Houston’s oil industry is a cluster of economic activity that starts with exploration and production. Oil service companies do the drilling and bring in the wells, and pipeline companies work with producers to deliver the product to markets. A highly skilled workforce of geologists and engineers in oil-related specialties, along with an abundant supply of experienced workers in support services is key to Houston’s role as the headquarters of the Texas oil industry.

Jan 7, 2014

Houston: America’s Oil Headquarters

Other areas have more oil rigs, but Houston is the beating heart of Texas’ (and the nation’s) oil industry. With a specialized workforce, producers, drilling and service companies, refiners, and pipelines and tankers to transport the oil, Houston supports every sector of the oil business.

quick links

Texas is home to about 280,000 employees in oil production and oil services. Most of these workers are here to exploit Texas’ vast hydrocarbon resources, which make up 26.5 percent of U.S. oil reserves and 29.4 percent of U.S. natural gas. These reserves are scattered throughout the state from East Texas to Eagle Ford to the Permian Basin, and Texas oil workers generally follow the drilling rigs.

There is, however, an important exception. The Houston metropolitan area has 107,000 workers in oil production and services, 38.1 percent of the state total (Figure 1). But in 2012, the Texas Railroad Commission issued only 445 drilling permits for the ten-county region, or 1.6 percent of the state total. There was other drilling in southeast Texas, of course, but not nearly enough to explain the large number of oil workers found in the Houston area.

Houston is headquarters for the American oil industry, bringing together an extraordinary concentration of management and technical skills dedicated to oil markets that reach far beyond Texas or the United States. Complexities arise when we ask how the industry came to be located there and why it stays. More complications come when we recognize there is much more to Houston’s oil industry than just “upstream” producers and service companies.

The table below describes various sectors of the local industry, with examples of companies that support each segment. Houston has a large downstream refining and petrochemical sector, much of it located on the ship channel, as well as the pipeline and engineering companies that serve upstream and down.

The Upstream Cluster

Houston’s upstream exploration and production (E&P) form a cluster of economic activity no different than the concentration of finance on Wall Street, autos in Detroit, movies in Hollywood or high tech in San Jose. Each of these cities is closely identified with the major industry located there and serves as home base for its highest levels of management and technical skills. These clusters form for much the same reasons: they house highly specialized, industry-specific skills that broadly complement one another, bring related firms into proximity, and provide an institutional framework to share the industry’s knowledge base.

At the heart of Houston’s oil-related activity are the large, integrated producers like ExxonMobil, Shell and ConocoPhillips, and the independents such as Apache, Anadarko, EOG and Noble. These companies decide what to drill for and where, arrange the financing and assume the risk of exploration. The oil service companies are hired to bring these projects to fruition, carrying out the drilling, cementing, down hole testing and other tasks necessary to deliver the well. Similarly, pipeline companies work with producers to deliver hydrocarbons to market, and the engineering companies support both upstream and downstream on specific projects.

The most important glue that binds any cluster together is a skilled and specialized workforce. Houston has a deep pool of geologists, geophysicists, petroleum engineers, reservoir engineers, chemical engineers and other oil-related specialties. The level of skills required by the clusters is generally high, reflecting the industry’s most demanding management and technical requirements.

In Houston, the typical upstream oil and gas job paid $140,500 in wages, salaries and employer-paid benefits in 2011, almost double the $71,000 earned by the typical Houston worker. Once the cluster is in place, a virtuous cycle forms to maintain and expand the base of specialized skills. The oil industry locates in Houston because the skills are there; workers with those skills come to Houston because the jobs are there.

Geological and geophysical societies are based there and share cutting-edge technical advances. The biggest trade and technical conferences in the industry come to the city. The 2013 Offshore Technology Conference drew 104,000 attendees to Houston. Local universities offer petroleum engineering degrees and MBAs specialized in energy markets. Local banks know how to finance the oil and gas exploration. Every cluster provides access to industry intelligence that is less available to business located elsewhere.

An industry downturn generally forces consolidation of companies into the cluster as firms located elsewhere must lower costs to survive. Each downturn in the oil industry in recent years has seen a wave of E&P companies or their divisions relocating to Houston from Midland, New Orleans and Tulsa. This is at the core of Houston’s unique role in the American oil industry and explains why it has no serious competitor.

If clusters have enormous competitive advantages once established, their initial location is often an historical accident. For Houston, the key event was the discovery of the first great oil gusher at Spindletop in 1901. Texaco, Gulf Oil and Sun Oil all quickly formed at Spindletop or at later discoveries in southeast Texas, and by 1904 the search for oil reached the Humble oil fields outside Houston. Houston was the closest major rail center with good telegraphy services, and — by a stroke of luck — it became the home of a new Texas industry.

