The mystery of the murdered economic expansion

Former Federal Reserve Chairman Janet Yellen: "I don’t think economic expansions die of old age."

Yellen’s predecessor, Ben Bernanke, in response: "I like to say they get murdered."

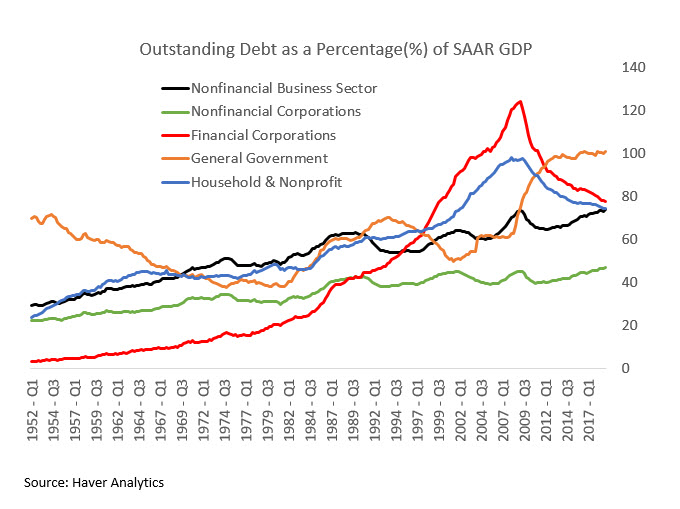

The "murderers" in the past have been financial imbalances like over-leveraging or the Federal Reserve raising rates too fast. Now, as the U.S. economy achieves the longest expansion recorded in the nation’s history, recession fears are rising, and we’re once again looking for the culprit.

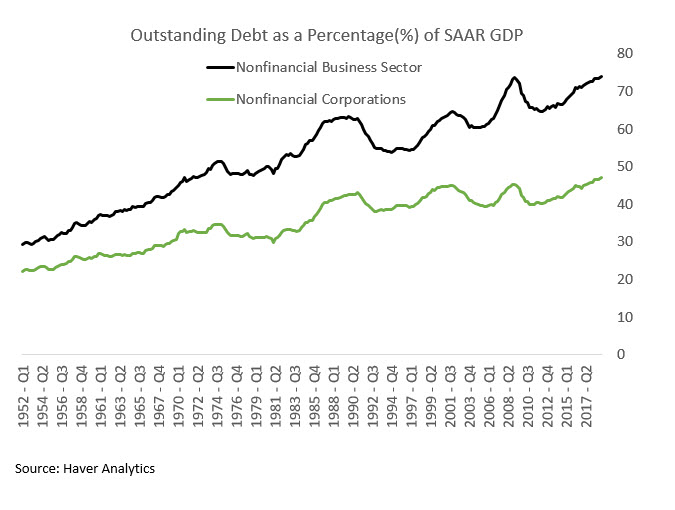

One likely suspect: the growing debt from the nonfinancial sector, such as corporate debt. Outstanding debt by nonfinancial companies, as a percentage of gross domestic product, is at a historical high.

In the past, interest rates that were too low for too long could contribute to financial imbalances, as they could encourage excessive leveraging. The U.S. economy is currently in a state of slow productivity growth with persistently low inflation leading to low interest rates. Even with these conditions, it is unclear whether nonfinancial businesses are taking more risk than they should.

Another important unknown is what happens if credit conditions change because investors’ perceptions of risk or their willingness to take on risk changes? This could cause a decrease in the supply of loanable funds, leading to a credit crunch.

Also, even though inflation pressures are currently low, what happens if inflation comes back, causing a sharp rise in interest rates?

These are difficult questions to answer, but one thing is clear: nonfinancial business sector debt is at a historical high, and we need to keep it under surveillance.

In This Post

You might also like

Publications

Receive our economic and housing reports and newsletters for free.