Even with the recent oil boom and bust, oil prices don’t explain everything happening with housing and land prices.

Aug 21, 2017

Oil Change

Fueling Housing and Land Prices?

Texas is the nation's top oil and natural gas producer, so oil price fluctuations have a considerable impact on the state's economy. The 2014 oil bust had widespread negative effects on different sectors and regions of the Texas economy, including real estate markets. Low oil prices impacted home prices as...

quick links

Texas is the nation’s top oil and natural gas producer, so oil price fluctuations have a considerable impact on the state’s economy. The 2014 oil bust had widespread negative effects on different sectors and regions of the Texas economy, including real estate markets. Low oil prices impacted home prices as income and employment growth declined. Some oil-sensitive areas—such as Houston, Odessa, and Victoria—registered a significant slowdown in housing demand as can be seen by the resulting increase in months of housing inventory (see table).

The link between oil prices and real estate market activity is felt in both the short term and long term due to demand and supply factors. Real estate markets as well as land prices are affected by the increase in household disposable income when oil and natural gas prices fall on a persistent basis. Persistent low oil prices are at least mildly positive for most areas as they tend to boost consumption of non-oil-derivative goods and services in the short-run. In Texas, the downside risks are concentrated in regions with a large portion of their employment base in the energy industry.

Texas gains from high oil prices in the long term, as seen after the 2007–08 recession when the state’s housing market outperformed the nation’s. The expanding energy sector led to both employment and income growth. Texas’ recent noteworthy performance in the real estate market highlights the role played by the energy industry and the significance of the relationship between housing and land markets.

Far-Reaching Effects

Oil prices impact Texas real estate through both supply and demand channels. The supply-side effects relate in no small part to land purchases and land prices. Higher oil prices contribute to an overall expansion of the state’s economy, as buyers compete for land for agriculture, recreation, and development. This affects the availability and price of land for new home construction. In addition, when oil prices rise, investment and employment by the energy sector tends to rise as well, causing an increase in income and an upsurge in housing demand. Labor supply is also affected because some laborers choose to work in the energy industry at higher wages, resulting in fewer workers to build houses and an increase in home construction costs.

Oil price changes produce non-negligible demand-side effects as well. For instance, if oil prices fall, so do gasoline prices and more generally transportation costs, and short-term consumption may increase as a result. Consumers may use a portion of their gas savings to upgrade their living standards, boosting housing demand. However, for Texas’ energy-concentrated regions, the economic benefits of an oil price increase driving employment up far outweigh the short-lived demand drag from higher oil prices.

Oil prices can have a substitution effect on housing demand as well when oil price fluctuations lead to relative energy and transportation cost changes. When this occurs, consumers can choose to buy less expensive goods instead and seek more affordable locations and housing arrangements. This may explain the impact oil prices have above and beyond their effect on discretionary disposable income, even after taking into account the concurrent effects of oil prices coming through the cost of land and long-term interest rates.

Land Prices’ Relation to Oil

Absent urban land price data, rural land prices provide a quantifiable measure of the opportunity cost of turning rural land into urban development. Rural land prices provide valuable insight on how costly it is at any given point to expand the urban housing supply by opening up rural land to urban development.

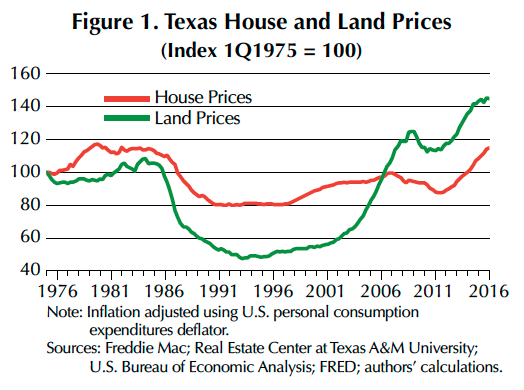

Since 1975, pronounced changes in land prices relative to house prices occurred (Figure 1). Both collapsed in the 1980s as oil prices fell. Texas fell into a recession as a result. House and land prices recovered in the early 2000s as oil prices rose and then the concurrent oil boom helped the state weather the 2007–08 financial recession. As oil prices rise and fall, so do land prices, which in turn affect the cost of new home construction. This suggests the importance of land as a key supply-side factor in pushing house prices up.