Global Role for Oil Services

When the North Sea opened for exploration and production in the 1960s, the British set a public policy goal of developing their own oil service industry. Recognizing that oil was a depleting resource, the British wanted to be able to take their oil-related skills to Africa, Asia or wherever the next oil frontier would be found. The American oil service industry, based in Texas and particularly Houston, was the model they chose to emulate.

This British effort, like later attempts by the Norwegians and French, was largely a failure. These countries could not break the American monopoly on oil services, a product of experience in U.S. oil fields, access to the best technology and a grip on that technology through key patents. Competitor countries often made gains in peripheral activities such as platform construction, building drill ships or supply boats, or in offshore logistics; but once the drilling began, American companies controlled core down-hole activities such as drilling, cementing and testing.

American control remains in place today, led by the four largest oil service companies: Baker Hughes, Halliburton, Schlumberger and Weatherford. They defend their technical leadership and market share with billions of dollars spent on research and development annually. Although three of these companies maintain headquarters abroad for tax or administrative purposes, their employment base is firmly in Houston. They have helped Houston become the most sophisticated oil-related labor force in the world, and these companies rely on their Houston-based employees for their most challenging work. Virtually no difficult oil-related project is carried out at home or abroad without substantial input from one or more of these companies.

Linkages to Manufacturing

Thanks to the boom in oil and natural gas over the past decade, Houston has added thousands of manufacturing jobs since 2003. Few other metropolitan areas can make a similar claim. During this period, the U.S. economy was losing 2.5 million manufacturing jobs.

Houston’s most obvious ties to oil- and gas-related manufacturing are refining and petrochemicals, which together account for about 48,000 well-paid jobs. Manufacturing of fabricated metal and machinery industries added 40,000 new jobs since 2003, now totaling 117,000 (Figure 2). These industries are not in the energy sector, but they are strongly linked to upstream E&P in Houston, supplying equipment such as pumps, compressors, drill pipe, drill bits and custom-machined products. The recent pressure exerted on Houston’s manufacturing base by the expanding oil sector is demonstrated by the average workweek, which reached 49.1 hours in 2012, compared with 43.3 in Dallas and 41.7 in the United States.

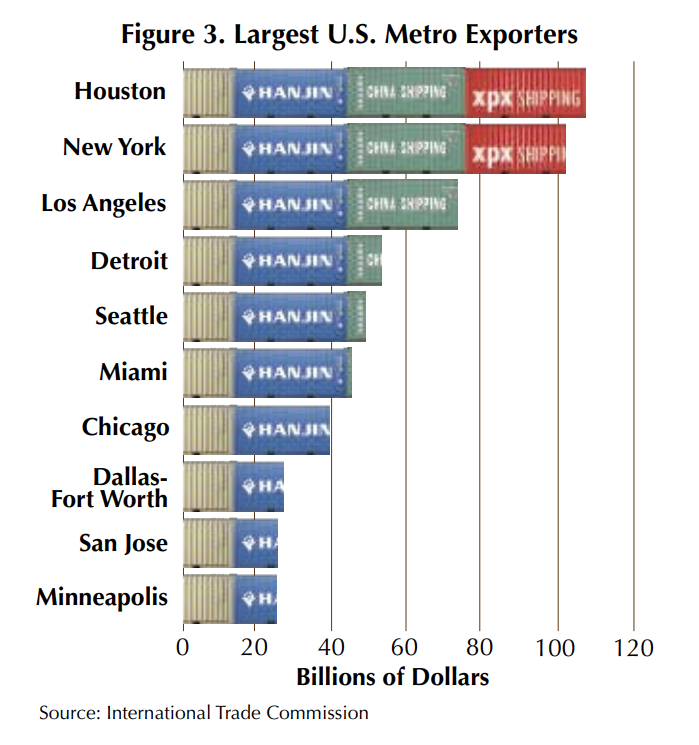

Like Houston’s E&P activities, these manufactured goods reach a market far beyond Texas. Last year, Houston passed New York to become the number one exporter among U.S. metropolitan areas, with $110 billion in exports (Figure 3). Oil-related industries — crude oil, refined products, petrochemicals and machinery — accounted for 85 percent of 2012 exports.

