The office market is rising like a phoenix from the ashes of the 2008 price collapse. The collapse was the biggest since 1986, when prices fell nearly 40 percent because Congress changed the tax laws for real estate owners. Lack of financing for commercial real estate, higher vacancies and declining rents due to recession, and a lack of confidence in the future of America caused transaction volume to plummet in 2009 and 2010.

But time marches on. Five years have passed since the commercial real estate lending market froze and started the downturn in July 2007. The recovery has been painfully slow, but it is clearly underway.

America’s office buildings fill when employment increases. Most professionals focus specifically on job growth in two key industry sectors: professional and business services (PBS) and financial activities. PBS employment peaked in January 2008 at roughly 18 million workers. By September 2009, this number had dropped to 16.4 million. Since that trough, PBS employment has risen virtually unabated to 17.9 million, recovering nearly all the recession losses.

Employment in the financial activities industry has not fared as well. This sector reached peak employment of 8.3 million in December 2006. The cataclysm in the industry caused employment to fall to a cyclical low of 7.6 million at the trough in July 2010. Since then, employment has resumed a gradual uptrend to 7.7 million workers by September 2012. Today there are over a half million fewer workers employed in financial activities than there were at the end of 2006.

According to CoStarNet, absorption for the Dallas–Fort Worth market was up nearly 610,000 square feet in second quarter 2012, following a 320,000-square-foot gain in the first quarter. Austin filled 314,000 square feet in the second quarter after absorbing over 631,000 square feet in the first quarter.

San Antonio followed the positive trend as well. Net absorption was nearly 250,000 square feet in the second quarter, following 468,000 square feet of positive absorption in the first quarter. The Houston office market is on fire, filling more than 1.5 million square feet in the second quarter after filling more than 1.3 million square feet in the first three months of 2012.