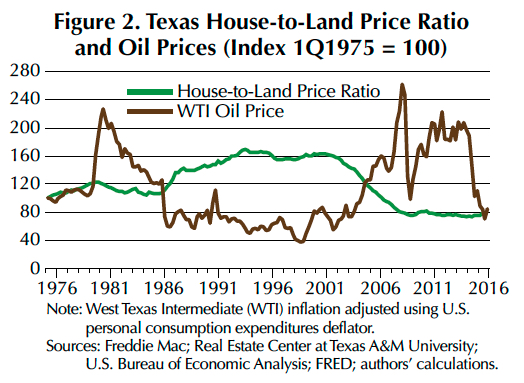

Examining the house-to-land price ratio compared to oil prices (Figure 2), there is an inverse relationship to oil prices at the turning points when oil prices rise or fall markedly. The house-to-land price ratio remained largely immune to the oil crises of the 1970s. However, when oil prices abruptly fell in 1986, housing prices decreased at a much slower rate than land prices due to the higher sensitivity of land prices to oil price changes. This caused the ratio to increase. The contrary occurred in the 2000s. As oil prices rapidly increased, land prices increased at a faster pace than housing prices, causing the house-to-land price ratio to decline. This suggests that oil price fluctuations have a stronger effect on land prices than on housing prices.

Declining Long-Term Interest Rates

Oil prices spill over to house and land prices through their effects on household disposable income. Other national and global factors, such as long-term interest rates, which affect mortgage and interest rates on commercial loans, alter both the supply of and demand for Texas housing as well. Rising oil prices could lead to increased inflation expectations and cause interest rates to rise. The opposite is true when oil prices fall.

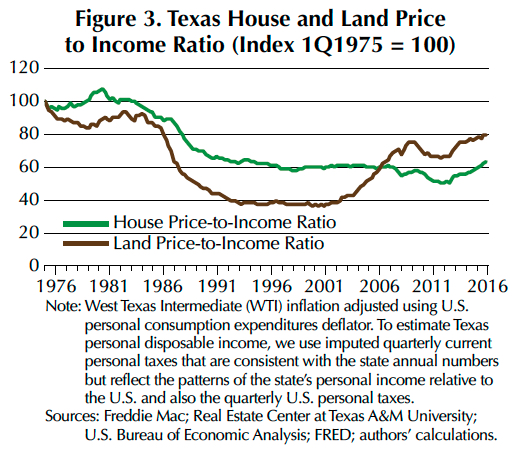

The house price-to-income ratio in Texas fell significantly in the early 1980s and has remained largely flat afterwards as income rose at a higher rate than house prices, at least until 2012 (Figure 3). The land price-to-income ratio rapidly increased in the early 2000s when oil prices started to rise, lifting land prices higher until the 2007–08 recession.

The decline in long-term interest rates has positive effects on Texas housing markets as low interest rates lead to lower mortgage rates and lower credit costs for commercial loans to develop lots, boosting both housing supply and demand. The long-run Texas house price-to-income ratio is notably influenced by the relationship between land prices and long-term interest rates as well.

The fall in oil prices in the early 1980s led to a substantial collapse in land prices, but the effect on house prices was somewhat mitigated. Disposable income growth remained fairly stable in the 1980s even as the Texas economy went through two recessions. This caused house price declines that helped lower the house price-to-income ratio.

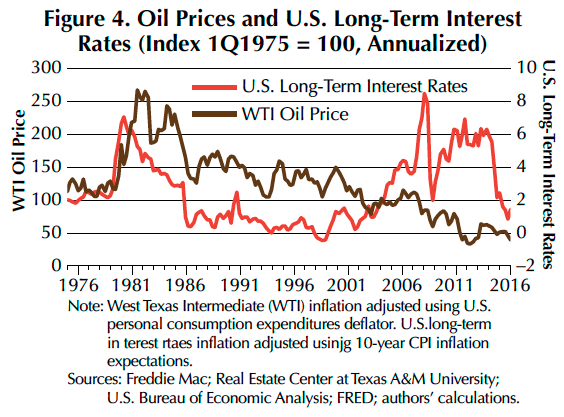

In the late 1980s and early 1990s, house and land prices continued to fall, but the combination of falling long-term interest rates, stable and low oil prices, and stalwart growth in disposable income allowed them to reach a trough and sustain house and land prices. Interestingly, oil prices and U.S. long-term interest rates diverged after the mid-2000s as oil prices increased while long-term interest rates fell (Figure 4).

Before and After Fracking

After the 1980s oil crash, the Texas economy became more diversified. In 2011, fracking technology led to the shale oil boom in the Permian and Eagle Ford. This made Texas an even more significant driver of U.S. oil production because oil production increased from 1.4 million barrels per day in 2011 to 3.2 million barrels per day in 2016. Data shows that technological advancement in the use of oil since the 1970s has resulted in sustained and sizeable energy-efficiency gains. This mitigates the demand-side effects of oil price shocks, potentially making the impact of oil supply shocks due to shale oil excavation more significant for Texas.

