Economic growth and development is driven by entrepreneurs who create new firms that produce innovations in production, marketing and finance. Data on state-level entrepreneurial activity show that Texans respond to lower economic growth rates by creating more firms and thus more jobs.

quick links

ENTREPRENEURSHIP, the process of new business creation, is an essential component of economic growth and development in free market economies. The growth of a competitive economy depends on whether business successes exceed business failures.

Creation is Critical

New business creation is the first step on the road to economic growth and development. Entrepreneurs create new firms, undertake various business risks, and help existing firms survive and grow through innovations in production, marketing and finance.

A number of government and nongovernment organizations exist to help business start-ups and small businesses on both national and local levels, including the U.S. Small Business Administration, National Venture Capital Association, National Business Incubation Association and the Service Corps of Retired Executives. These organizations offer programs designed to create favorable business environments for entrepreneurial activities and to help existing businesses succeed and expand.

In Texas, the Comptroller’s Texas Business Advisor, the Governor’s Office of Economic Development, the Texas Business Portal, the Texas Entrepreneurs Association, the McCombs Entrepreneur Society and many local economic development councils encourage entrepreneurial activities.

In the course of monitoring the Texas economy, the Real Estate Center monitors the state’s entrepreneurial activities. Research found that higher than national average economic growth is closely related to higher than national average entrepreneurial activities in the state. Research also indicated favorable trends in the state’s entrepreneurial activities.

such as Blue Baker in College Station (previous page) and Steephollow Forgeworks in Bryan (above) play a vital role

in the state’s economic growth. As new businesses emerge, they bring innovative approaches to marketing and other

business practices that spur changes in existing enterprises and keep the market competitive.

Measuring National Entrepreneurial Activity

In the United States, the most widely used measure of entrepreneurial activity is the Kauffman Index of Entrepreneurial Activity, published by the Ewing Marion Kauffman Foundation. The index reflects the percentage of all non-businessowner individuals between ages 20 and 64 who start a business each month. The Kauffman index also expresses the number of entrepreneurs per 100,000 people.

The index uses data from the monthly Current Population Surveys of the U.S. Census Bureau and the Bureau of Labor Statistics to capture new business owners in their first month of significant business activity (defined as 15 or more usual hours worked per week). An overall index of entrepreneurial activity is estimated for the United States and separate indexes are estimated for states, selected metropolitan statistical areas and specific demographic groups.

The index includes individuals starting businesses as their main work activity and includes employers, non-employers, incorporated and unincorporated businesses but not small-scale business activities such as casual businesses and consulting. The index captures entrepreneurs only once, when they first create their businesses.

Texas Entrepreneurial Activity Rate

The Real Estate Center’s research program for monitoring Texas entrepreneurial activities looks at both short-run and long-run trends in the state’s entrepreneurial activities. The most recent datasets show that in 2010, on average, 400 of every 100,000 adults in Texas launched a business each month (Table 1).

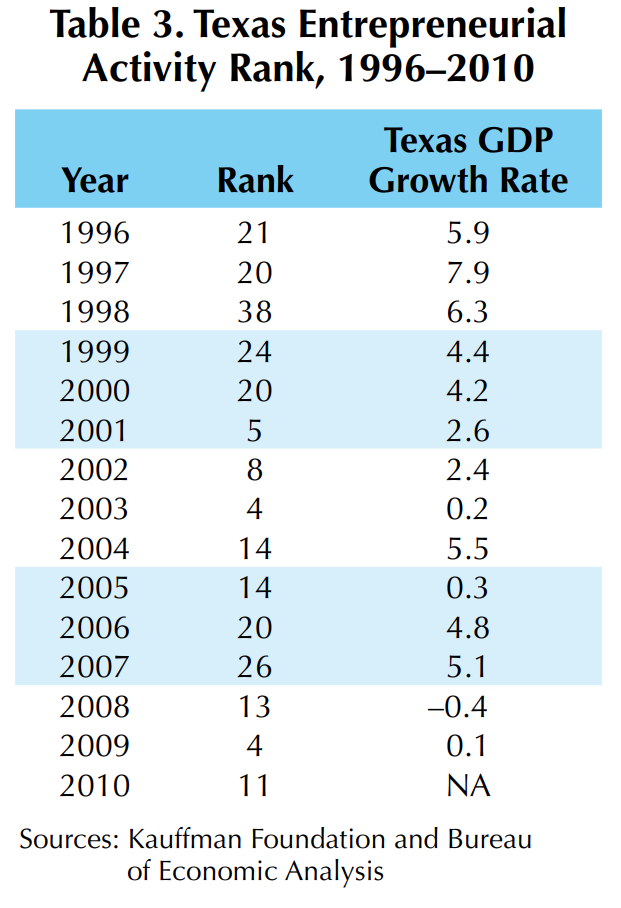

The state’s entrepreneurial activity rate rose from 370 in 2008 to 450 in 2009, then fell to 400 in 2010. The state ranked 13th in 2008, fourth in 2009 and tenth in 2010.

