Determining the market value of commercial real estate can be difficult. Direct capitalization is one method of estimating values, but it requires accurate income estimates and market capitalization rates to produce a meaningful property value

Jan 8, 2010

For What It’s Worth: Accurate Valuation Makes the Difference

Commercial investors who want to pick up distressed properties need to understand the risks of doing deals without reliable property values. Here are the risks of using direct capitalization to estimate those values.

quick links

Pick up the newspaper, turn on the television or log on to the Internet, and you can find the price of a publicly traded stock almost immediately. With commercial real estate, it’s not so simple.

Commercial properties are not publicly traded on a daily basis. As a result, market values — the prices that would be paid in an open and competitive market — are significantly more difficult to obtain.

Compounding the problem, the recent credit crunch and the ongoing economic downturn have dramatically reduced the number of commercial real estate transactions. Critical market information is in shorter supply, making price discovery much harder.

Distressed commercial real estate loans and commercial mortgage-backed securities are less attractive to potential investors when reliable property values cannot be established. During the next few years, accurate value estimates will be essential to creating efficient, liquid markets for these investments.

Direct capitalization continues to be a popular, straightforward method for estimating commercial property values. However, the ability to correctly estimate property incomes and market capitalization rates remains crucial to its success as a valuation tool.

Investors and appraisers can face serious challenges when attempting to use direct capitalization, especially in sluggish or distressed real estate markets. The following discussion will shed some light on challenges that may arise when deriving commercial real estate values via the direct capitalization approach.

Estimating Net Operating Income

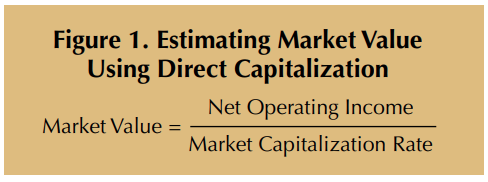

To estimate market value using direct capitalization, a property’s “stabilized” net operating income (NOI) must be divided by the market capitalization rate (Figure 1). NOI is based on observed market data and should be easy to calculate. But this is not always the case.

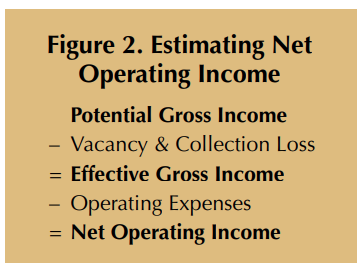

Stabilized NOI is arrived at using rental rates, vacancy and collection loss rates, and operating expense data for other comparable properties in the market area (Figure 2). Comparables should also have similar physical and locational characteristics and future income expectations. Stabilized NOI is an assumption of how a subject property should perform under “normal” market conditions based on similar properties’ performance.

The level of risk associated with each comparable’s sale price must also be similar to the subject. Risk is often assessed by investigating each comparable’s tenant credit ratings, income stability and assumed up- or downside potential. Overall market conditions should be considered in the risk estimation as well.

Certain nonrecurring costs such as leasing commissions, tenant improvement allowances, replacement reserves and lease turnover vacancy must be treated consistently when calculating NOI for all comparables and the subject. Some investors may expense one or more of these costs before NOI is calculated. The result will be a lower NOI, leading to a reduced property value.

Estimating Market Capitalization Rate

A capitalization rate is a simple ratio of property NOI to its price or market value, similar in concept to a price-earnings ratio for a stock. Estimating the market capitalization rate requires dividing each comparable property’s NOI by its reported sales price.

After obtaining the capitalization rate for each comparable, an “appropriate” cap rate for the subject property must be chosen. The rate should be based on the comparable most similar to the property being valued, not an average of all the comparables’ cap rates.

Theoretically, concerns about capitalizing a single year’s NOI are eliminated by deriving the market capitalization rate from comparable sales. Buyers who expect future NOIs to increase (or decrease) for any reason or combination of reasons should pay prices reflecting those expectations.

All such expectations should be captured within the comparables’ estimated capitalization rates. The subject property’s value will then reflect these market assumptions to arrive at an accurate value conclusion.

“Investor sentiment,” a wild card, may play a role in the estimation of real estate prices. Investor sentiment has been defined as a misguided or irrational belief regarding the growth in future cash flows or investment risks (or both). It may be based on current (and often incomplete) information.

Investors sometimes think, “If the market looks good today, it should be even better tomorrow,” or vice versa. The argument is that not all investors act rationally, and biases in their beliefs about the future convince them to invest based on past performance.

For example, consider the following scenario. Rational investors exit the market when they believe prices have become too high relative to expected rents, leaving market-clearing prices to be determined at the margin by overly optimistic investors.

Unrealistic expectations for future rent growth results in increased capital flows to real estate from the optimists. Property sales prices rise.

The high prices (and low cap rates) produce increased new construction that eventually leads to lower, not higher, real rents. Unrealistic market sentiment produces meager returns for the optimists as market rents return to lower, historical means.

By weighing historical conditions too heavily, investor sentiment can play a part in overpricing commercial real estate.

Alternative Ways to Estimate Market Cap Rates

Ideally, cap rate data would always be based on a large number of constant-quality properties with identical lease terms. In reality, such conditions are highly unlikely.

Problems can occur when true comparables are not available. The capitalization rate must then be derived from “best available” comparables to produce a value estimate that reflects the correct market expectations.