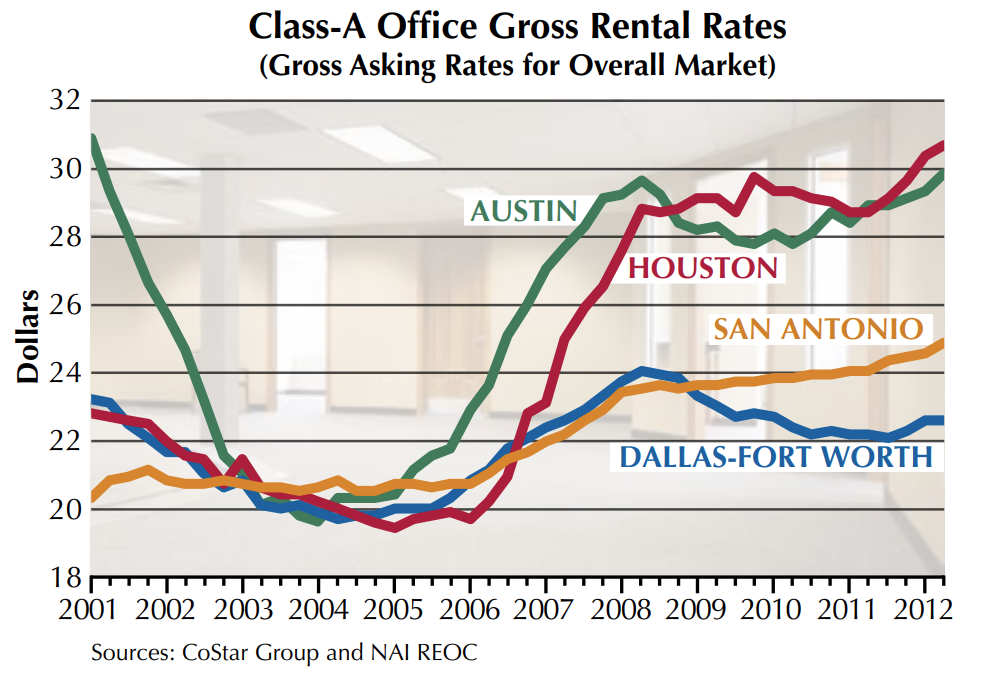

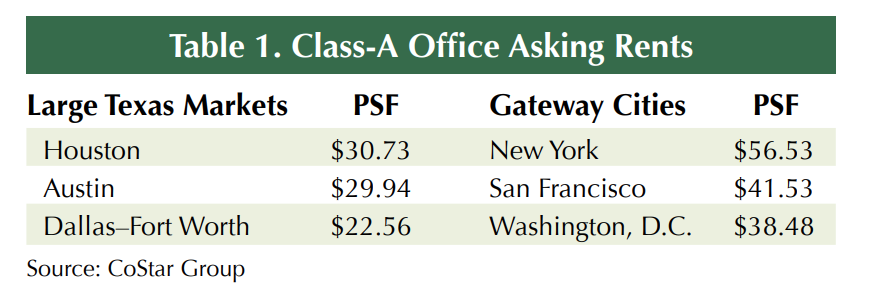

Nationally, rental rates for office buildings have been stabilizing, and Class-A office space rents are inching upward (see figure). Texas is no exception. Amazingly, asking rents for downtown (central business district; CBD) space in Houston, Austin and San Antonio are now higher than during the halcyon days of 2007. Asking rents in Texas cities compared with the “gateway cities” that are drawing strong investor interest are shown in Table 1.

After the financial collapse in 2007, construction for all commercial real estate came to a grinding halt. Lending for new real estate projects vaporized. For nearly two years, little new supply of office space was added in America. But times are changing. As someone once said, the state bird of Texas is the construction crane.

A review of F.W. Dodge data revealed there are 64 office projects currently under construction in Houston alone. Dallas has 16 projects underway and Fort Worth and Austin have 25 and 15, respectively. San Antonio has 26.

The Great Recession did substantially delay many construction projects in the Texas office market. As of Sept. 27, 2012, F.W. Dodge data indicate 45 office construction projects have been put on hold in Houston, 46 in Dallas, 26 in Fort Worth, 40 in Austin and 17 in San Antonio.