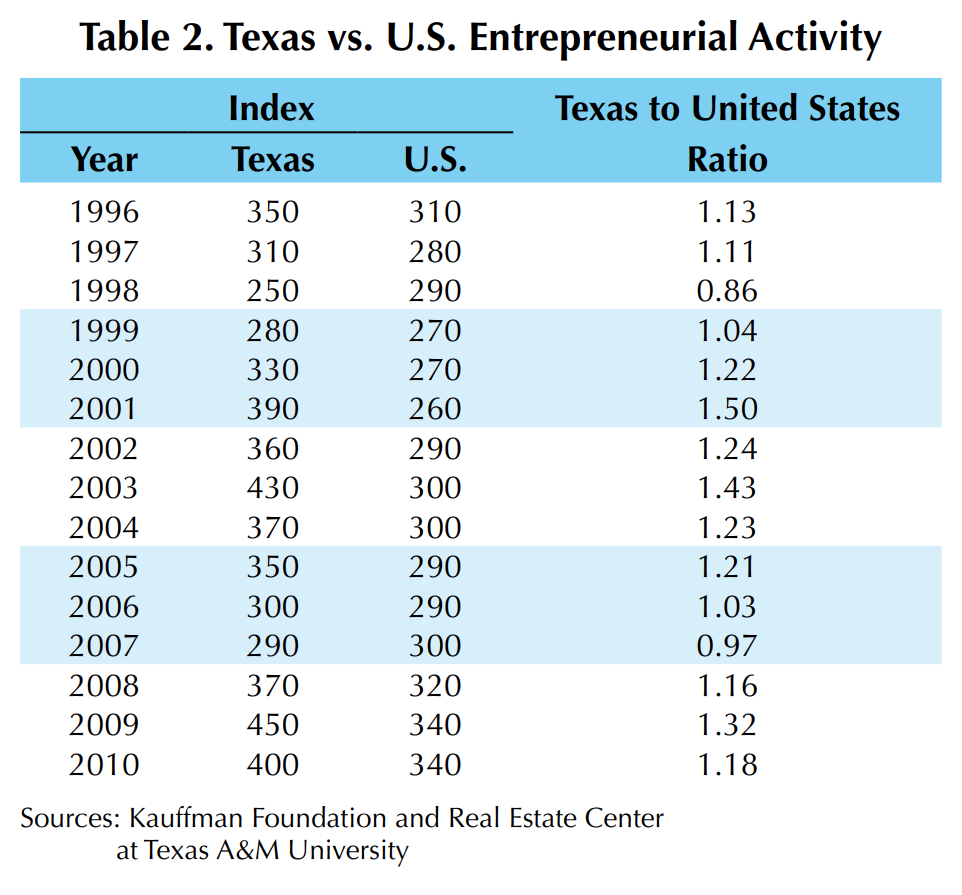

Kauffman Foundation data on state-level entrepreneurial activity rates since 1996 show that Texas’ rate exceeded the national average from 1996 to 2010, except in 1998 and 2007 (Table 2). The largest ratio of the Texas rate to the U.S. rate occurred in 2001 when the Texas rate was 50 percent higher than the national average. The second largest ratio was 1.43 in 2003.

The lowest ratio of Texas to U.S. entrepreneurial activity rates occurred in 1998, when the Texas rate was 86 percent of the U.S. rate. The Texas rate to U.S. rate was 97 percent in 2007. Since then, Texas entrepreneurial activity rates have remained above the national average.

Texas’ entrepreneurial activity rank among the 50 states and District of Columbia varied significantly from 1996 to 2010, the period for which activity rate data are available on a state level (Table 3). Compared with other states, Texas ranked low in the late 1990s, 2006 and 2007. However, the state ranked fourth in entrepreneurial activity in 2003 and 2009 and fifth in 2001.