Subjective adjustments would be required to force properties that are not truly comparable into resembling ones that are. The adjustment process is particularly tricky in the early stages of a distressed market when few, if any, properties may be trading.

Alternative methods of estimating the market capitalization rate are often attempted in markets where few transactions are occurring. Two of the most popular alternatives are the band of investment and investor survey methods.

Band of Investment

Because most commercial properties are purchased with debt and equity capital, the overall cap rate must satisfy the market return requirements of both investment positions.

The band of investment calculates weighted average returns to debt and equity based on market information for each component (Figure 3). Primary inputs are the annual “mortgage constant” and the annual “equity dividend rate.”

![The figure presents the formula for estimating a market capitalization rate (cap rate) using the band of investment method. The cap rate is calculated as the sum of two components: (Mortgage Constant × Loan to Value Ratio) plus (Equity Dividend Ratio × [1 – Loan to Value Ratio]). This approach blends the rates of return required by both lenders and equity investors according to their proportion of the total investment in a property.](https://trerc.tamu.edu/wp-content/uploads/2010/01/image-32.png)

The annual mortgage constant is defined as the ratio of the annual debt service payment divided by the total initial loan amount. The equity dividend is estimated by deducting the annual debt service payment from the first year’s NOI and dividing the result by the original equity investment. It is the equity investor’s anticipated first-year cash-on-cash return.

The survey technique is applicable only when sufficient market data is available to extract accurate equity dividend rates. When market data is scarce or less reliable, band of investment should only be used as a test against cap rates derived using comparables.

Investor Surveys

Appraisers and investors often use surveys to supplement cap rate data derived directly from transactions or when no other direct data is available.

Investor surveys are completed on a periodic basis by several large and respected real estate valuation and consulting firms. The surveys are intended to reflect investor expectations. Examples include the Korpacz Real Estate Investor Survey produced by Price Waterhouse Coopers and the RERC Real Estate Report and Viewpoint produced by Integra Realty Resources.

Investor surveys usually report investors’ expectations for several different property types. A major limitation is that they are designed to report more general expectations rather than the expectations for a specific property in a specific market.

Correct use of survey data also hinges on one additional piece of information. The survey must state whether any of the respondents recently acquired properties at the cap rates reported. In the absence of that information, the assumption must be made that the low end of the reported cap rate range (not the average) is the point at which property acquisitions are actually occurring.

What Affects Direct Cap Formula?

Looking at the components of the direct capitalization formula, a primary driver of changes in NOI is an adjustment in the property markets, such as an increase or decrease in market rent or vacancy.

An important driver of change in cap rates is movement (a change in supply or demand) in the capital markets. This effect is evident in the band of investment formula discussed above, in which current capital market conditions play a significant role in influencing market cap rates.

Changes in the property markets still play out relatively slowly today. The speed at which new supply can be constructed is still quite lengthy, generally taking months or even years to complete. The demand for commercial space can adjust much faster.

Capital markets have had a more radical change. Prior to the 1980s, commercial real estate was primarily financed by local lenders. Changes in the supply of and demand for capital were more measured. Properties were kept in local lenders’ portfolios, and volatility in capital markets was comparatively low.

Capital market forces can now easily overwhelm property market fundamentals. Since the 1980s, globalization of capital flows and the securitization of real estate debt have worked together to dramatically increase the volatility of real estate capitalization rates. As a result, capital markets have become commercial real estate’s best friend or its worst enemy.

In the mid-1990s, public real estate investment trusts (REITs) stepped in to provide enormous liquidity to ailing commercial real estate markets. A relatively high, consistent rate of return from the REITS enticed investors to provide the necessary funding that jump-started the ailing property markets.

More recently, the story has been much different. Beginning in 2002, cap rates for all property types began to decline. Apartment cap rates were 8.7 percent in first quarter 2002. By second quarter 2007, they had declined to 5.7 percent, according to the RERC Investor Survey.

Investors accepted lower yields from commercial real estate despite a sharp deterioration in market conditions and property earnings. As a result, cap rate compression (lower cap rates) completely overwhelmed the negative effects of falling property income (lower NOI) until late 2007.

Years of easy credit and high liquidity had created the expectation that commercial real estate would always produce adequate, steady returns. Credit markets seized almost overnight as the true risk was discovered to be much higher than imagined.

Capital market forces clearly dominated property market forces during these two most recent real estate market downturns, but with very different results.

What’s to Come?

Falling property values in 2008 reflected only one adjustment to reconcile prices with buyers’ increased capital costs brought on by the credit crunch. With the current recession in full swing, property income has also begun to decline. This will continue to exacerbate the decline in commercial real estate values.

In the absence of high-leverage buyers, equity investors going forward will press for even higher cap rates to justify the risk of low-leverage deals. How long current property owners will wait for prices to recover is still open for debate.

Dr. Hunt ([email protected]) is a research economist with the Real Estate Center at Texas A&M University.

You might also like

8 minute read

Oct 20 2009

Bad for Business: Commercial Real Estate Faces Uphill Climb

The commercial real estate crisis may not be as dramatic as the residential meltdown, but it’s just as complex. Consumers are spending less and saving more, which is never good for business. Look out! Foreclosures ahead!

PUBLISHED SINCE 1977

Tierra Grande

Check out the latest issue of our flagship publication.

SUBSCRIBE TO OUR

Publications

Receive our economic and housing reports and newsletters for free.