Current Oil Boom

Since December 2003, Houston has added 497,000 payroll jobs, more than the total number of jobs in Tulsa, Omaha or Honolulu. The 2003 date is important because it marks the point at which oil prices began to rise quickly from $40 per barrel to $140 just before the financial crisis. Oil prices fell hard at the height of the crisis in 2009, and Houston lost 100,000 jobs to a combination of the U.S. recession and a setback in oil markets. But prices bounced back quickly, and Houston’s 2009 job loss was restored by the end of 2011. More than 100,000 new jobs were added in 2012, and strong growth continues today.

Since 2009, Houston’s job growth stands in stark contrast to a weak U.S. recovery, adding jobs at more than twice the national rate. History tells us that the price of oil is always the key factor that sets Houston’s economy apart.

Despite the continued size and importance of the E&P sector, Houston seems to have diversified in the 1980s and 1990s, and the volatility that marked the local economy in the 1970s and 1980s has dissipated. That is the good news. The bad news is that the source of the diversification — the U.S. economy — recently has been weak relative to the growth in oil markets.

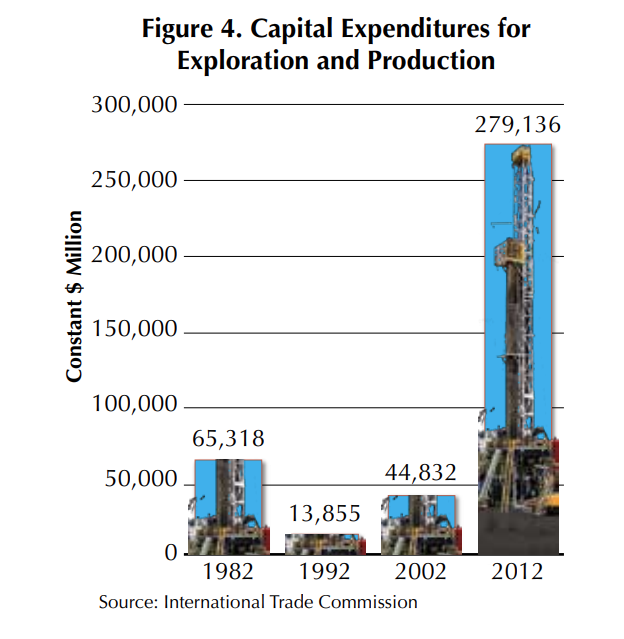

While the U.S. recovery has provided little impetus to Houston’s economy, the current boom in E&P spending is unprecedented. We often monitor changes in the drilling cycle indirectly through the rig count. But new technology to extract oil and natural gas from shale has been the hallmark of this latest boom, bringing widespread use of expensive horizontal drilling and fracturing. High oil prices also have opened the door to other high-cost technologies such as deep-water drilling and tar sands. The cost or effectiveness of a vertical rig from the 1980s simply cannot be compared with today’s horizontal or deep water rig. E&P capital expenditures per working rig have quadrupled since 2003, resulting in a surge in spending unrelated to the number of working rigs.

Exploration and production budgets were $65.3 billion in 1982 (Figure 4), the year that marked the end of the last great oil boom, and the beginning of the great Texas oil and real estate crash. E&P spending did not return to 1982 levels until 2003, and since then, E&P spending has increased by a factor of four to $279.1 billion. The current boom in Houston’s economy is the result of a massive and unprecedented expansion of E&P spending.

Where does this boom go from here? Maybe it all comes crashing down as the price of oil falls to less than $65 per barrel, the price needed to sustain drilling in oil shale or deep water. The price of natural gas collapsed in late 2011, and today 80 percent of drilling at home and abroad is directed to oil. Or perhaps it ends in a whimper, as the global commodity cycle of the last ten years simply winds down. Oil prices would settle to lower levels, not necessarily under $65, but low enough to reduce margins and return drilling to a pedestrian pace. Or maybe it continues as it is, with high oil prices driving higher levels of drilling and a sustained push for American energy independence.

Which is it? No one knows because no one can predict the price of oil. Certainly oil markets have let the Houston economy down in the past — in 1982, 1986, in the Asian financial crisis of 1998, and in the American crisis of 2009. And they will disappoint again. The biggest mistakes of past downturns have stemmed from thinking oil prices were predictable: they would never go down, or they would not go down soon. The hardest lesson learned from these downturns is remarkably simple: Never bet your business on the price of oil. Now is as good a time as ever to keep that lesson firmly in mind.

Dr. Gilmer ([email protected]) is director of regional forecasting at Bauer College of Business at the University of Houston, and has a longstanding relationship with the Center.

You might also like

PUBLISHED SINCE 1977

Tierra Grande

Check out the latest issue of our flagship publication.

SUBSCRIBE TO OUR

Publications

Receive our economic and housing reports and newsletters for free.