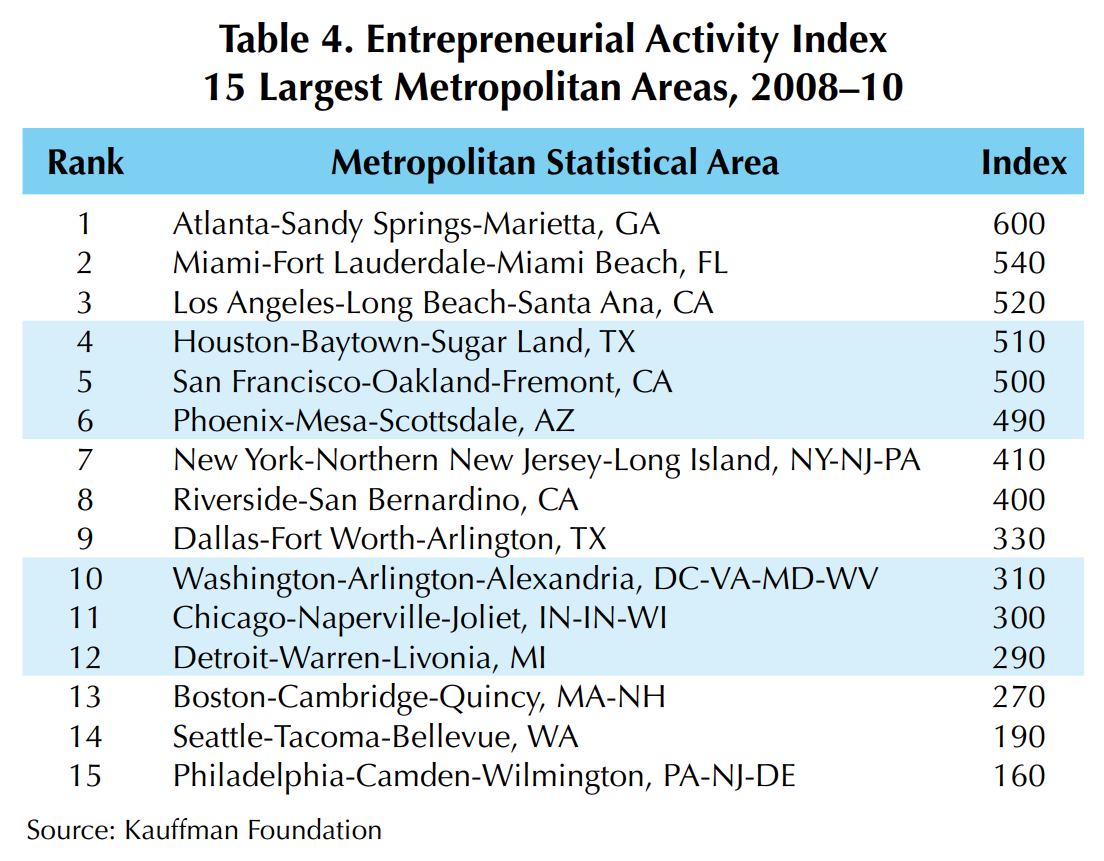

The Houston and Dallas metropolitan areas play important roles in the state’s entrepreneurial activities. According to a Kauffman Foundation index of entrepreneurial activity for the nation’s 15 largest metropolitan areas, the Houston-Baytown-Sugar Land metro ranked fourth in entrepreneurial activity with an average rate of 510 per 100,000 adults from 2008–2010 after Atlanta-Sandy Springs-Marietta (600), Miami-Fort Lauderdale-Miami Beach (540), and Los Angeles-Long Beach-Santa Ana (520). Dallas-Fort Worth-Arlington ranked ninth with an average entrepreneurial activity rate of 330 per 100,000 adults (Table 4).

A comparison of Texas’ economic growth rates, measured by annual growth rates of gross domestic product (GDP), and the state’s entrepreneurial ranks reveals that Texans have responded to lower economic growth rates and recession by creating more firms. In other words, if Texans cannot find employment, they create jobs for themselves.

Recessions, while bringing economic hardships, also bring opportunities for business creation. According to a Kauffman Foundation study, over half of the current Fortune 500 firms started during recessions and economic slowdowns.

Dr. Anari ([email protected]) is a research economist with the Real Estate Center at Texas A&M University.

In This Article

Contents