When natural gas fracking production increased in the Barnett Shale at the start of the 2000s, the house price-to-income ratio remained largely stable while the land price-to-income ratio started to increase (Figure 3). From 2000–08, declining real interest rates, rising oil prices, and especially upward pressures on land prices were partly due to an increase in the price of commodities. Robust growth in disposable income kept the house price-to-income ratio stable as housing prices rose at a slower rate than both income and land prices. After the 2007–08 financial recession and as the shale oil boom in the Permian and Eagle Ford geared up, house and land price increases outpaced disposable income, raising both house- and particularly land-price-to-income ratios during the recovery and subsequent expansion.

An Evolving Relationship

Oil prices are an important factor determining the opportunity cost attached to converting rural land for urban development. Oil prices affect land supply availability and land prices. Oil prices also have an influence on disposable income through demand-side effects and their impact on oil production. In Texas, the shale oil boom in the 2000s appears to have played a major role in shaping the relationship of oil prices to land and house prices.

All of this occurred against a backdrop of a large fall in oil prices in 2014. In the years following the oil bust, housing prices have accelerated while income and land prices have flattened in a low oil price environment. A more diversified Texas economy allows housing demand to remain strong even when the state’s economy has to contend with low oil prices. However, the low oil price period since 2014 also suggests that the relationship between oil prices and housing prices continues to evolve.

House prices registered higher growth than income and continued to increase even with the large drop in oil prices in 2014. Housing supply constraints caused by lack of developed lots, tight labor conditions, and limited development loans apparently could be altering the relationship between housing and oil prices. Texas’ lower dependence on the upstream energy industry, as well as those housing supply constraints, seem to have contributed to modify the relationship between housing prices and oil prices as well.

____________________

Data and Research Methodology

This analysis covers 1Q1975 to 2Q2016. All series are inflation-adjusted using the seasonally adjusted quarterly U.S. personal consumption expenditures deflator from the U.S. Bureau of Economic Analysis—obtained from the St. Louis Fed’s FRED database—and indexed in units to 1Q1975=1.

Freddie Mac’s house price indexes were used to derive the real house price series. The monthly indexes from Freddie Mac are not seasonally adjusted by the source, so they were converted to quarterly frequency by simple averaging and seasonally adjusted with the standard Census X12/X13 procedure.

The real land price indexes were calculated by the Real Estate Center at Texas A&M University. The quarterly nominal rural land price series are expressed in dollars per acre and seasonally adjusted by the Center using a simple four-quarter moving average.

The real oil price series is based on the U.S. Energy Information Administration and Dow Jones & Company’s data on West Texas Intermediate (WTI) — Cushing, Oklahoma — crude oil spot prices (dollars per barrel) obtained from the St. Louis Fed’s FRED database. The nonseasonally adjusted series is reported at monthly frequency and converted to quarterly frequency with simple averaging. All remaining seasonality is removed by implementing the standard Census X12/X13 procedure for the quarterly nominal oil price series.

To construct the real long-term interest rate, the nominal long-term rate was used, which is the ten-year Treasury constant maturity rate (yield in percent per annum) from the Board of Governors of the Federal Reserve System (H.15 Selected Interest Rates) obtained through the St. Louis Fed’s FRED database. The daily time series is not seasonally adjusted by the source—the data were converted from daily to quarterly frequency by simple averaging without requiring any seasonal adjustment. The real U.S. long-term interest rate is straightforward to construct based on Fisher’s equation by netting out a consistent survey-based measure of long-term inflation expectations.

The long-term inflation expectations data is the forecast of the annual average rate of headline CPI inflation over the next ten years from the Federal Reserve Bank of Philadelphia’s Survey of Professional Forecasters (SPF) extended with linearly interpolated Blue Chip Economic Indicators survey data prior to 4Q1991 back to 4Q1983 (which is also provided by the Philadelphia Fed’s SPF). We use the monthly FRB/US-model series ZPI10 produced by the Board of Governors transformed to quarterly frequency (by simple averaging) to complete our long-term inflation expectations series back to 1Q1975.

____________________

Ms. Grossman ([email protected]) is web content manager in the Research Department of the Federal Reserve Bank of Dallas; Dr. Martínez-García ([email protected]) is a senior research economist and advisor with the Federal Reserve Bank of Dallas; Yongzhi Sun ([email protected]) is a Texas A&M University Ph.D. graduate student in Economics; and Dr. Torres ([email protected]) is a research economist with the Real Estate Center at Texas A&M University.

Takeaway

October 2017

You might also like

PUBLISHED SINCE 1977

Tierra Grande

Check out the latest issue of our flagship publication.

SUBSCRIBE TO OUR

Publications

Receive our economic and housing reports and newsletters for free.