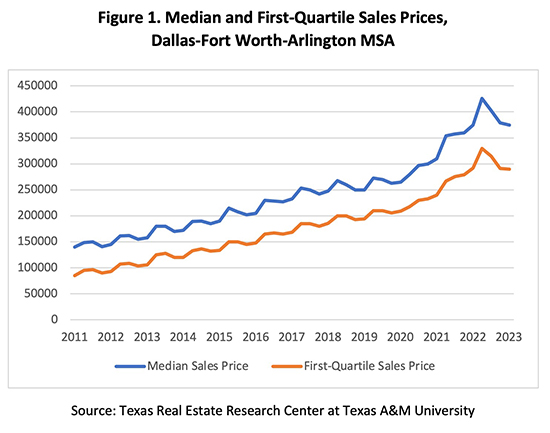

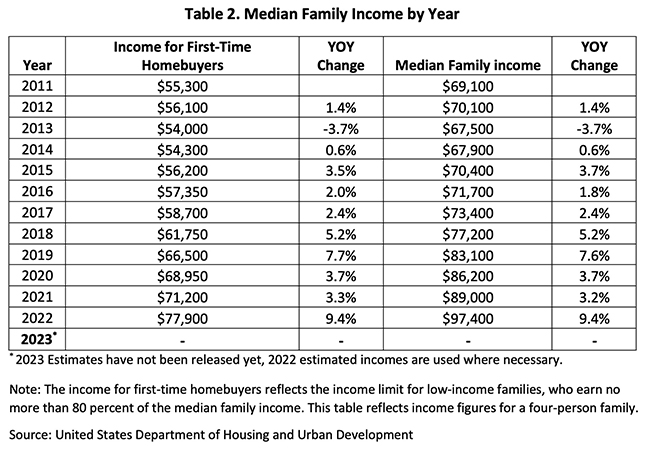

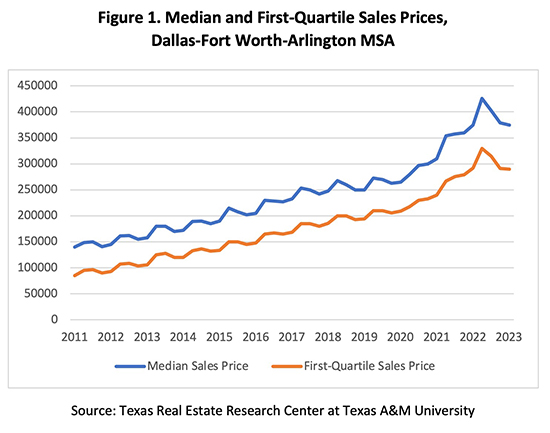

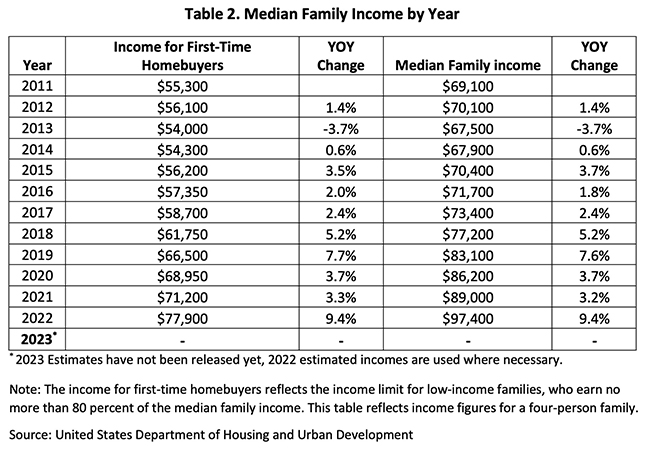

Affordability remained low in 1Q2023 amid high mortgage interest rates and still-elevated home prices. Year-over-year (YOY) change in both the median and first-quartile sales price was negative, at -1.3 percent and -2.4 percent, respectively (Figure 1 and Table 1).1 The significant YOY increase in family income seen in 1Q2022 followed years of modest rises (Table 2).

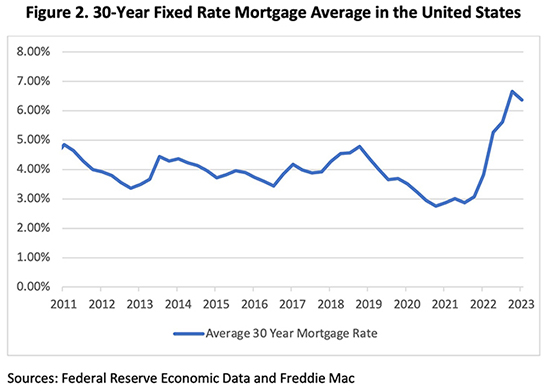

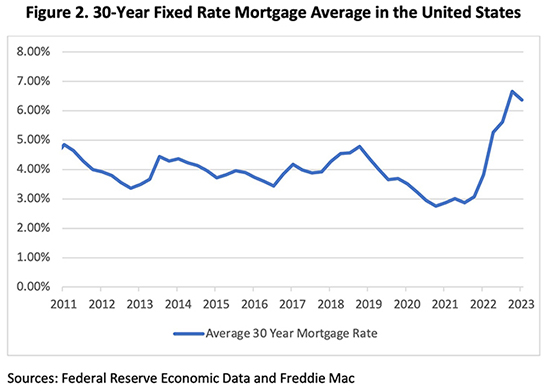

The rapid rise in mortgage interest rates in 3Q and 4Q2022 moderated going into 1Q2023. Rates averaged 6.37 percent in 1Q2023, a slight decrease from 4Q2022, which averaged 6.66 percent (Figure 2). All other things being equal, lower (higher) mortgage interest rates translate into lower (higher) monthly mortgage payments and ease (diminish) purchase affordability. For more information on the effect of mortgage interest rates on purchase affordability, see Center publication “How Higher Interest Rates Affect Homebuying.”

____________________

1 The first quartile reflects the lowest-priced 25 percent of homes sold in a particular geography. The first-quartile sales price represents the highest home price among those lowest-priced 25 percent of homes sold. If the price of the lowest 25 percent of homes sold ranges from $100,000 to $150,000, the first-quartile sales price would be $150,000.

To read this report in its entirety, download the pdf.

Previous reports online:

2022: 1Q2022, 2Q2022, 3Q2022, 4Q2022

2021: 4Q2021