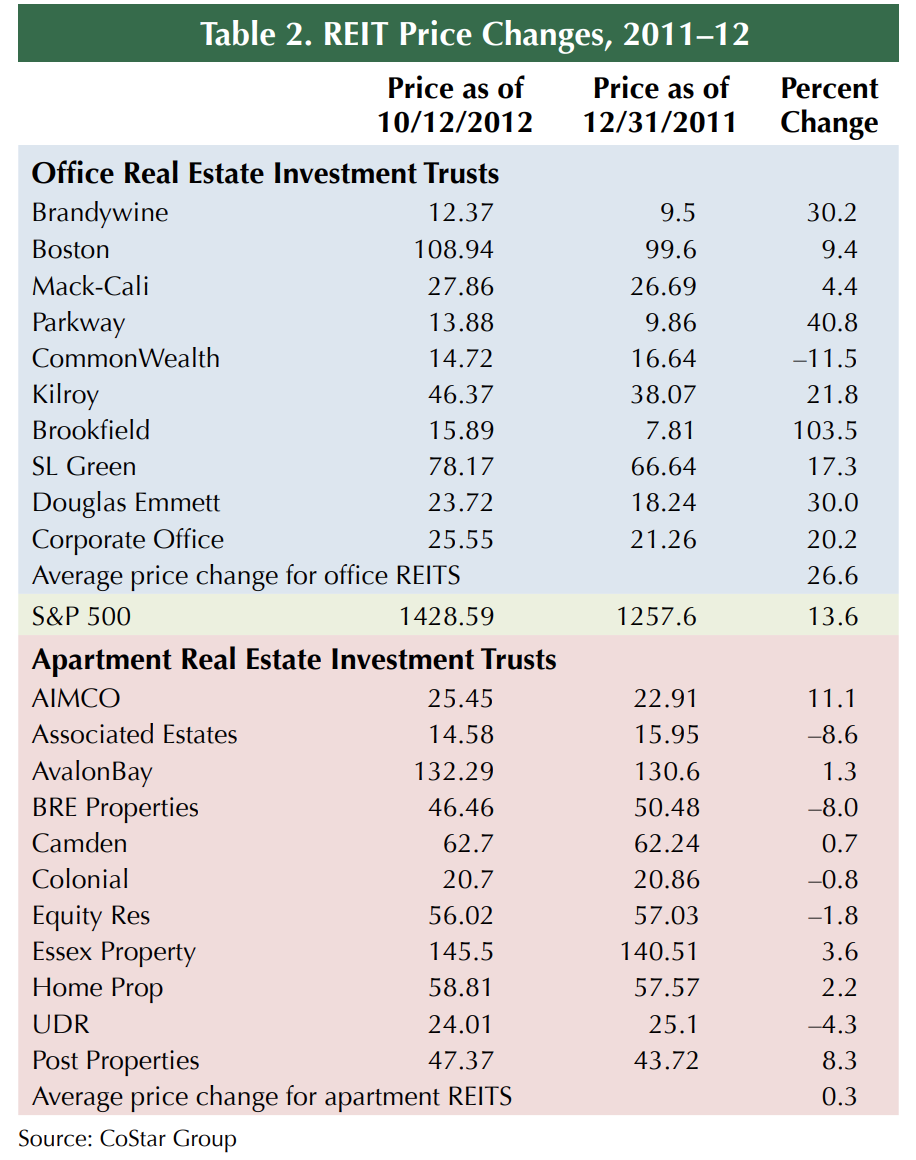

The stock market has been signaling an office market reawakening. Real estate investment trusts (REITs) that own office buildings put in a strong performance in 2012. Prices for the largest REITs are up 26.6 percent in 2012 (Table 2). Notice how the average price for the apartment REITs is up just .3 percent for the same time period. Apartment REITs were the darling of the market in recent years, but a new sheriff moved into town in 2012.

Some office REIT managers still view the overall market as weak and are preparing for the possibility of future challenges by holding large cash reserves and acquiring only top quality buildings in the strongest markets. However, they are seeing occupancy continuing to recover in quality markets and are starting to increase rental rates.

The uncertainty of America’s economic and political future has been a major concern. Mortimer Zuckerman, CEO and co-founder of Boston properties, expressed his concern during a second quarter 2012 conference call: “We’ve had the biggest or the most stimulative fiscal and monetary policy in our history, and here we are, three or four years later, and we’ve run up deficits of close to $5 trillion, and it has not taken the economy out of the very weak status.”

Class-A buildings in major cities are seeing rents and occupancy pick up thanks to a “flight up the quality curve” according to Gerry Sweeny, CEO of Brandywine Realty Trust. In a weak market, tenants can move into the best buildings at affordable rent levels. Hence, the nicest buildings fill up with tenants that move out of lesser-quality buildings in the same city.

A surge of buying interest from REITs, pension funds and other investors is pushing prices up, especially in large markets. Real Capital Analytics reported that their Commercial Property Price Index was up 10.3 percent in the 12 months ending June 2012. CoStar noted that office buildings in New York, Boston and San Francisco have recently sold with cap rates less than 5 percent. A Boston office building, 100 Federal Street, sold for $471 per square foot and a cap rate of 4.4 percent.

As cap rates are further compressed in the gateway cities, REITS have started to look more and more to alternative markets with strong economic growth. Office market growth requires strong job growth, and there is no better place for job growth than Texas. There will likely be increased institutional interest in Texas office buildings that are filled with quality tenants, which could drive prices higher.

According to CoStar, the average office cap rate for sales on office buildings 15,000 square feet or larger declined from a high of 8 percent in first quarter 2009 to 7 percent at the end of March 2012. Clearly prices have begun to pick up steam. Real Capital Analytics (RCA) reports cap rates in CBDs dropped from 8 percent to around 6.5 percent by August 2012.

Data from RCA shows cap rates for the CBD areas ranging from 5.5 percent in Washington, D.C., to 7.2 percent for New York City boroughs. CoStar shows Houston and Austin following similar trajectories with average cap rates at around 9 percent in second quarter 2009, then trending downwards to the high 6 percent range for Houston and the low 6 percent range for Austin at the end of March 2012. These rates are lower than the national average, and this displays leakage from the overcrowded gateway cities that are driving cap rates down and prices up in these two Texas markets.

With Class-A markets bid up so high, there is a potential opportunity for investors in the B and C office buildings based on relative value. The Class-A space will reach a point that is too expensive to justify the cost, making the Bs and Cs (especially the high-quality ones that can also benefit from a little rehab) a much more attractive alternative. There is always value in leaving “something for the other guy.”

Opportunity will be concentrated in strong economic areas with good job growth, and if Texas remains one of the lone areas with this quality it will become even more flooded with people wanting a piece of the action. It would be prudent to get into these markets before this occurs so when things do heat up investors can sell into strength and not buy at the peak.

With all the focus on apartments for the past two years, the office market hasn’t gathered as much media attention. But clearly the market is coming back, and the investor public is moving back into the sector.

Dr. Dotzour ([email protected]) is chief economist and Parulian and Stewart research assistants with the Real Estate Center at Texas A&M University.